The Chilean service company CyD Asesoría Agrícola compiled a report on the 2022-2023 season by examining data and statistics directly from soil and product analyses. This data was subjected to a process of analysis and standardisation among the different exporters, and the results are then presented in the form of summary reports. The objective is to probe the reasons for price fluctuations, providing management tools for producers to refine their profitability.

AN EARLY SEASON

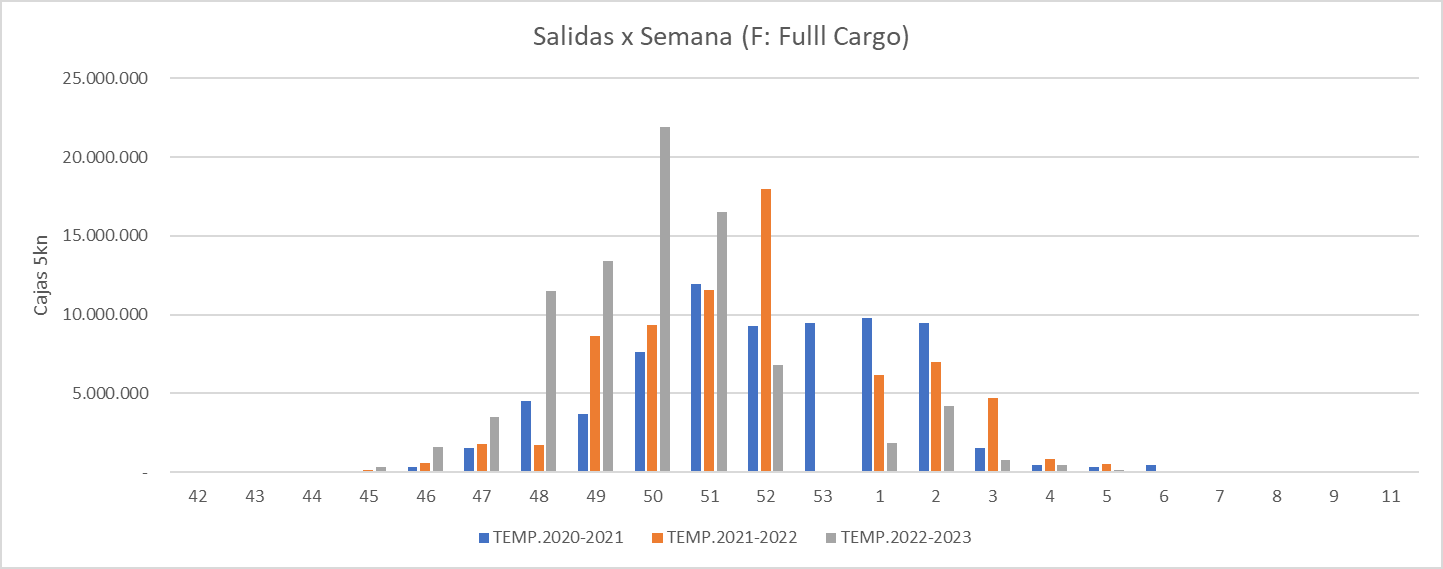

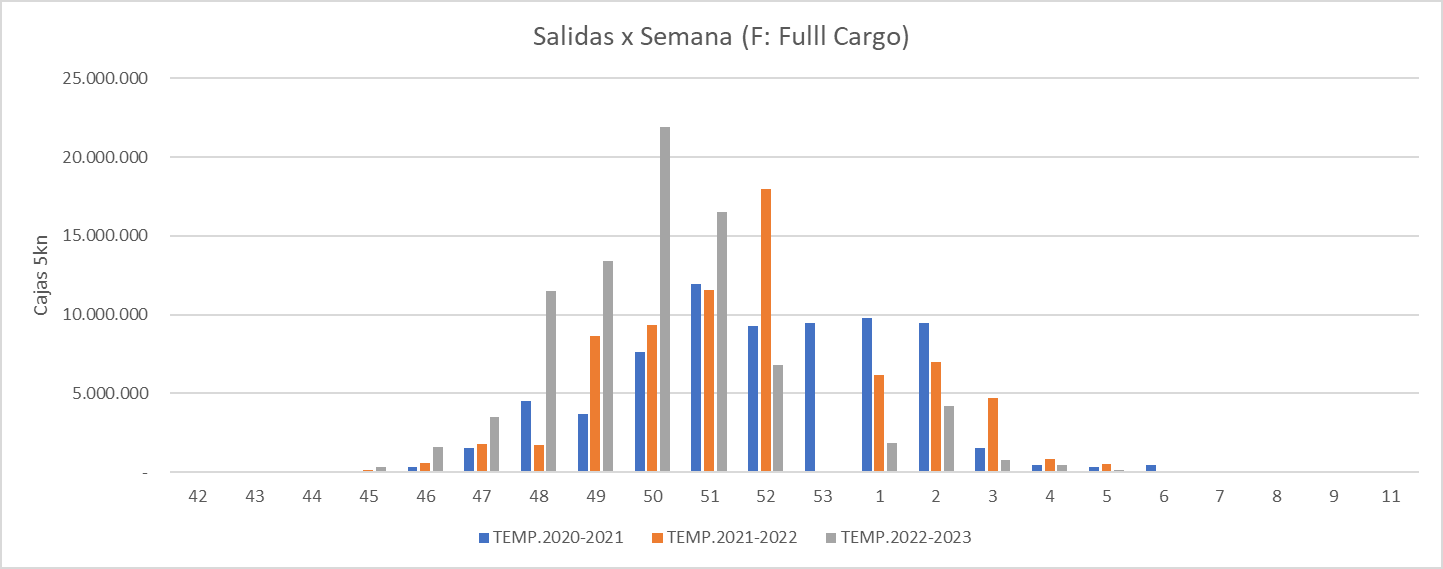

In the previous season, we witnessed one of the earliest Chinese New Year's Eve, actually the most timely in the last ten years (22 January). At the same time, there was widespread concern about a possible price drop due to this holiday. This situation prompted the entire industry to move towards an early harvest, adopting a variety of technical strategies. The weather, in turn, contributed to this dynamic, and the effect of a considerably premeditated harvest is evident in the following graph, which illustrates the trend of fruit shipments.

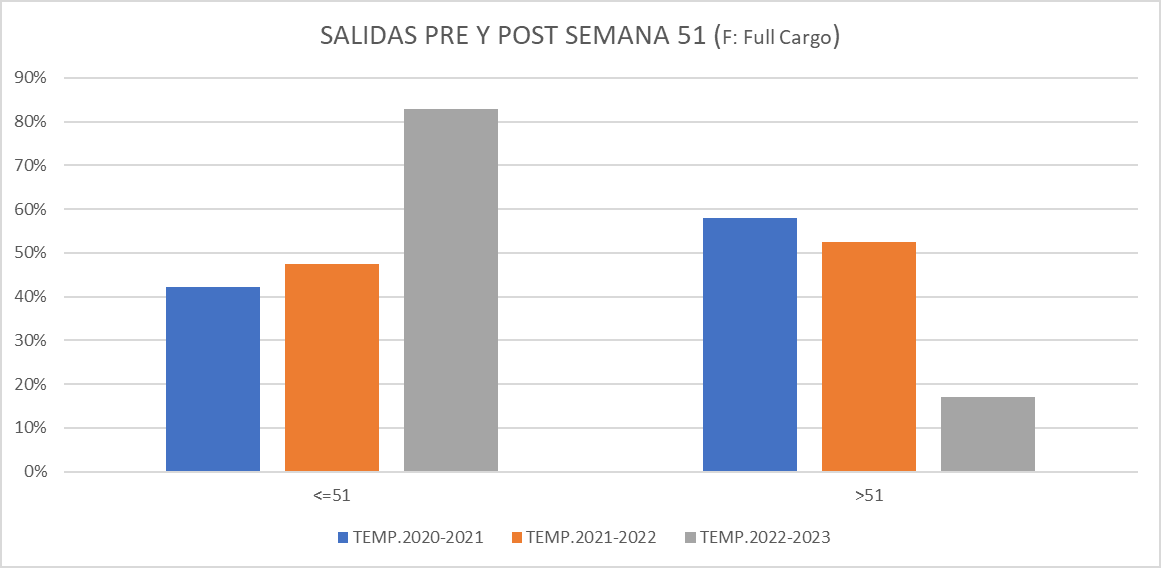

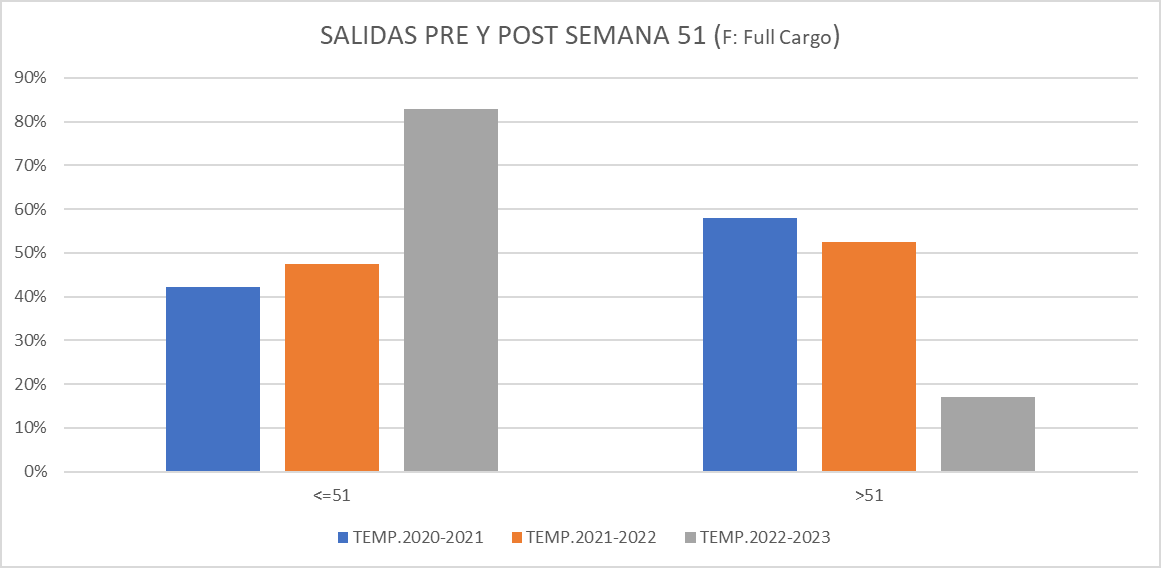

The highest shipments during week 50 clearly emerged, with a marked acceleration from week 48 onwards, marking a clear deviation from previous weeks. Overall, the industry (with the help of the weather) pushed hard, achieving the result of doubling the amount of fruit usually shipped by week 52. As shown in the graph below, we were up more than 80 per cent, leaving only a small amount of fruit for the final stage of the season.

FORMATS AND COSTS

According to CyD, as far as regulations and their structures are concerned, it has been noted that traders generally display their data using processing/receiving weeks. This approach seems to be gaining ground as a clearer indicator for manufacturers. On the other hand, there is room for improvement in the specificity of labels, as the prices of 'premium' labels, as opposed to lower-end labels, can differ significantly and sometimes explain disparities between two distinct producers.

Not all exporters provide details on their internal costs, although such information is generally included in contracts. However, in general terms, costs for materials and services are in the range of USD 2 per kilogram (USD 1.8 to 2.1/kg). There is a widespread consensus about an 8% fee charged for export services.

When making a comparison, it is crucial to take into account the specific benefits offered by the various operators, such as transport, financing, processing costs for fruit for trade, as well as technical support and other aspects.

THE SIZE

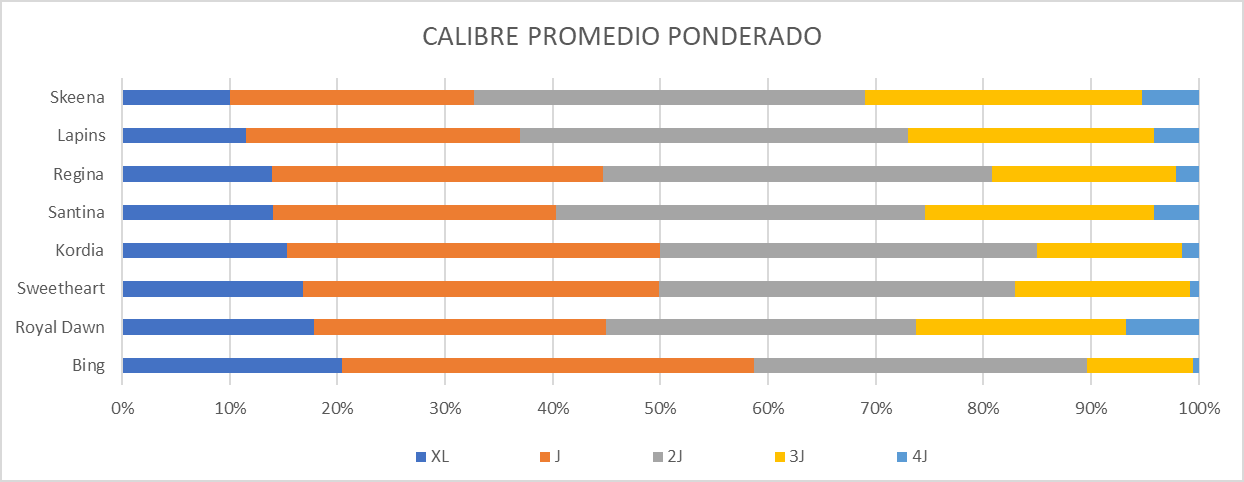

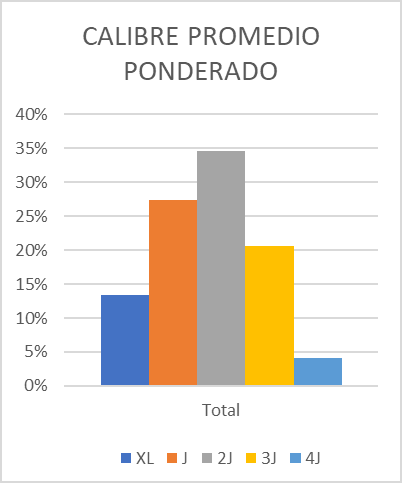

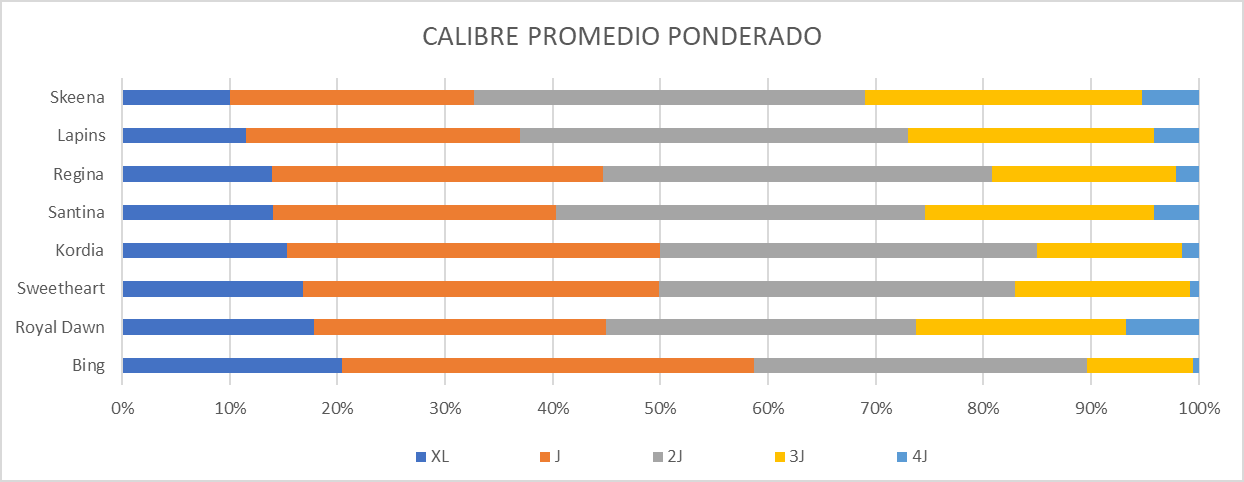

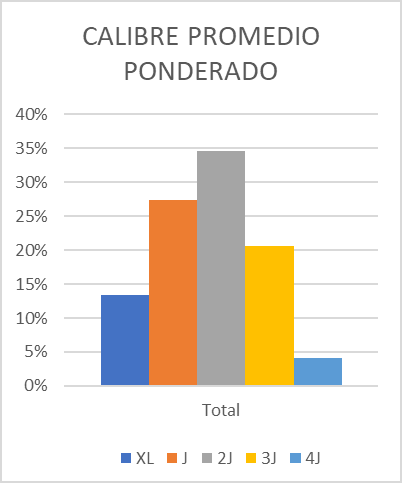

The scope has been homogenised through the use of a nomenclature ranging from L to 4J. This practice facilitates understanding and validation between different exporting entities. Graphic representations of the weighted size for the most crucial varieties are presented below:

The average size of the entire base indicates that the pre-eminent size corresponds to 2J, followed by J and, in third place, 3J. These together make up more than 80% of the total volume.

THE PRICES

Regarding the analysed figures, CyD presents a set of graphs and tables containing data collected from various companies. It is important to emphasise that this constitutes only a sample representing approximately 16 million kilos from various operators. Consequently, we cannot speak of an exact average representation of the sector, but we are confident that it has an adequate degree of representativeness.

The information is expressed in NPR (Net Producer Return).

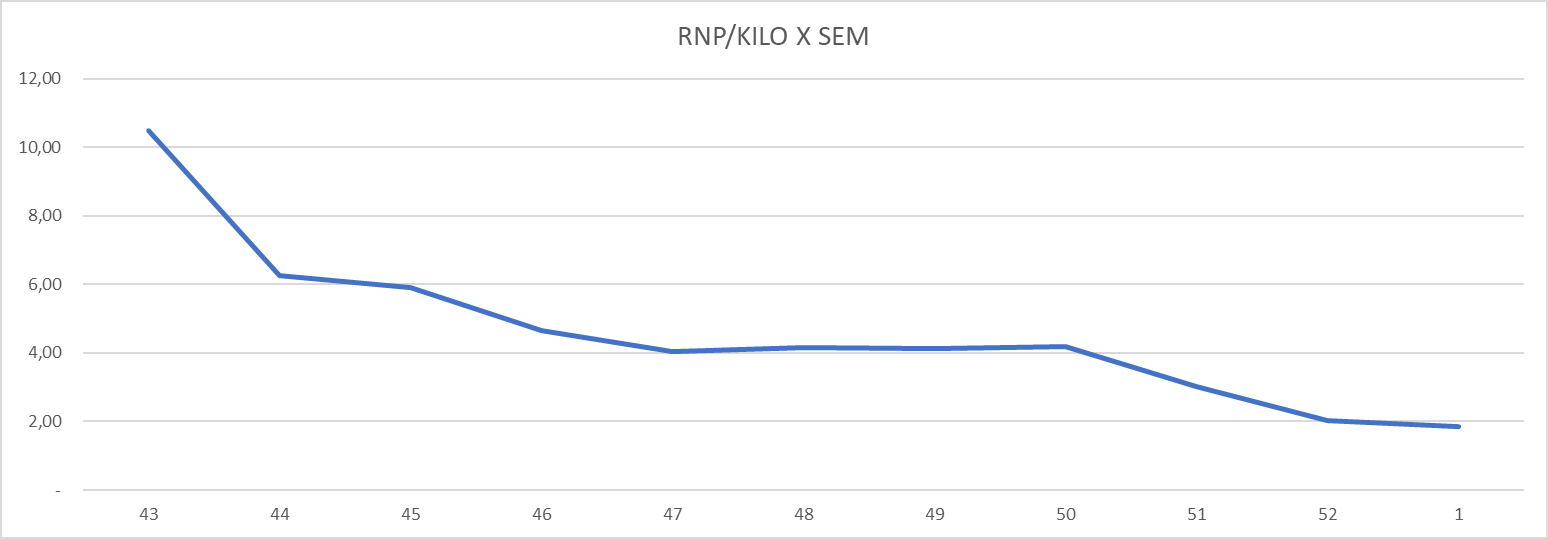

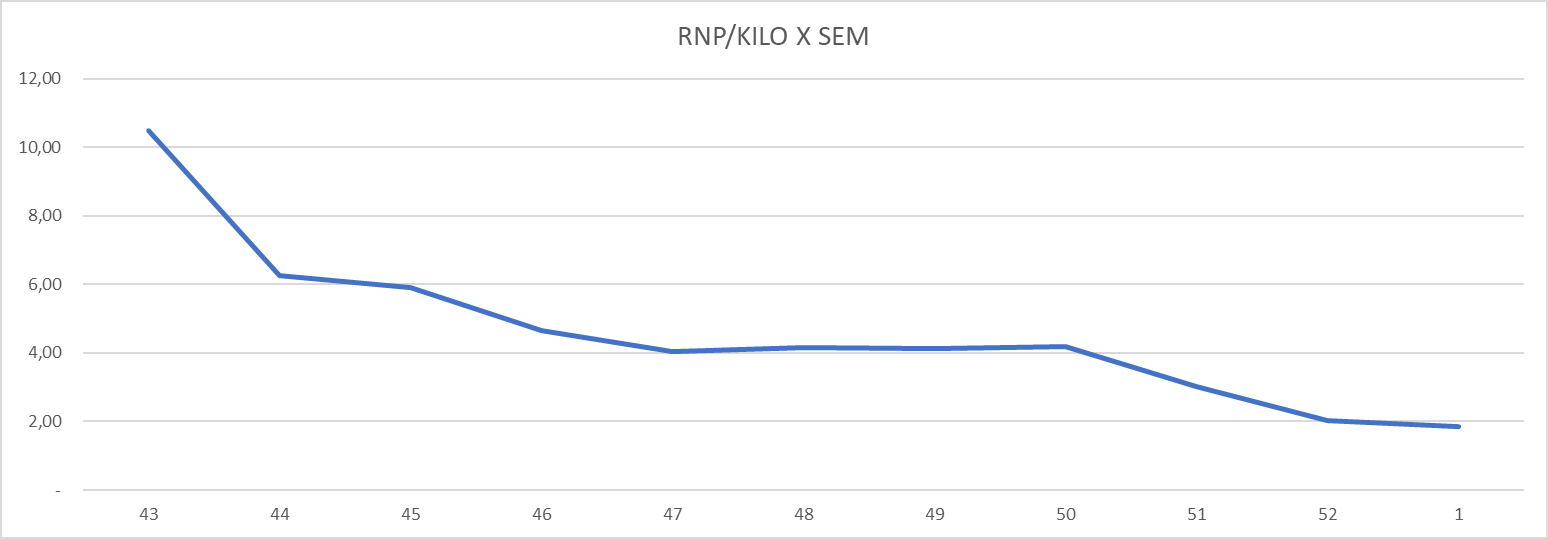

Image 5: RNP x kilo (process week).

Image 5: RNP x kilo (process week).

The above graph represents the base with a weighted average, considering Cat1 fruit (XL-5J). As can be seen, during the course of the season, there is a stabilisation around USD 4 until week 50, or week 51 of shipments. It is relevant to bear in mind that in the current year more than 80% of the fruit was shipped before this week. This circumstance provides a clear explanation for the seasonally weighted average of USD 4 per kilo.

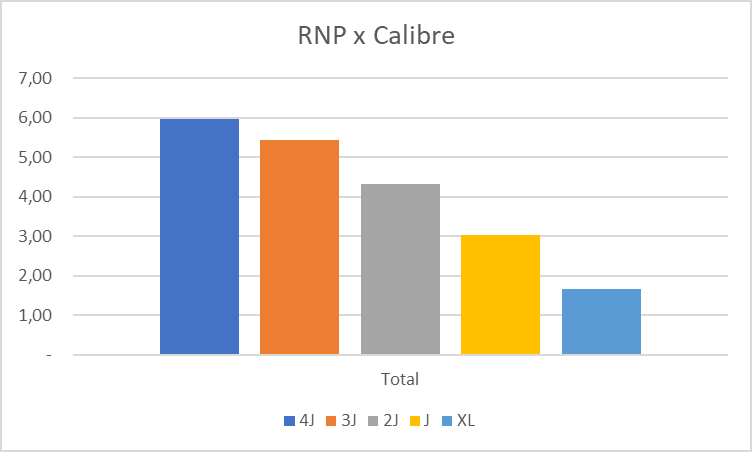

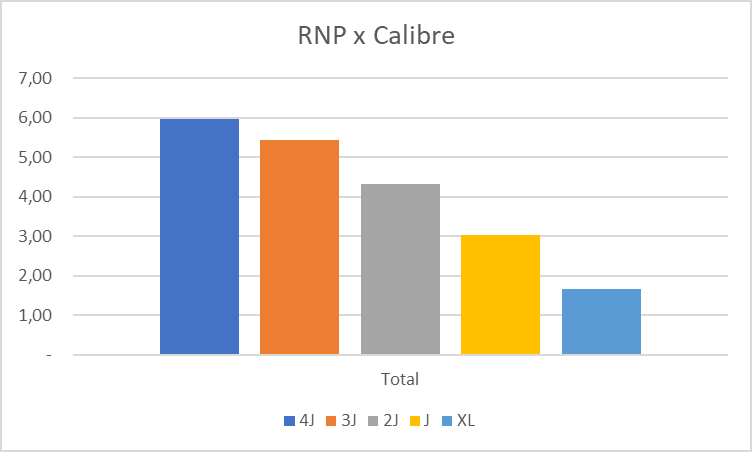

Image 6: RNP x Equivalent Gauge.

Image 6: RNP x Equivalent Gauge.

In the graph provided, the price decreases for each size are highlighted. It is evident that the 4J size costs on average four times more than the XL size. Consequently, size optimisation efforts will have a positive impact on profitability prospects. A summary of the weighted average RNPs for the main fruit types by size is presented below.

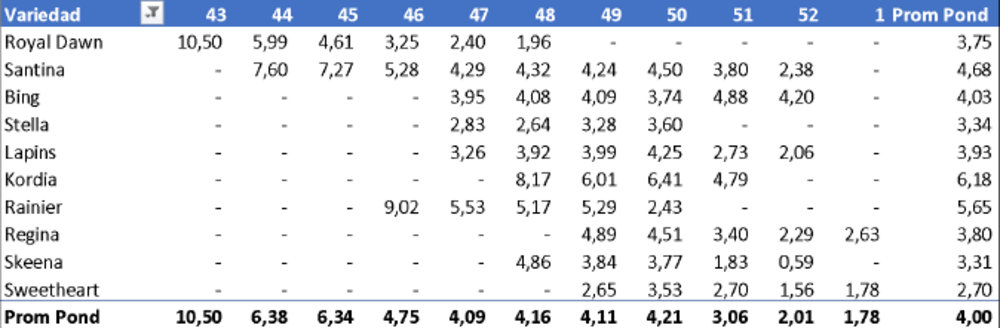

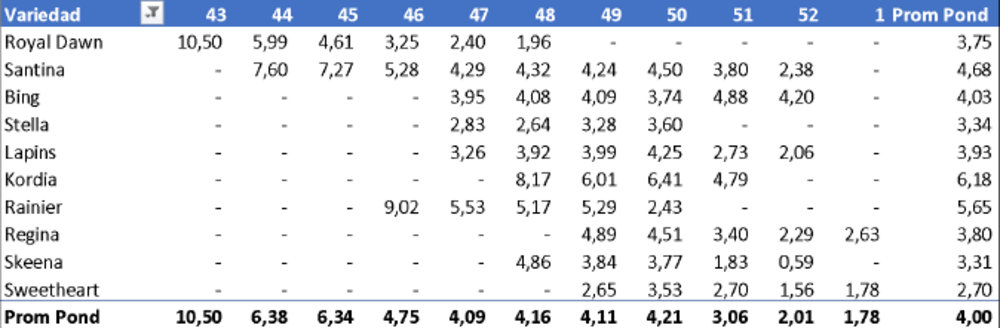

Table 1: Weighted averages per variety (all sizes).

Table 1: Weighted averages per variety (all sizes).

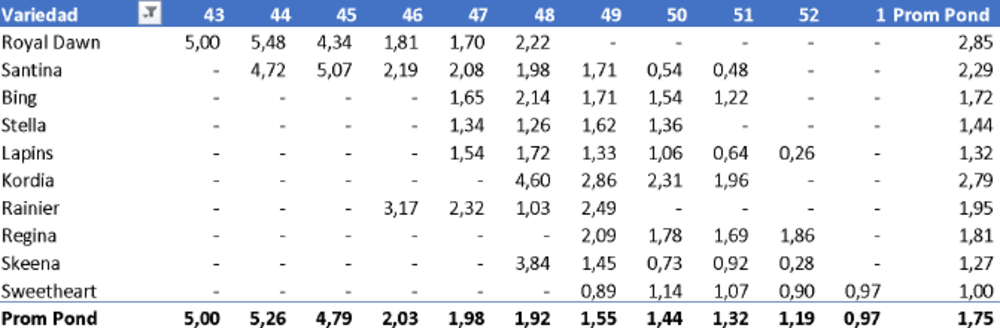

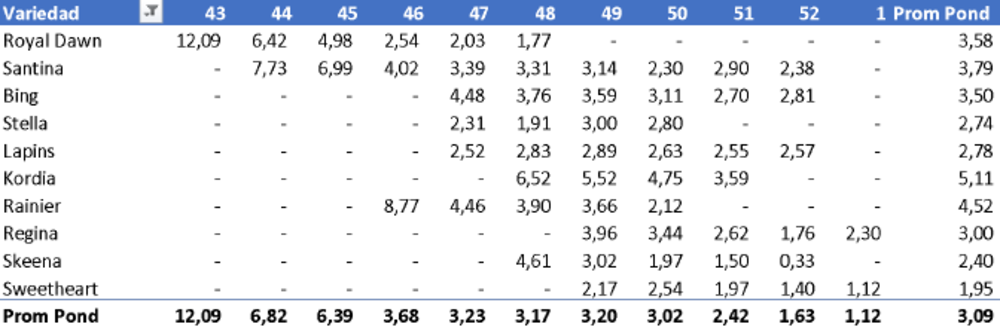

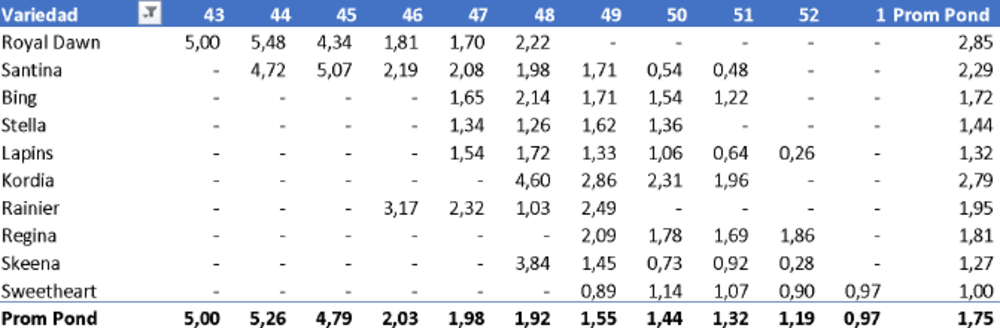

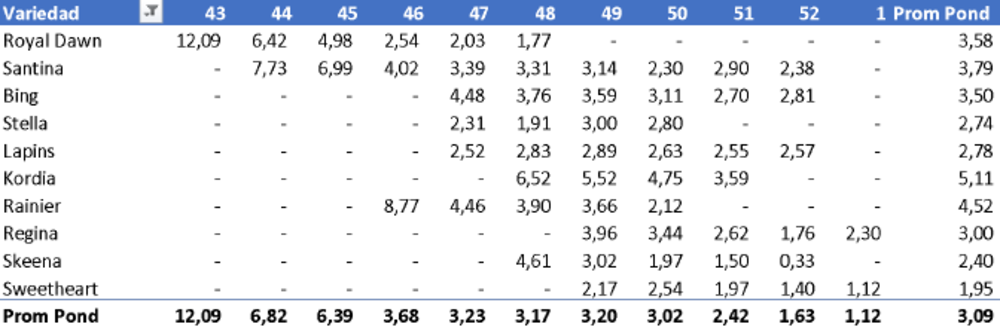

Table 2: Weighted averages per variety (XL).

Table 2: Weighted averages per variety (XL).

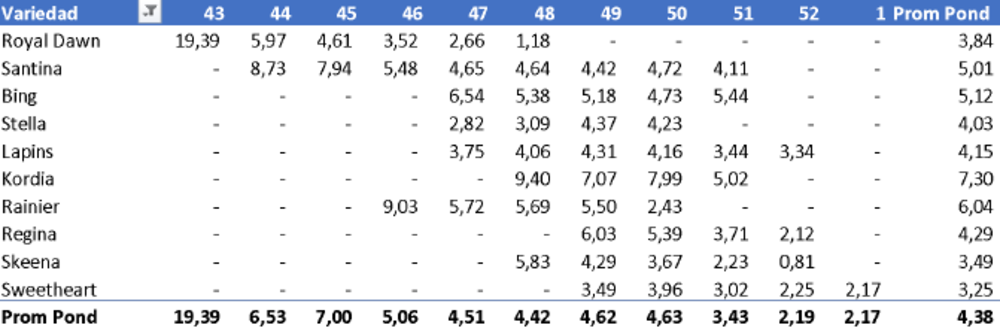

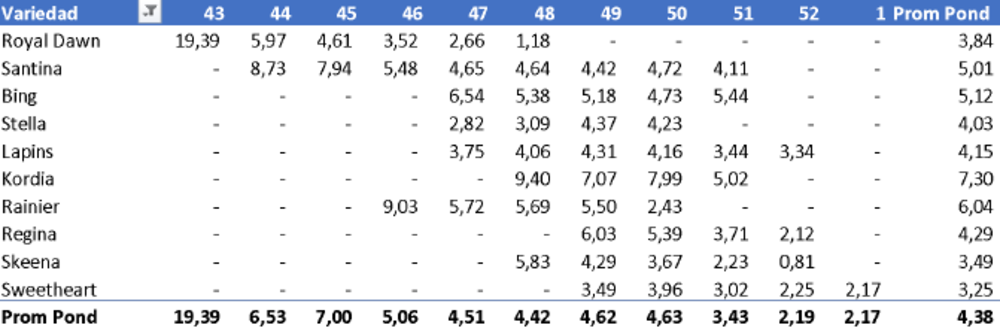

Table 3: Weighted averages per variety (J).

Table 3: Weighted averages per variety (J).

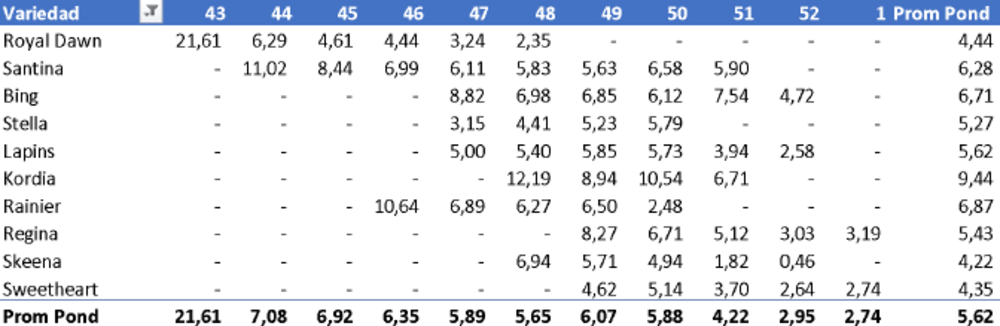

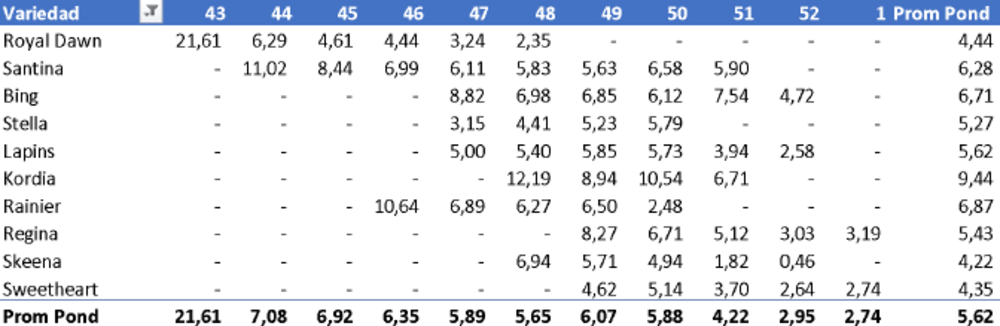

Table 3.1: Weighted averages by variety (2J).

Table 3.1: Weighted averages by variety (2J).

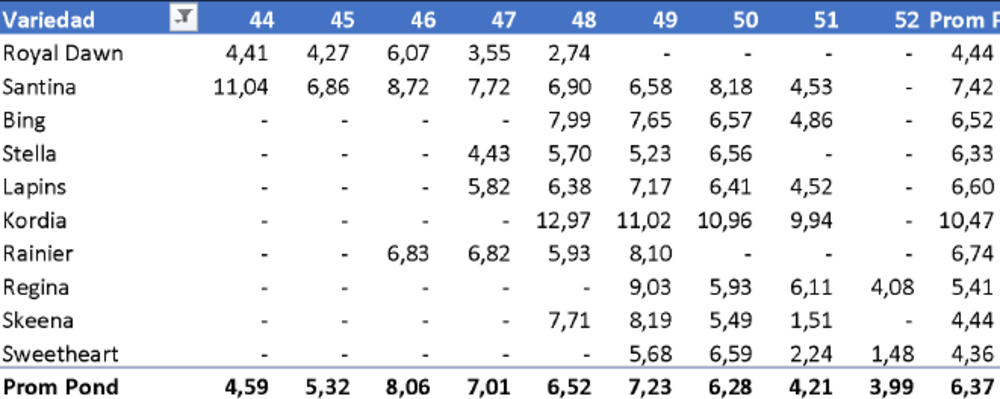

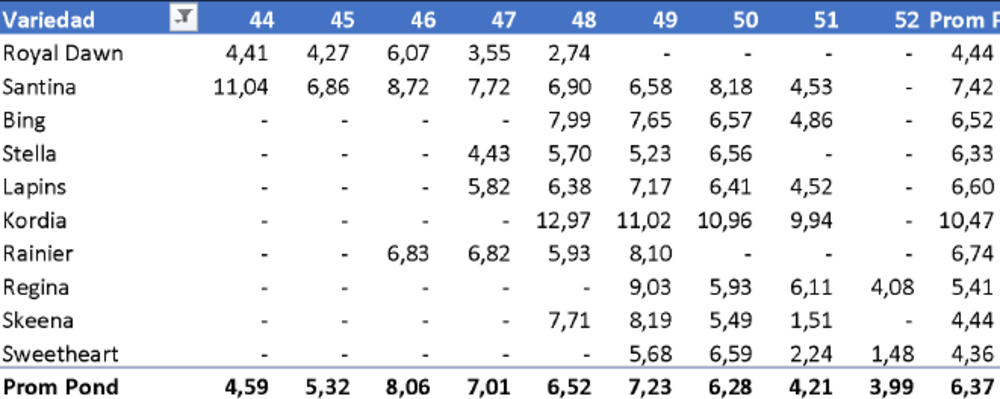

Table 4: Weighted averages by variety (3J).

Table 4: Weighted averages by variety (3J).

Table 5: Weighted averages by variety (4J).

Table 5: Weighted averages by variety (4J).

A FEW CONCLUSIONS

After conversations with several growers and after examining numerous liquidations from various exporters, we can draw some significant conclusions:

Early fruit

In contrast to previous years, this year saw a significant drop in prices for this type of fruit, putting those growers who had invested in early fruit and were used to obtaining valuations of $5-7 per kilo in difficulty. The Royal Down and Santina varieties suffered, achieving lower yields than expected.

Late Fruit

This segment, comprising fruit harvested after the first week, experienced an increase in prices compared to last season, but values are still around $2-2.5, which poses challenges for Southern Chile. Regina's Resurgere: In the 21-22 season, the Regina variety had suffered such a severe collapse that several growers considered uprooting trees or proceeding with grafting. This year, Regina maintained a good price until week 50-51, gaining appreciation in the market.

Kordia and Rainier

These two varieties remain the spearheads, although they are difficult to produce, and show higher yields per kilo than the others.

Average price

This season, the average price was around USD 4 per kilo for the Cat1 fruit category, with an impressive volume of 83 million boxes exported (an all-time record). It should be noted that 80% of the fruit was shipped within the 51st week.

Once again, the cherry sector proves to be one of the most profitable in Chilean agriculture. Despite its maturity, the sector continues to grow both in terms of processing capacity and land expansion. 100 million boxes are expected in the coming seasons, and producers wishing to maintain their success must focus on producing fruit of considerable size (2J and above) and qualify for the premium labels offered by exporters.

In this respect, careful technical management and timely execution of technical tasks will be critical, along with a climate that favours us the most.

Source: CyD AsesorÍas Agricola

Cherry Times - All rights reserved