Alessandro Palmieri - University of Bologna (IT)

Comitato tecnico-scientifico di Cherry Times

The Italian fruit-growing sector has long been in a complex situation, caught between market issues that have never been adequately addressed and new challenges. These include increasingly unpredictable and hostile climate patterns, the emergence of new diseases that are difficult to manage, and various socio-economic issues affecting consumption, labor markets, logistics, and raw material prices.

In this context of difficulty, economic sustainability appears increasingly at risk, as evidenced by the abandonment of thousands of hectares of fruit-growing areas, especially in the northern regions of the country, particularly in Emilia-Romagna, one of the cradles of national fruit-growing.

However, the economic picture varies significantly depending on the species or, in some cases, the variety.

A recent study [1] analyzed production costs and average margins of the main species in the Emilia-Romagna region, identifying 12 case studies related to 7 species. Data were collected through direct surveys of appropriate samples of professional enterprises, considering the main types and densities of planting found in the area.

Regarding the case study of cherry trees, the reported values are averaged for medium-density Ferrovia espaliers, equipped with anti-hail and rain coverings.

Subsequent data processing was necessary to consider the peculiarities of the current production context. The Gross Value Added (GVA) was calculated based on "ordinary" production yields over the medium to long term for healthy orchards, as well as weighted prices based on values from the last decade.

It is not significant, in a future perspective, to consider the average yields of recent years, heavily affected by adverse climatic trends, as well as the related prices, influenced by resulting supply shortages.

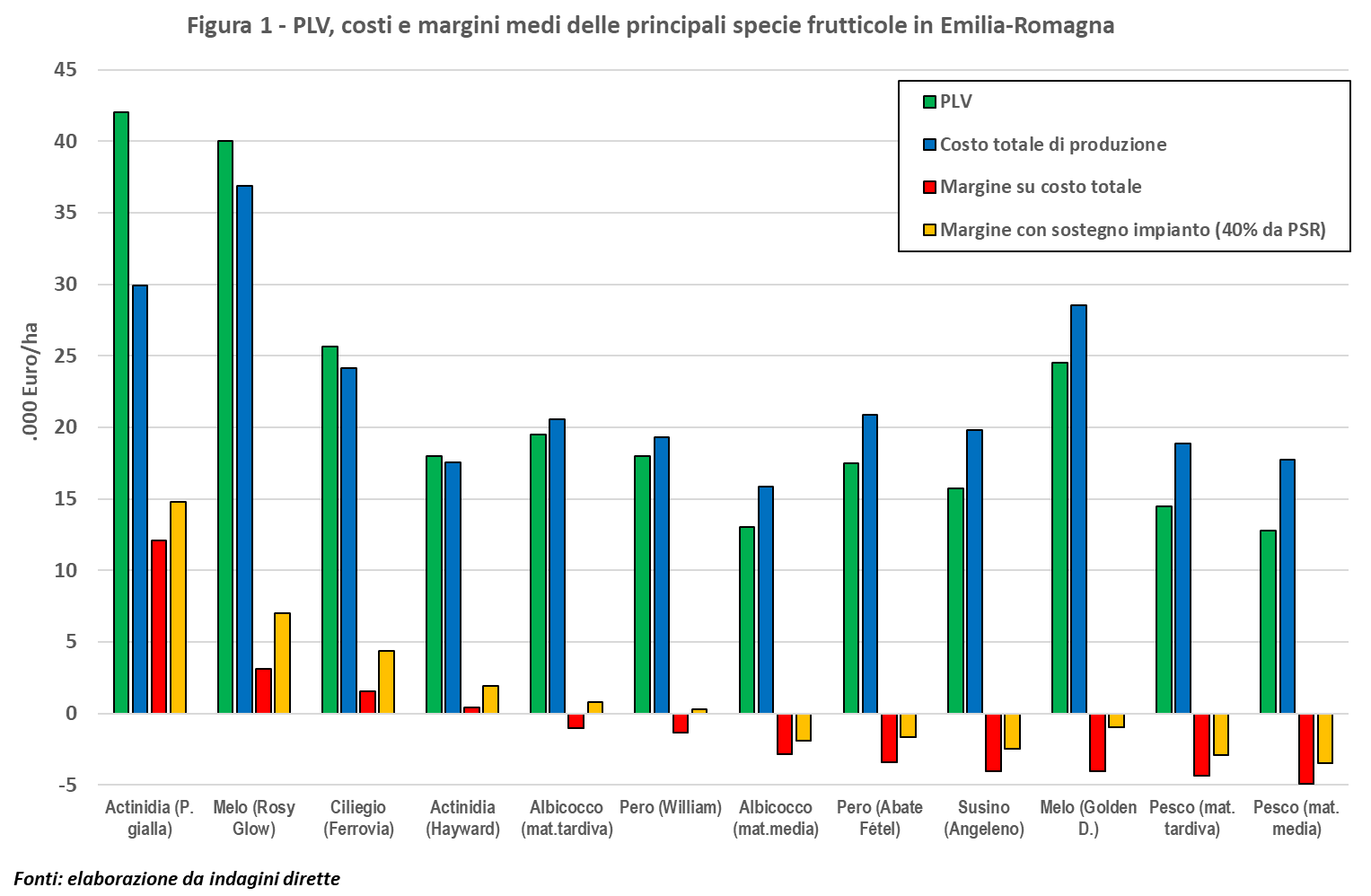

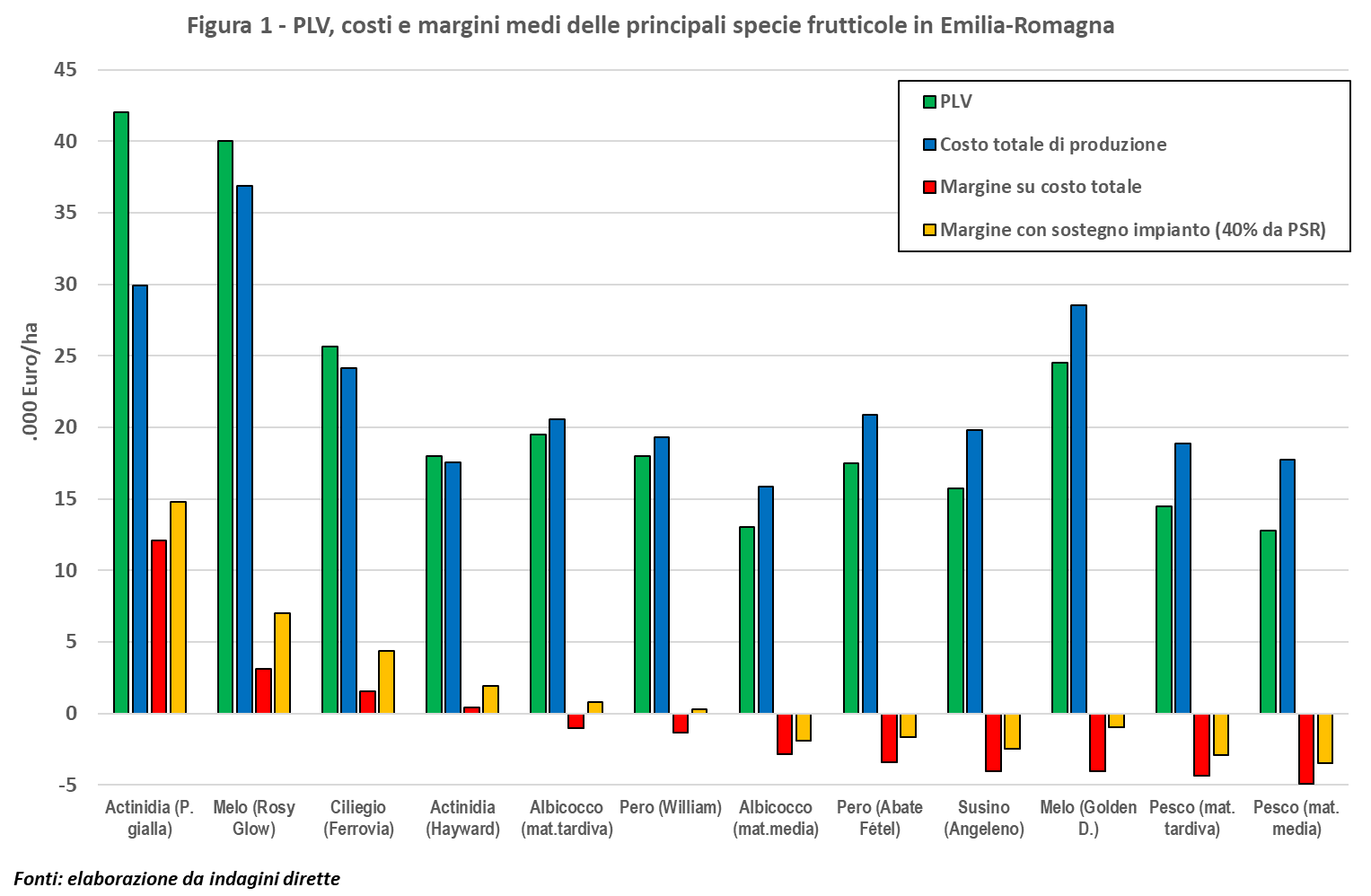

That being said, Figure 1 highlights the GVA, costs, and the relative average annual margin of the cases examined, calculated based on total costs, or 40% financing on planting costs, currently provided by the Rural Development Program (RDP) to enterprises grouped in Producer Organizations (POs).

As noticeable, the Gross Value Added (GVA) levels vary significantly among them, with maximum values observed in the two exemplary cases related to varieties managed as clubs: apple, cv. Rosy Glow (Pink Lady group), and yellow-fleshed kiwifruit (average data for major brands) which can reach around 40,000 euros/ha.

Following closely, at around 25,000 euros/ha, is the case study concerning cherry trees, essentially on the same levels as apple trees, referring to its most widespread traditional cultivar, Golden Delicious. In this latter case, high yields enable reaching a high GVA, though countered by a very low liquidation price.

Conversely, cherries boast high prices, although with generally lower average yields compared to the other cases under examination. In the remaining cases, the GVA ranges between 13,000 and 20,000 euros/ha.

On the other hand, in cases where the highest GVA values are observed, clearly higher cost levels are also noted compared to the other examples: these high costs are mainly due to the high workload required, typically from varieties whose fruits are better remunerated to achieve the high quality standards demanded.

From the comparison, it emerges that only in a few cases, with the parameters considered, a positive margin value is achieved, and among these, cherry trees rank just after the two examples of club varieties, reaching a value around 1,500 euros/ha, which rises to almost 4,500 euros/ha considering the opportunity for financing planting costs by rural development programs.

It's worth noting that these values are inclusive of all costs incurred, while in reality, business profitability may be higher depending on the contribution of labor or capital from the enterprise.

Economically, however, it's decidedly negative for most stone fruits, but also for pear trees, especially concerning its most representative cultivar, Abate Fétel, or for apple trees, considering traditional varieties, despite the very high yields they can achieve.

On the other hand, the strength of cherry trees lies mainly in the prices which, with data from the period under review, range between 3 and 3.5 euros/kg, as the average value settled based on the distribution of each plantation's calibers.

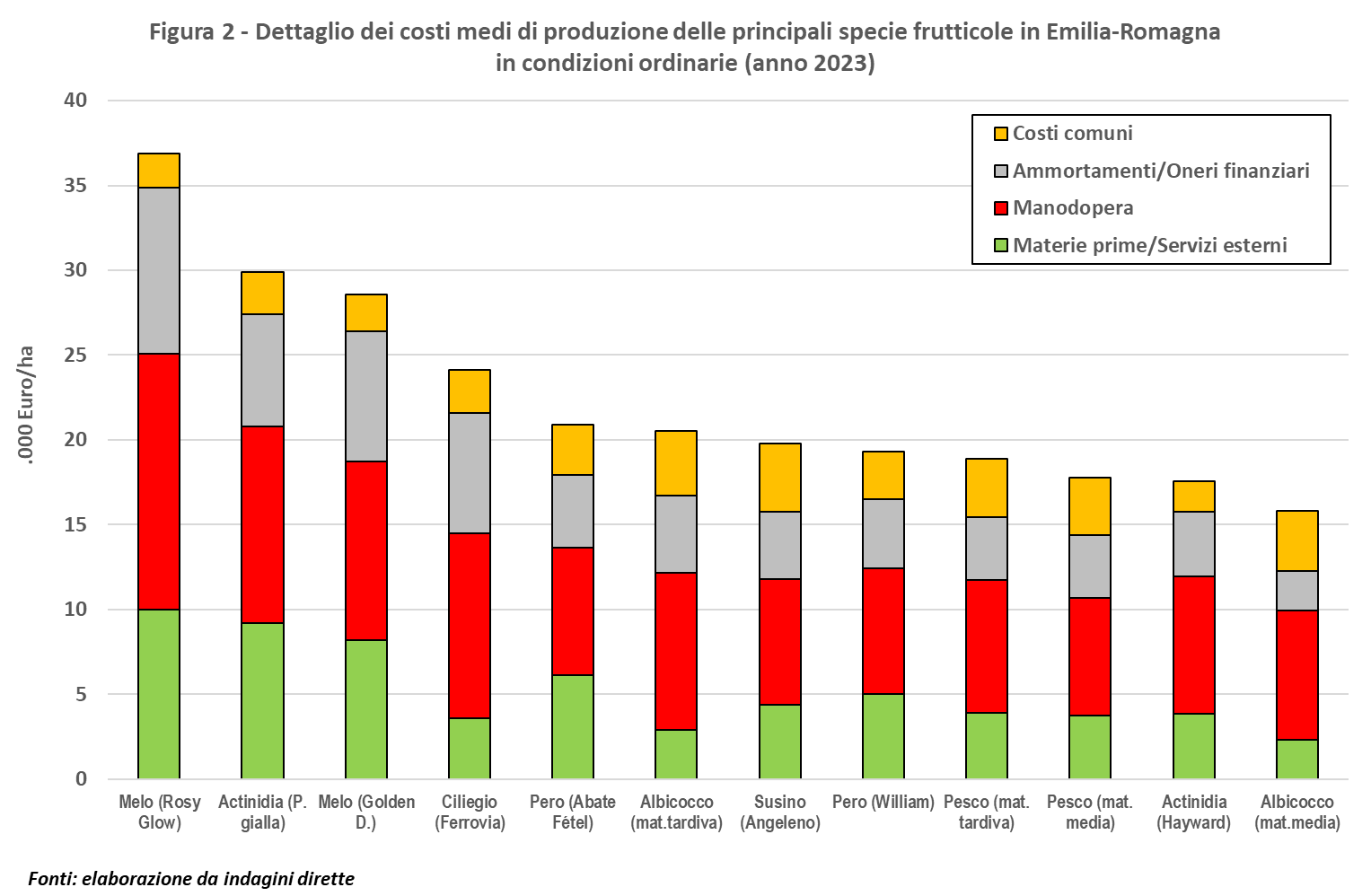

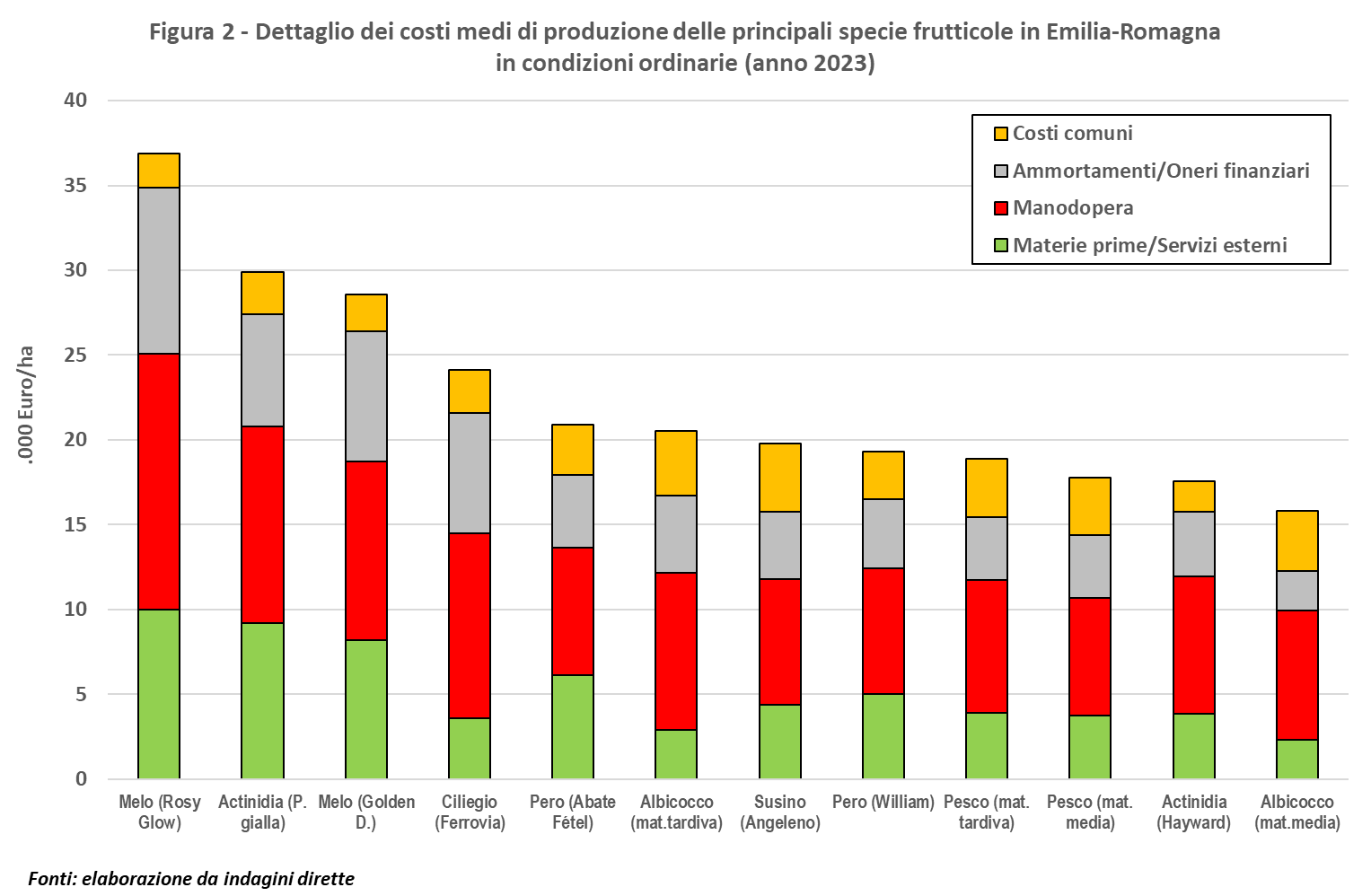

Regarding costs, analyzing their breakdown (Figure 2), it's clear that for cherry trees, labor is the most strategic item, accounting for 45% of the total cost, among the highest in the cases considered. Material expenses are much lower, at around 15% of the total, while fixed charges for depreciation and financial charges are proportionally significant, amounting to just under 30% of the total.

From the comparison between costs and revenues, it emerges that cherry trees confirm themselves as one of the few fruit species capable of achieving full economic sustainability in the Emilia-Romagna region, thanks to the intense valorization efforts that have always been supported, resulting in significantly higher prices compared to the national average.

On the other hand, the costs to be incurred are very high and remain a risk factor that can be best addressed with adequate coverage of the orchards to seek production continuity, and with the optimization of forms and densities of cultivation to optimize harvesting, which is by far the most labor-intensive operation in cherry cultivation.

Avoiding high production costs and risk, however, does not seem possible in the current context that rewards cases such as those managed as clubs, characterized by a strong valorization activity but requiring high-quality standards, thus generating high investments and workloads accordingly.

[1] Cfr, A.Palmieri “Frutticoltura senza sostenibilità economica”, Rivista di Frutticoltura e di Ortofloricoltura, nr.2/2024

Cherry Times -All rights reserved