2025 begins with the Year of the Snake, but for Chilean cherries it's a time for bitter reflections. According to the data, the economic returns from the last season show a collapse, despite record-high volumes.

The Chinese market, traditionally the main driver of Chilean cherry exports, was not enough to save a season that will be remembered more for its challenges than for successes. According to the 2025 Annual Report by iQonsulting, FOB revenues will slightly exceed $1.8 billion (around €1.65 billion), a sharp drop from the $3 billion (around €2.76 billion) recorded in the 2023/24 campaign. A 40% plunge, even more surprising considering that this year production reached the historical record of 125 million boxes, representing a 51% increase over the previous season.

A season of growth

Isabel Quiroz, co-founder of iQonsulting, is blunt: "The average price collapsed in historic terms. It’s true that the product reached a broader audience and the entire volume was sold, but the revenues no longer cover production costs in Chile."

The loss caused by the sinking of the Maersk Saltoro cargo ship — which resulted in the destruction of about 5 million boxes — further worsens the financial balance, but it is not enough to explain the depth of the crisis.

A global strategy is needed

While acknowledging that China remains a strategic asset, Quiroz calls for a major review of sales dynamics: "We have reached an average annual consumption of 434 grams per capita in China alone. That’s a huge figure, but also a risky one: any misstep can trigger dramatic price drops, as we've already seen."

The message is clear: market diversification is now a priority. Moreover, a more granular planning of exports is necessary. Every week follows its own rhythm, influenced by seasonal, cultural, and promotional factors. "Selling at $100/kg (about €92/kg) in week 44 is not the same as during the weeks before the Chinese New Year. Each week must be carefully analyzed to determine how much can be sold and at what price."

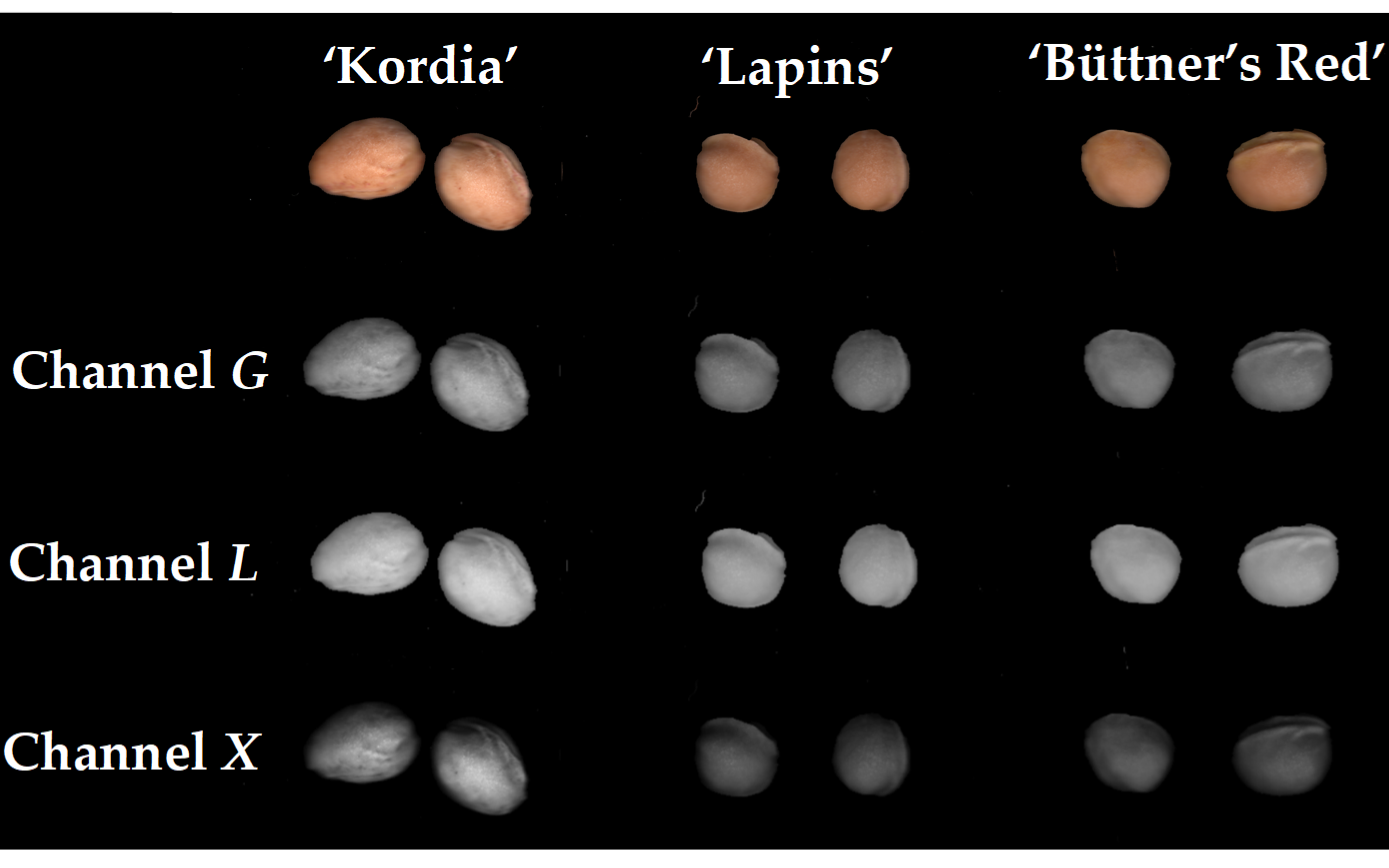

Bicolor cherries stand out

In a season marked by falling prices, the performance of bicolor varieties, such as Skylar Rae and Rainier, stood out by maintaining high price points. The former reached $68 per kilo (about €62/kg) in December, while the latter surpassed $50 (about €46) in the early weeks of the season.

These are niche productions, more complex to manage and with limited volumes, but they show a premium potential that is still largely untapped.

Conclusion: the future of export

The lesson is clear: quantitative growth is no longer enough. The sector must rethink its strategy, not only to regain value, but also to build a more resilient and sustainable model, capable of weathering the fluctuations of the Chinese market and expanding into new global destinations.

Source text and images: redagricola.com

Cherry Times – All rights reserved