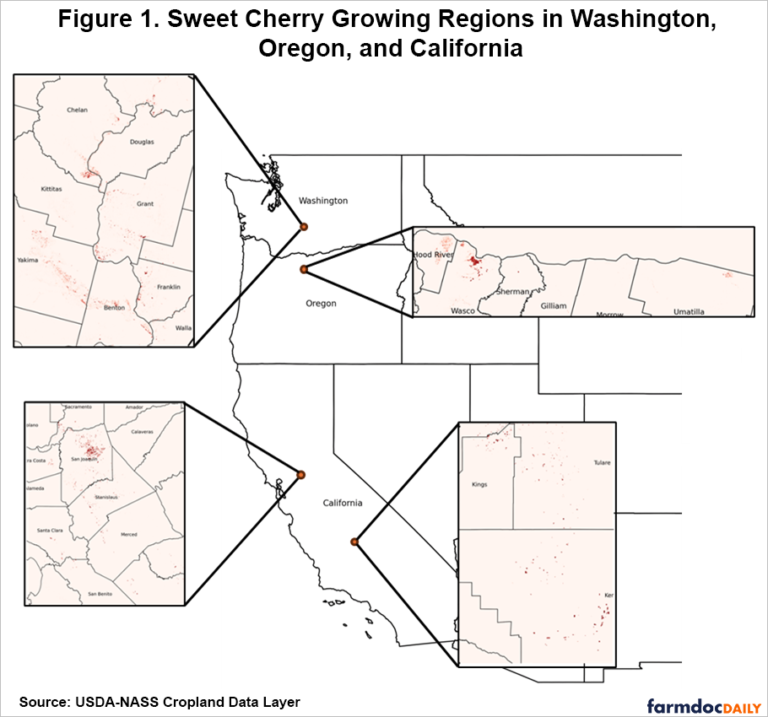

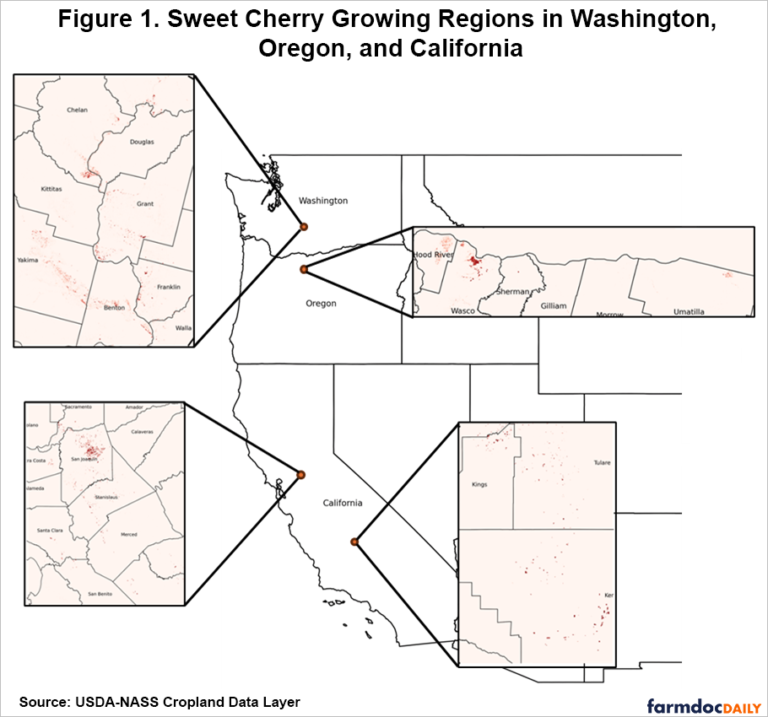

The sweet cherry industry in the United States is primarily concentrated in Washington, California, and Oregon (Figure 1), which together represent over 90% of the national total production in 2023 (Figure 2). Washington leads in production with 443,640 tons, followed by California with 317,736 tons and Oregon with 58,765 tons (USDA-NASS, 2022).

Image 1: Regions growing sweet cherries in Washington, Oregon, and California.

Image 1: Regions growing sweet cherries in Washington, Oregon, and California.

The sweet cherry industry faces challenges such as pressure from pests and diseases, in addition to significant transitions in land use. This article summarizes changes in sweet cherry production in the United States and discusses the dynamics of land use transitions based on USDA Cropland Data Layer (USDA-NASS, 2024), the USDA-NASS census (USDA-NASS, 2024), and the USDA-AMS specialty crop shipment dataset (USDA-AMS, 2024).

Sweet Cherry Production

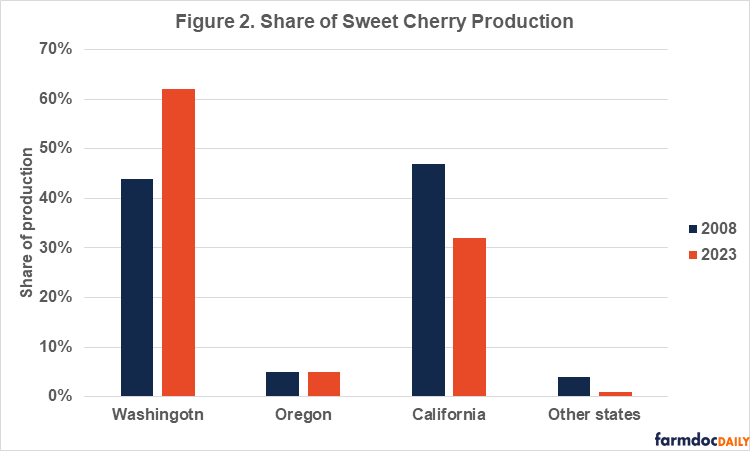

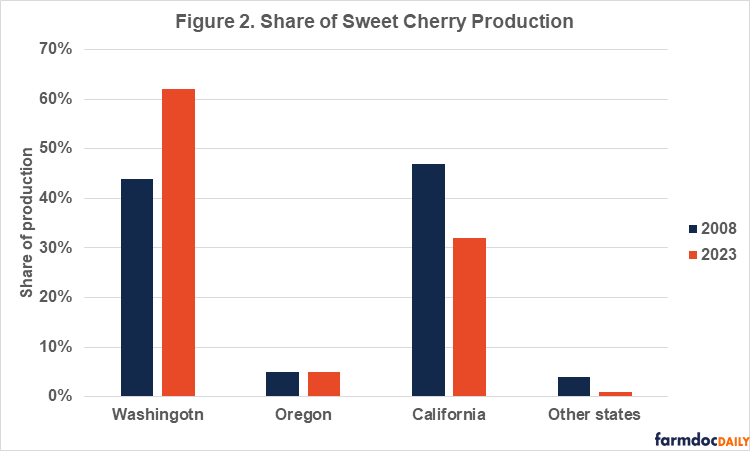

Over the past 15 years, national sweet cherry production in the United States has seen significant growth, increasing from 330 million pounds in 2008 to 550 million pounds in 2023. In 2008, Washington and California were the dominant producers of sweet cherries, with 44% and 47% of the total production, respectively (Figure 2).

Image 2: Sweet cherry production percentages in the United States from 2008 to 2023.

Image 2: Sweet cherry production percentages in the United States from 2008 to 2023.

However, by 2023, Washington's share had risen to 62%, while California's share had decreased to 32%. This shift in production highlights the growing importance of Washington as a key player in the sweet cherry industry. Oregon's sweet cherry production remained stable, consistently representing 5% of the country's total sweet cherry production between 2008 and 2023, highlighting the state's steady contribution to the sector (Figure 2).

Overall, the increase in national sweet cherry production, coupled with rising cherry exports and decreasing imports, demonstrates the strong growth and competitiveness of the U.S. sweet cherry market.

Sweet Cherry Land Use Trends

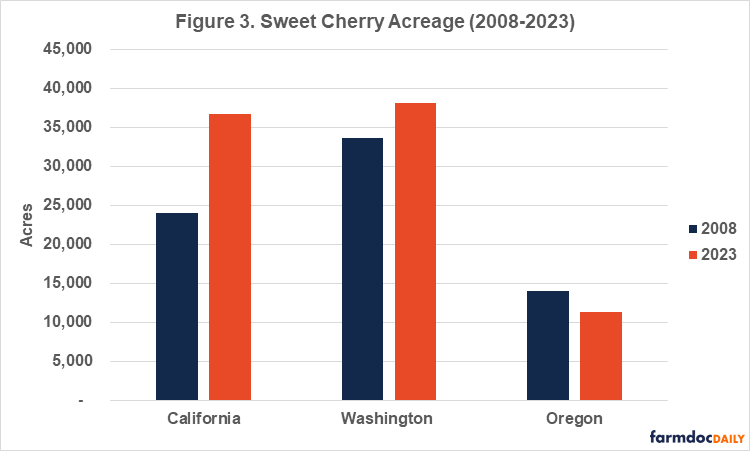

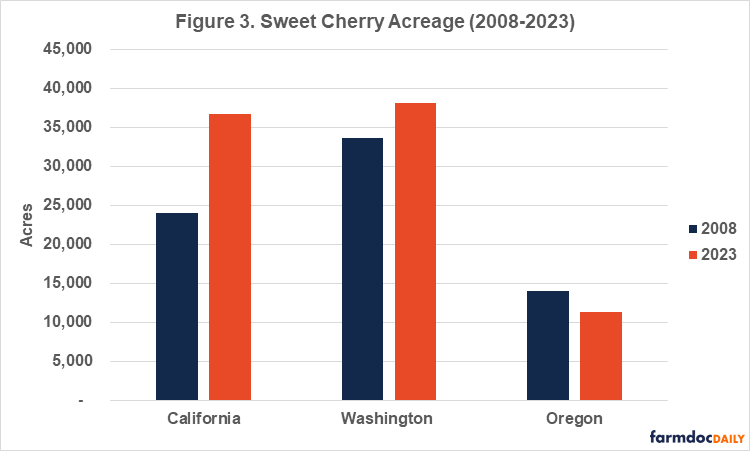

From 2008 to 2023, the area of sweet cherry orchards in Washington, the leading production region, increased by 14% (Figure 3). This growth can be attributed to the consistent demand for premium cherry varieties such as Bing and Rainier. Advanced irrigation systems in Washington, particularly in the Yakima Valley and Wenatchee areas, have also supported large-scale cherry production (WSU Tree Fruit, 2021).

Image 3: Area of sweet cherry production in the United States (in acres) from 2008 to 2023.

Image 3: Area of sweet cherry production in the United States (in acres) from 2008 to 2023.

During the same period, California experienced a significant 52% increase in sweet cherry acreage (Figure 3). Part of this increase can be attributed to the introduction of new cherry varieties better suited to California's various climatic regions.

These advancements enable growers to produce high-quality cherries for a longer period and capitalize on market opportunities at the beginning and end of the season (Marino et al., 2020). In contrast, Oregon has seen a 19% decrease in sweet cherry acreage over the past 15 years (Figure 3).

This decline can be attributed to several key environmental factors, including water availability and pest pressure. Cherry cultivation has become increasingly challenging in some areas of Oregon that suffer from water scarcity due to prolonged drought conditions (OSU Extension services, 2023).

Additionally, policies promoting sustainable agricultural practices have encouraged the shift from intensive crop production to more sustainable uses such as pastureland or grazing. This transition away from cherry cultivation is often supported by state and federal programs that promote land conservation and sustainable farming practices (USDA-NRCS, 2023).

The Impact of Pests and Diseases

Pressures from pests and diseases, such as the spread of spotted wing drosophila and Western X-disease, have increased costs and complexity in managing cherry orchards. Spotted wing drosophila affects soft-skinned fruits like cherries, leading to increased use of pesticides and higher production costs, which may deter growers from continuing cherry production (OSU Extension services, 2023).

For example, the outbreak of Western X-disease that affected Washington and Oregon from 2015 to 2020 resulted in an estimated revenue loss of $65 million and estimated replanting costs of $115 million (DuPont et al., 2021; Molnar et al., 2022).

Conclusions

The sweet cherry sector in the United States has undergone significant changes from 2008 to 2023. Washington has emerged as the leading producer, thanks to increased orchard acreage and advanced agricultural practices. California has also expanded its acreage by introducing new cherry varieties.

Oregon, on the other hand, has seen a decrease in acreage due to environmental challenges and a shift towards sustainable land use practices. Land use transitions, such as the shift from apples to cherries in Washington and from pastures to cherries in Oregon, reflect the sector’s adaptability to market and environmental pressures.

However, the sector continues to face significant challenges. Issues with pests and diseases, such as spotted wing drosophila and Western X-disease, have increased management costs and caused economic losses. These challenges highlight the need for adaptation strategies and innovation in the sweet cherry sector.

Read the full article: Farmdoc Daily

Images: Farmdoc Daily; SL Fruit Service

Cherry Times - All rights reserved