In the last decade, Chile has experienced a steady increase in cherry production due to the profitability of the crop and strong demand. According to the USDA, for the marketing year (MY) 2024/25, Chilean cherry production is expected to reach 500,000 metric tons (MT), a 6.8% increase compared to the previous year.

This growth is expected despite the challenges faced in MY 2023/24, where a warm winter and a rainy spring led to a slight decline in production of 0.2%. The adverse weather conditions impacted cherry yields, highlighting the delicate balance necessary in agricultural production.

However, the outlook for MY 2024/25 is more optimistic, with favorable winter rainfall and sufficiently low temperatures, both of which are crucial for cherry development.

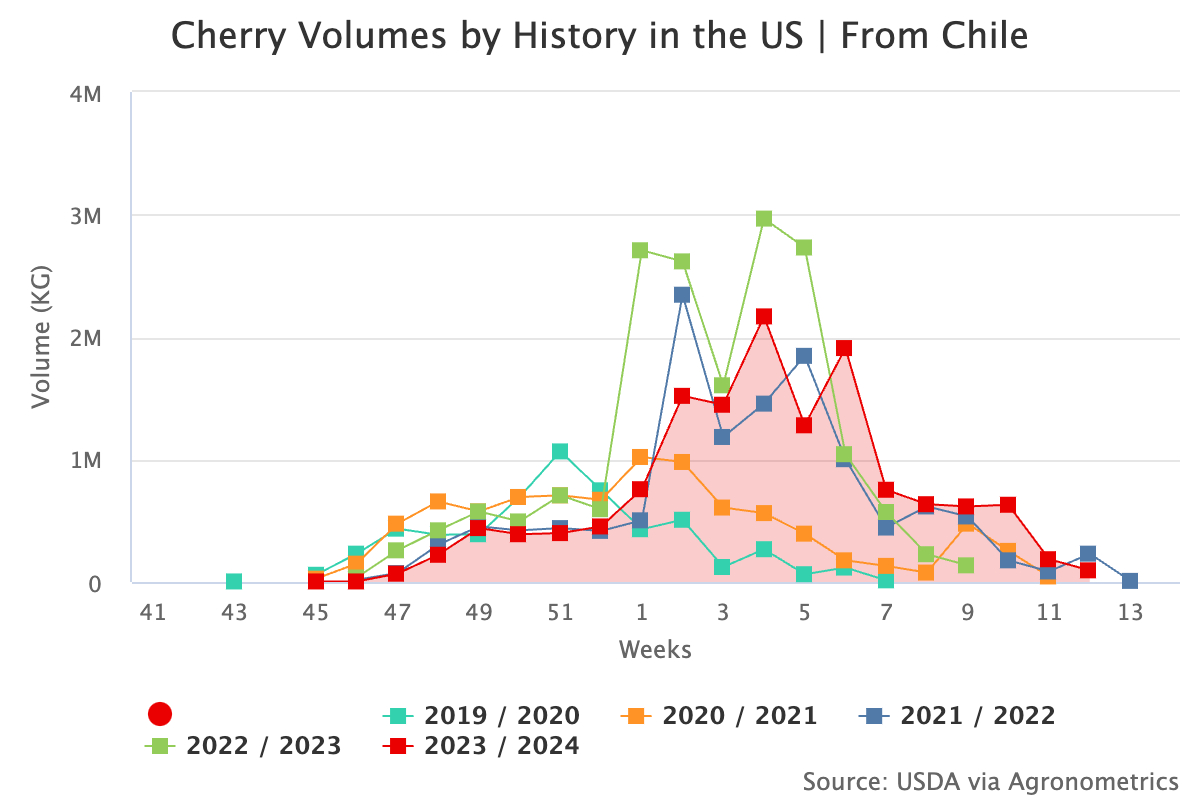

Image 1: Volumes of cherries imported from Chile into the USA.

Image 1: Volumes of cherries imported from Chile into the USA.

In addition to the overall increase in production, Chilean cherry export volumes are expected to rise by 7.6%, reaching 445,000 tons in MY 2024/25. This anticipated growth underscores Chile's strategic focus on expanding its presence in the global cherry market, particularly in China.

The expansion of cherry orchards has been a significant factor in this growth. In MY 2024/25, the cultivated area for cherries is expected to reach 67,000 hectares (HA), a 5.5% increase compared to the previous year.

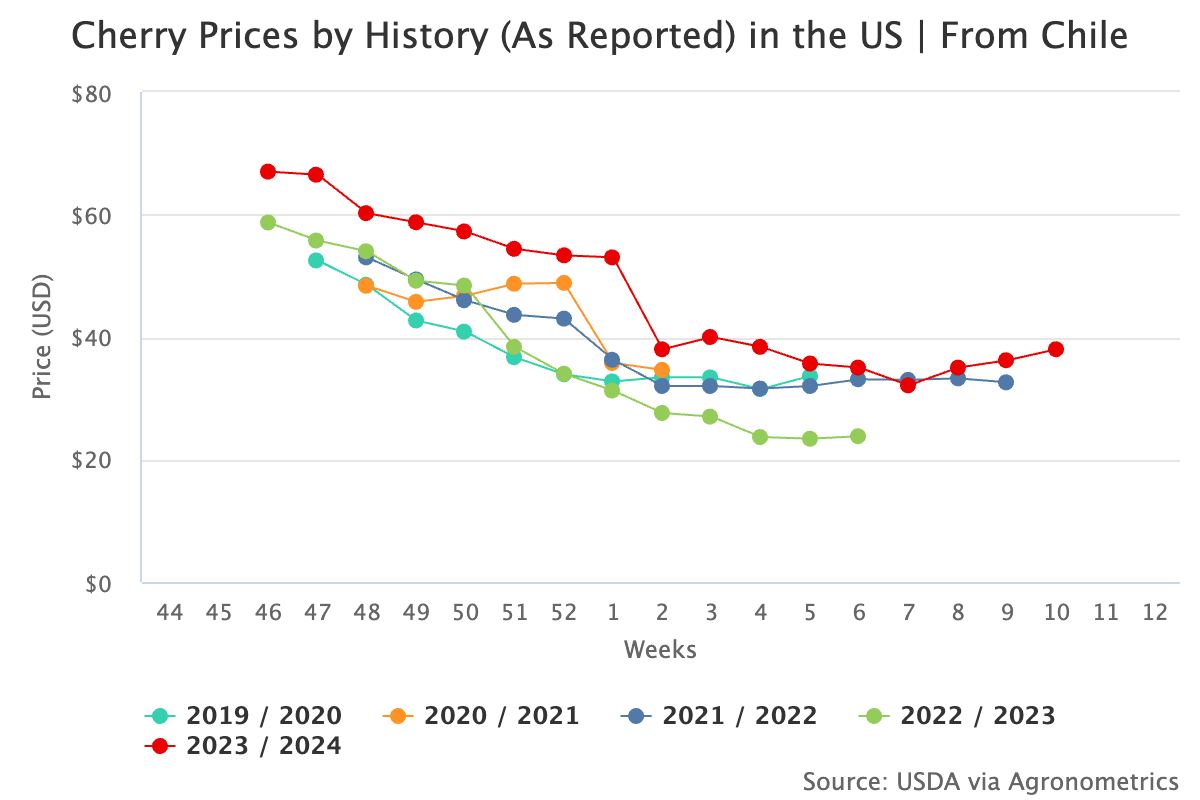

Image 2: Prices of Chilean cherries in the USA.

Image 2: Prices of Chilean cherries in the USA.

Given the delicacy of cherries, which are prone to damage due to handling and high temperatures, the packing process has been largely automated to minimize physical damage to the fruit. Producers and exporters are making concerted efforts to streamline harvesting and packing processes to ensure cherries are ready for export as quickly as possible.

All U.S. domestic product prices represent the spot market at the shipping point (i.e., packinghouse, refrigerated warehouse, etc.). For imported fruit, price data represents the spot market at the port of entry.

Read the full article: Agronometrics

Images: Agronometrics

Cherry Times - All rights reserved