Portugal is proving to be a country with enormous potential for cherry production, especially during times when European production is insufficient to meet existing demand.

Characterization and Context of the Sector

Thanks to its climate and geographical position relative to Europe, Portugal proves to be a country with enormous potential for cherry production, especially during times when European production is insufficient to meet existing demand. The dominant growing areas in Portugal are limited to the region of Entre Douro and Minho, namely Resende, Trás-os-Montes, and Beira Interior.

The Beira Interior region is also the most productive, with the Fundão and Cova da Beira areas standing out. The season starts earlier in Resende, in mid-April, where the Earlise, Brooks, Abrileira, and Rabicha varieties abound. At the end of April and the beginning of May, the season starts in Fundão and Covilhã with the Burlat and Earlise varieties. In mid-May, the season begins in the rest of the country and lasts until the end of July.

The certification of Protected Geographical Indication (PGI) has established the Cova da Beira and Fundão brands and has set specific varieties and cultivation systems for each.

1. National Context

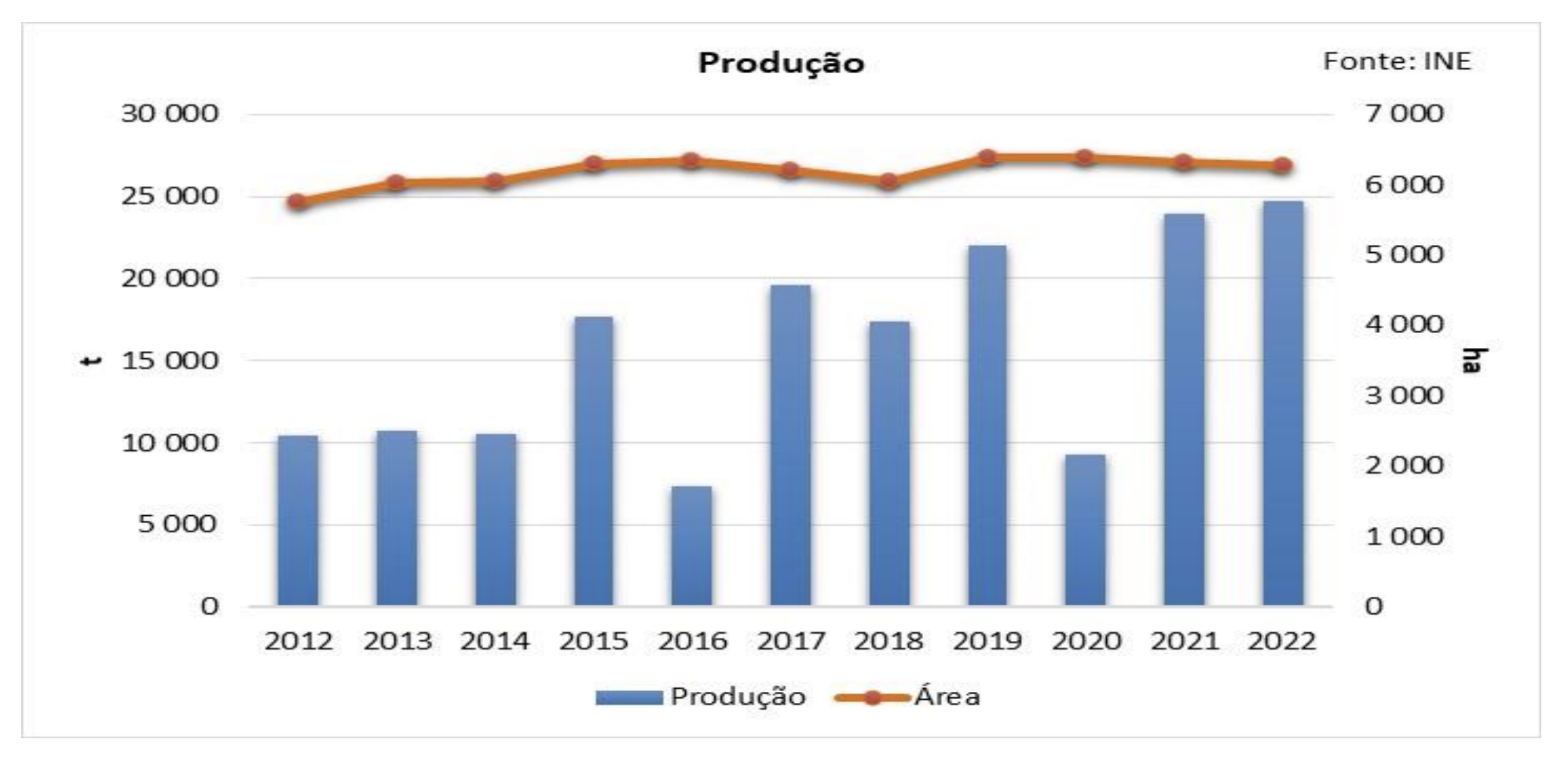

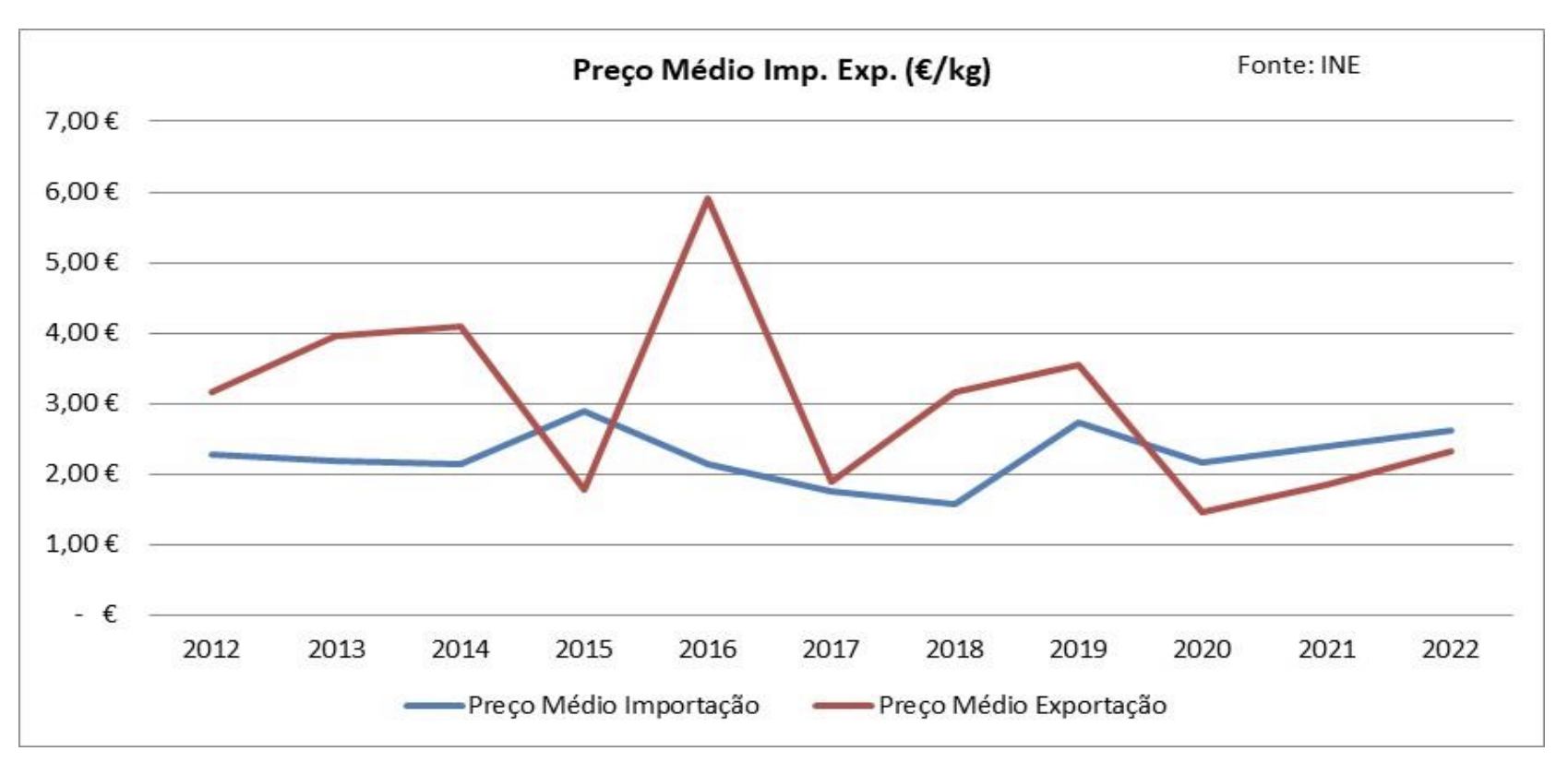

Below is the evolution of production, area, and productivity of cherry cultivation in Portugal between 2012 and 2022. Data collected by INE.

1.1 Production and Cultivated Area

In terms of installed area, it remained relatively stable during the period under analysis. In Portugal, there are approximately 6,279 hectares of cherry orchards in production. Regarding the production obtained, there were substantial fluctuations during the analyzed period. In 2016 and 2020, there was a sharp decline, with production reaching just 7,362 tons and 9,241 tons, respectively.

Image 1: Cherry production in Portugal from 2012 to 2022.

Image 1: Cherry production in Portugal from 2012 to 2022.

In 2020, according to information gathered by INE, the season saw a decrease of about 60% due to "very adverse weather conditions in the spring, namely the heavy rains that occurred during sensitive periods of these crops' cycle." Subsequently, there was a significant increase in production in 2021 and 2022, when a record volume was reached. In 2022, Portugal reached a maximum production of about 24,678 tons of cherries.

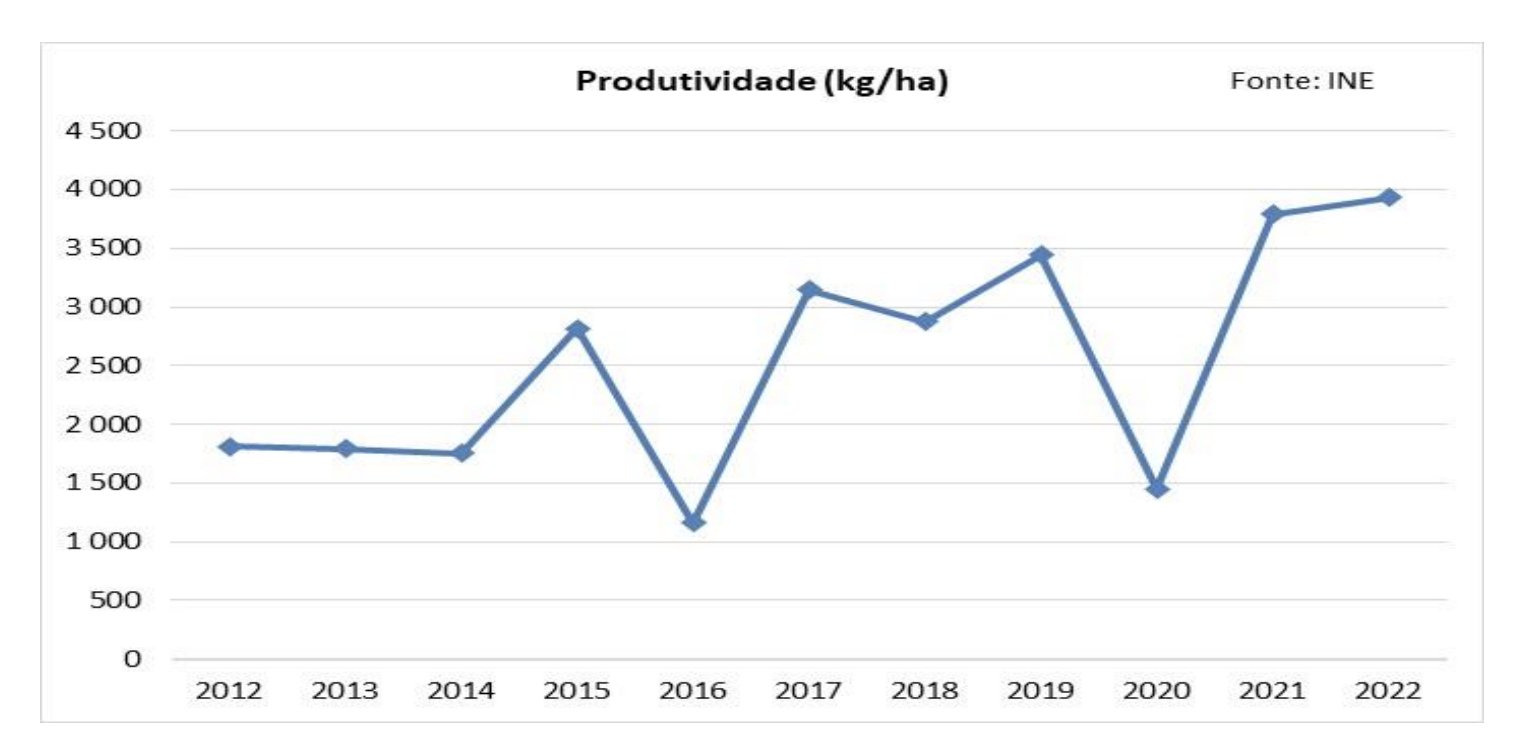

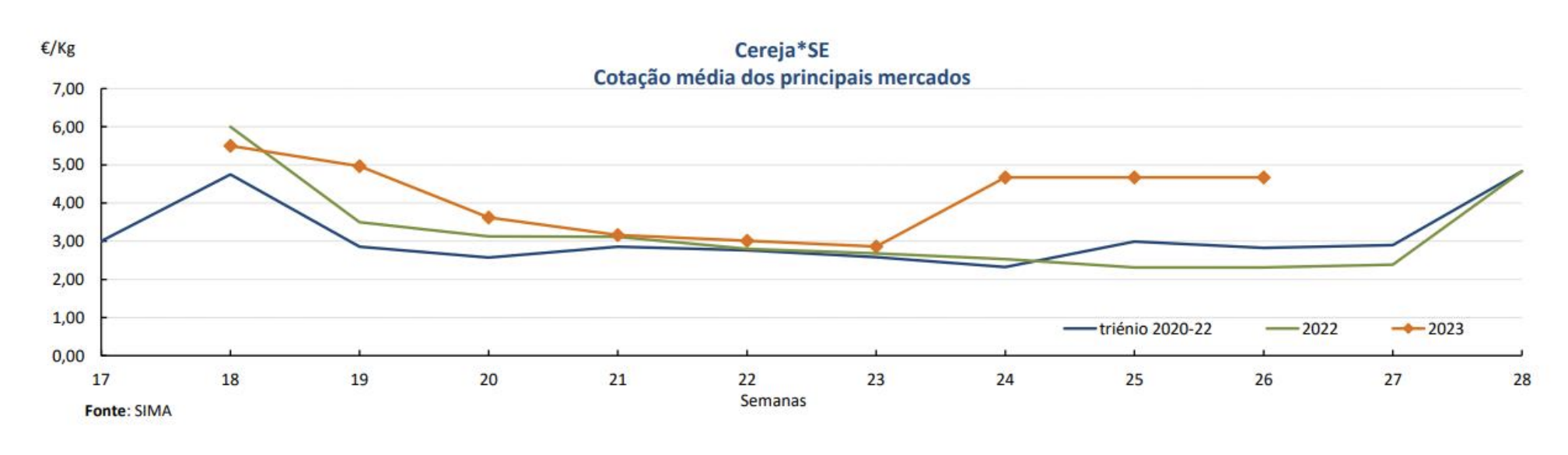

1.2 Productivity

In terms of productivity, due to the poor seasons in 2016 and 2020, these years correspond to the minimum values recorded, with 1,159 kg/ha and 1,447 kg/ha, respectively. In 2021 and 2022, the productivity of the crop recovered, reaching record values of 3,793 kg/ha in 2021 and 3,931 kg/ha in 2022.

Image 2: Production (kg/ha) of cherries in Portugal from 2012 to 2022.

Image 2: Production (kg/ha) of cherries in Portugal from 2012 to 2022.

2. International Trade

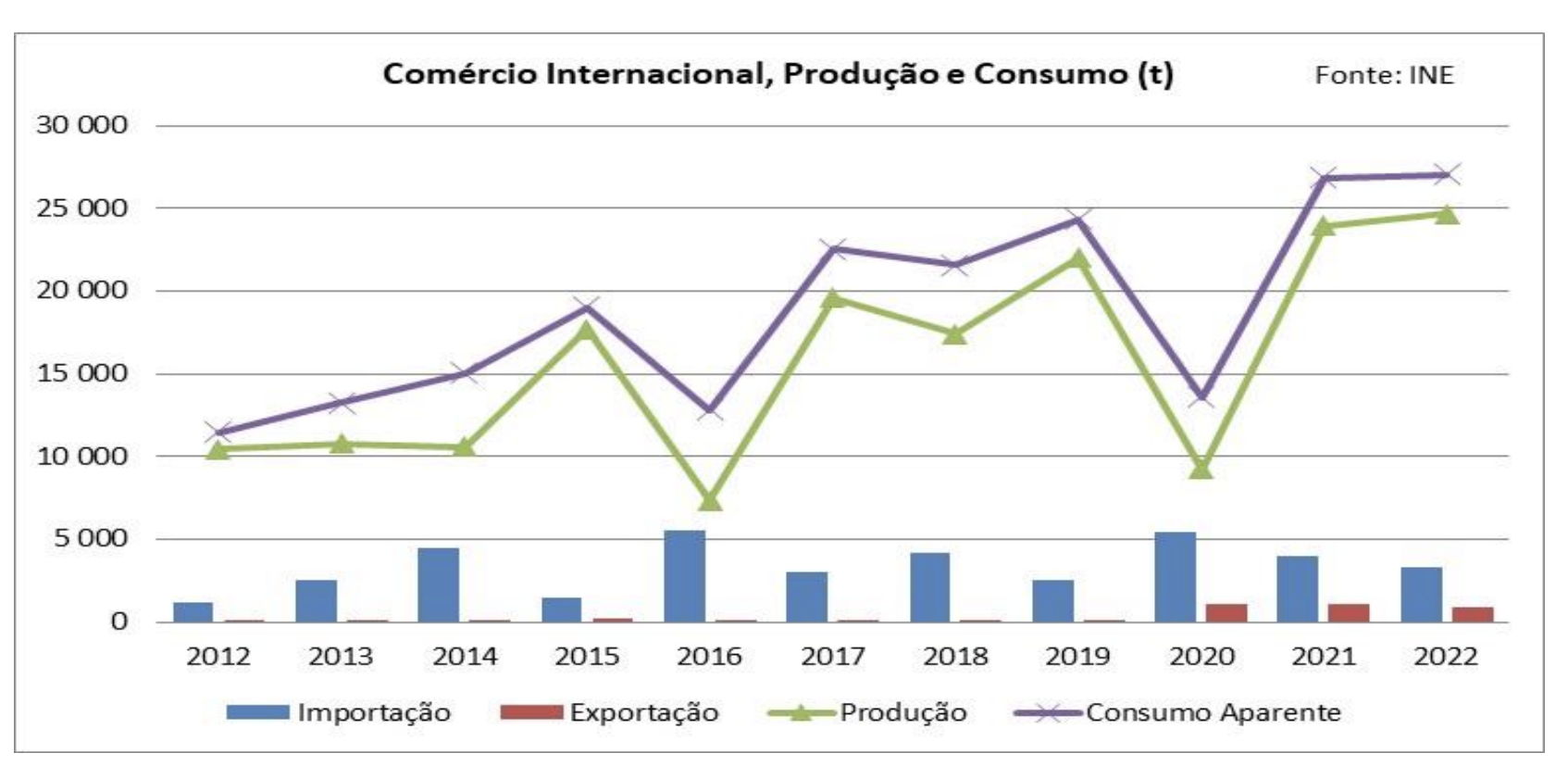

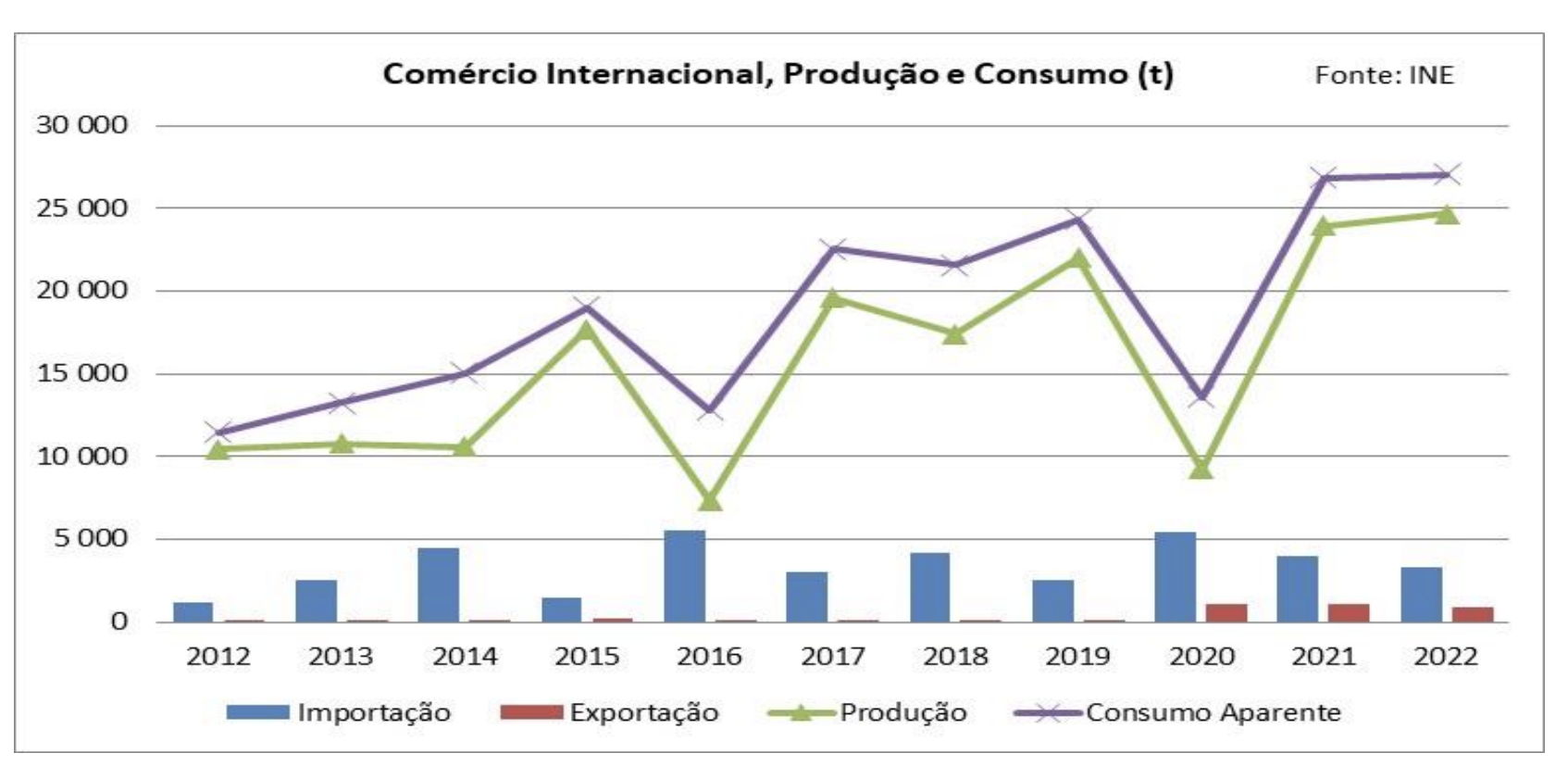

Below are the main indicators related to international trade. It should be noted that the vast majority of national production is absorbed by the domestic market, and the trade balance is in deficit.

2.1 International Trade, Production, and Consumption

Analyzing the presented chart, it can be observed that imports have fluctuated in line with the variations in production and apparent consumption, with the contrast observed in 2016 and 2020, years of lower national production. In 2021 and 2022, apparent consumption increased by about 27,000 tons. In 2022, Portugal's level of supply for the domestic market was about 88%.

Image 3: International trade, production, and consumption (in tons) of cherries in Portugal from 2012 to 2022.

Image 3: International trade, production, and consumption (in tons) of cherries in Portugal from 2012 to 2022.

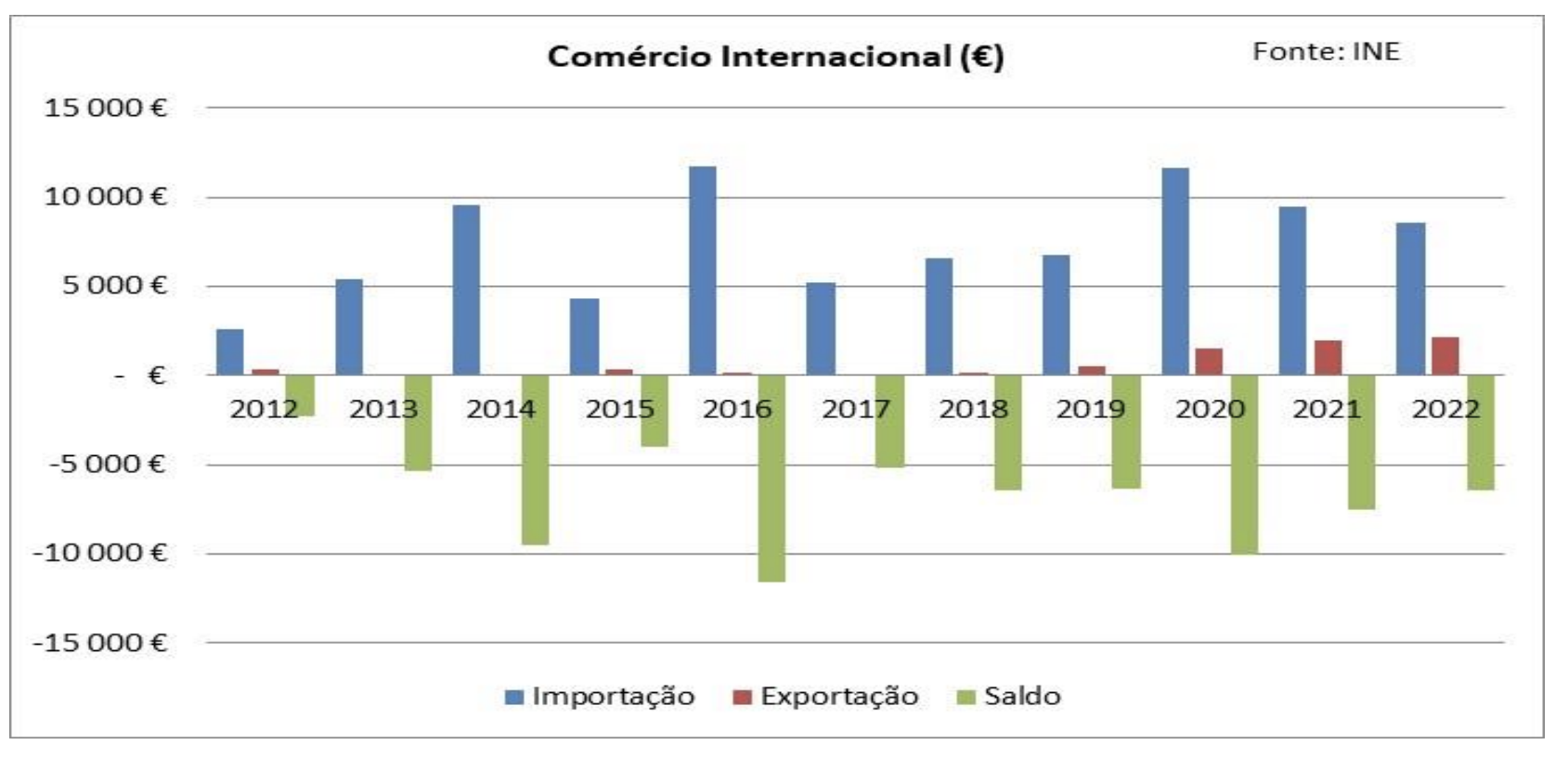

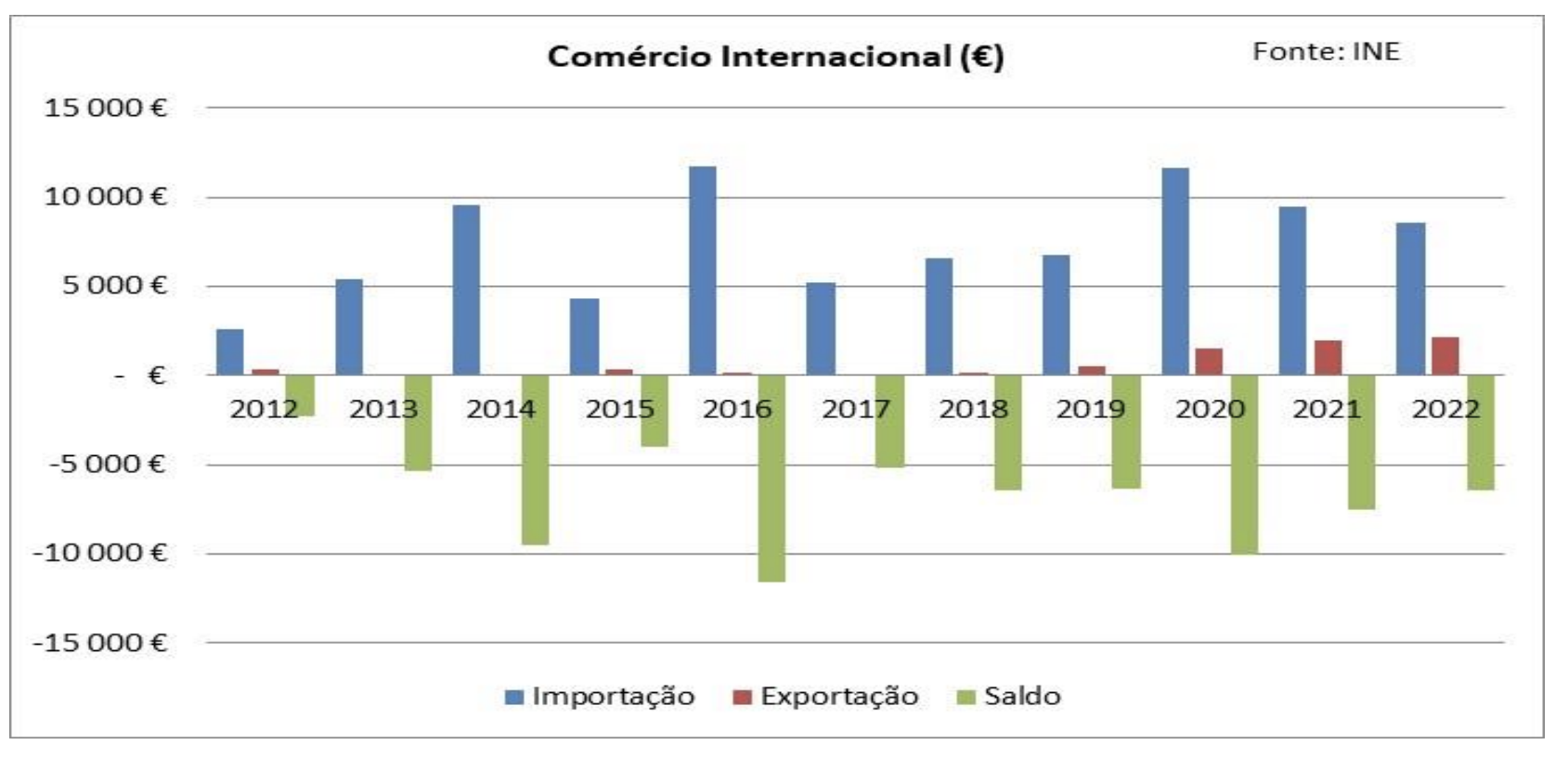

2.2 International Trade in Value and Quantity

Analyzing the presented chart, it is noted that the volume of imports is much higher than exports, with a trade balance in deficit throughout the analysis period. However, the growth of exports in 2020, 2021, and 2022 stands out. In 2022, a volume of 3,260 tons of imports and 912 tons of exports was recorded, with a negative trade balance of 2,348 tons.

Image 4: International trade (in tons) of cherries in Portugal from 2012 to 2022.

Image 4: International trade (in tons) of cherries in Portugal from 2012 to 2022.

As with the trade balance in volume, the trade balance in value is also in deficit, following the behavior of the traded volume. In 2022, imports were about 8.5 million euros, and exports were about 2.1 million euros, with a negative trade balance of about 6.4 million euros.

Image 5: International trade (in €) of cherries in Portugal from 2012 to 2022.

Image 5: International trade (in €) of cherries in Portugal from 2012 to 2022.

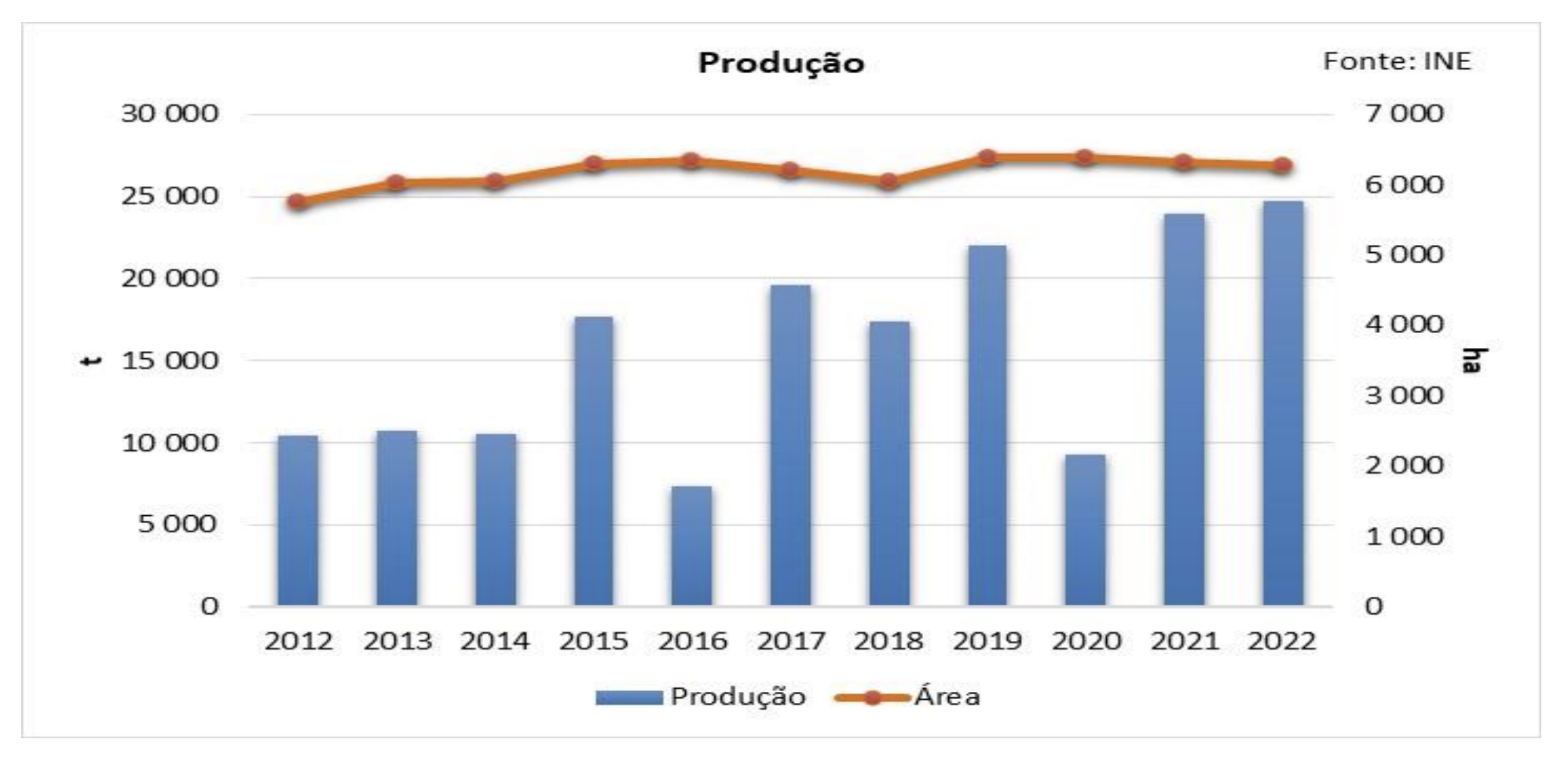

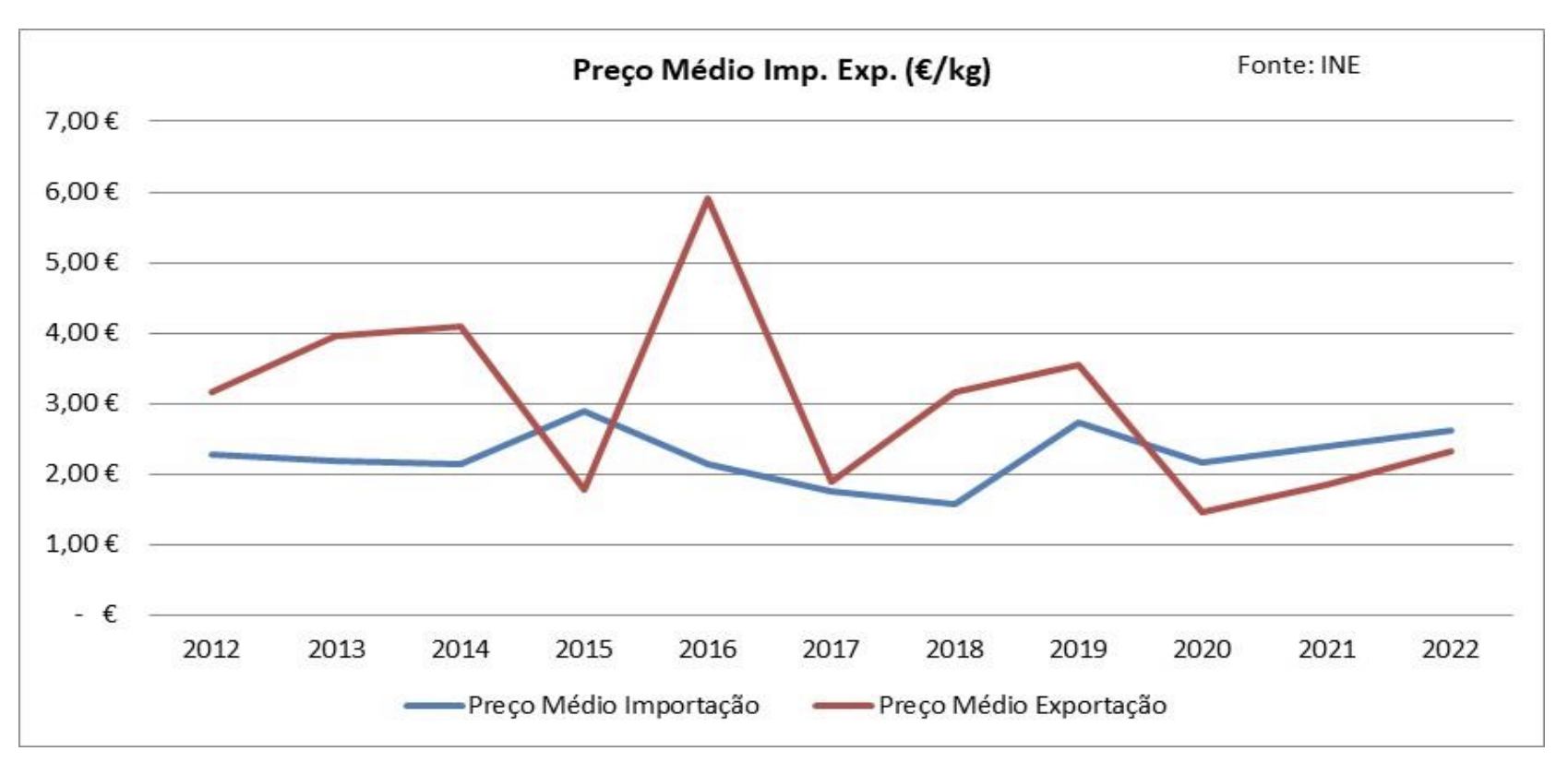

2.3 Average Import and Export Prices

The prices of international trade have undergone some fluctuations, especially concerning exports. In 2022, the average import price was about 2.62 euros/kg, and the average export price was about 2.32 euros/kg.

Image 6: Average price (€/kg) of imports and exports of cherries in Portugal from 2012 to 2022.

Image 6: Average price (€/kg) of imports and exports of cherries in Portugal from 2012 to 2022.

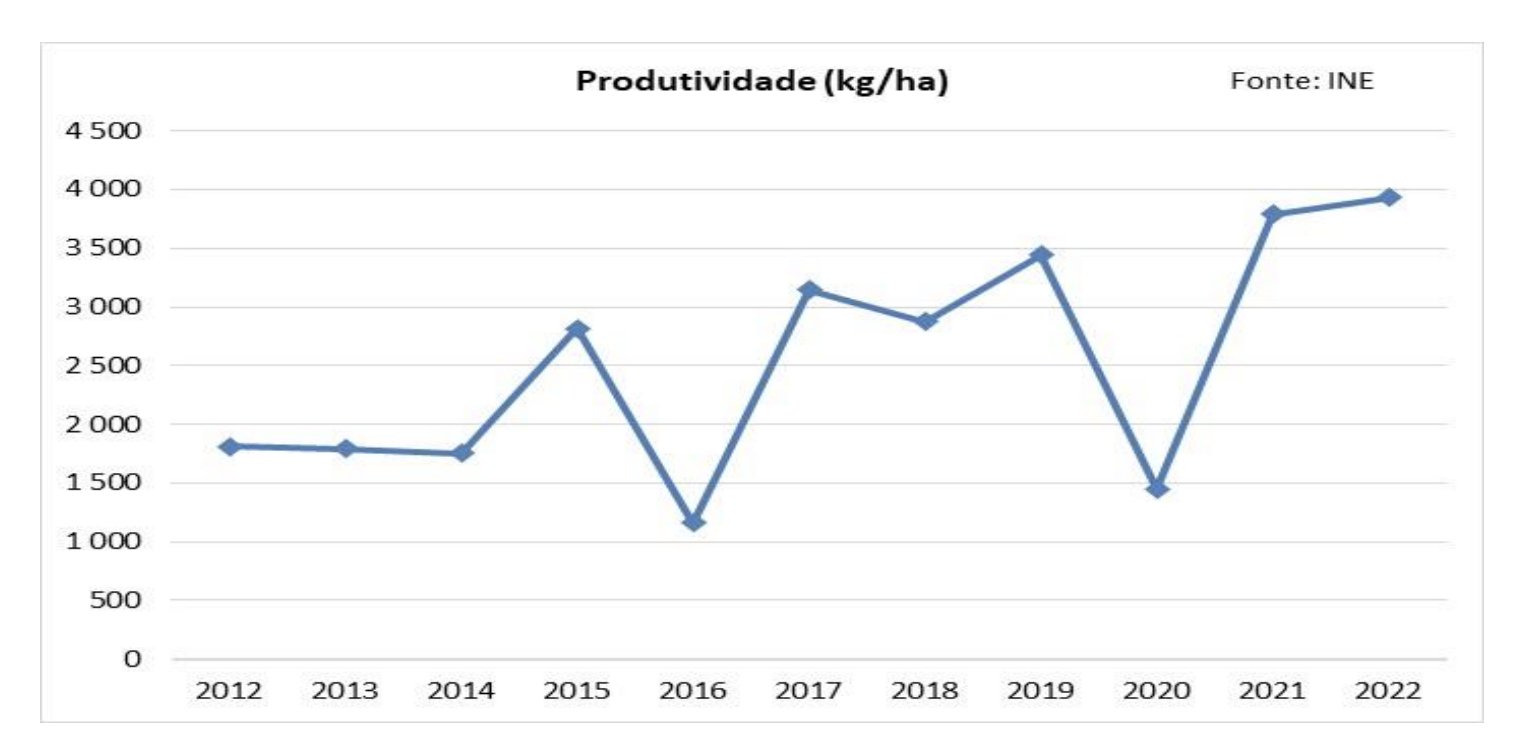

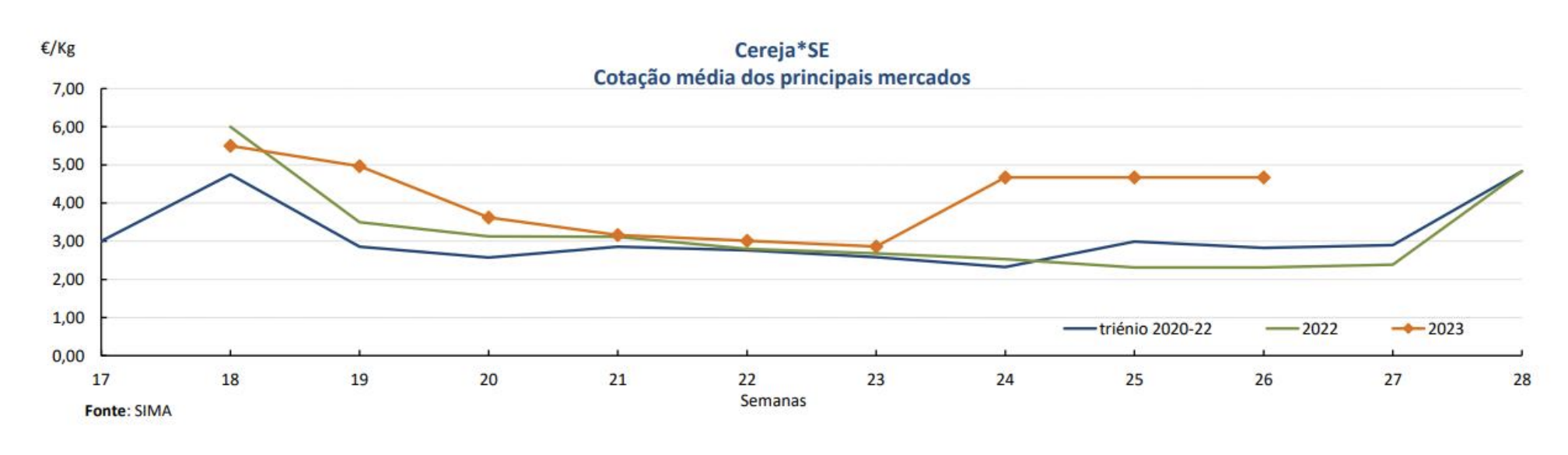

3. Prices

Regarding the domestic market, according to SIMA GPP data, there was an increase in prices in 2023 compared to the previous three years (2020-2022), especially in the last weeks of the season, where the price rose from about 3€/kg to about 4.70€/kg.

Image 7: Average quotation (€/kg) of the main markets in Portugal from 2022 to 2023.

Image 7: Average quotation (€/kg) of the main markets in Portugal from 2022 to 2023.

Source: Voz do Campo

Images: Voz do Campo

Cherry Times - All Rights Reserved