Alessandro Palmieri - University of Bologna (IT)

Cherry Times technical-scientific committee

As is well known, Italian cherry cultivation is undergoing a phase of profound evolution, although to date limited mainly to northern areas. Once based on densities of a few hundred plants per hectare, today cherry cultivation involves densities of up to a few thousand plants/ha.

Intensification tends to result in earlier entry into production and improved fruit quality, but this is counterbalanced by higher planting costs and a shorter productive life of the plants.

Another aspect of absolute importance in modern cerasiculture is that of cover crops, due to the now well known unpredictability of the climate and the spread of Drosophila suzukii, whose control is difficult and costly.

The question that arises, therefore, is whether or not to cover the plant and, if so, whether to do so with simple covers that include hail and rain protection, or multitask covers that also include insect netting.

The parameters at stake in the economic calculations are, in this case, the high initial cost of the covers and the management time (opening and closing), as opposed to the greater protection against adverse events and, in the case of anti-insect nets, the savings in the use of pesticides.

One aspect not to be neglected is the efficiency of the harvest yard, which is greatly undermined by the presence of rain-damaged or Drosophila-damaged fruit, leading to sudden cost increases due to longer harvesting and sorting times.

From an economic point of view, given the time lag of production times, the financial aspect, linked to the cost of money, becomes crucial when calculating costs.

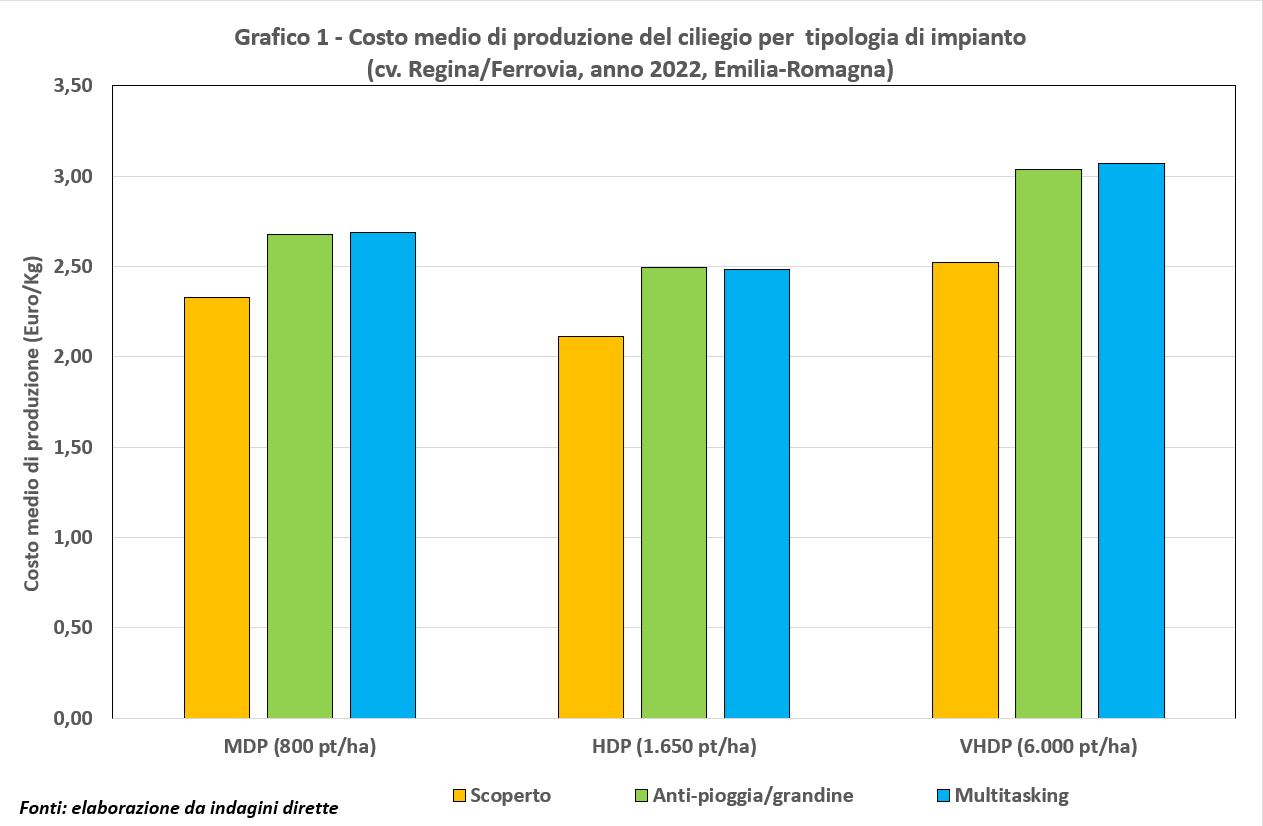

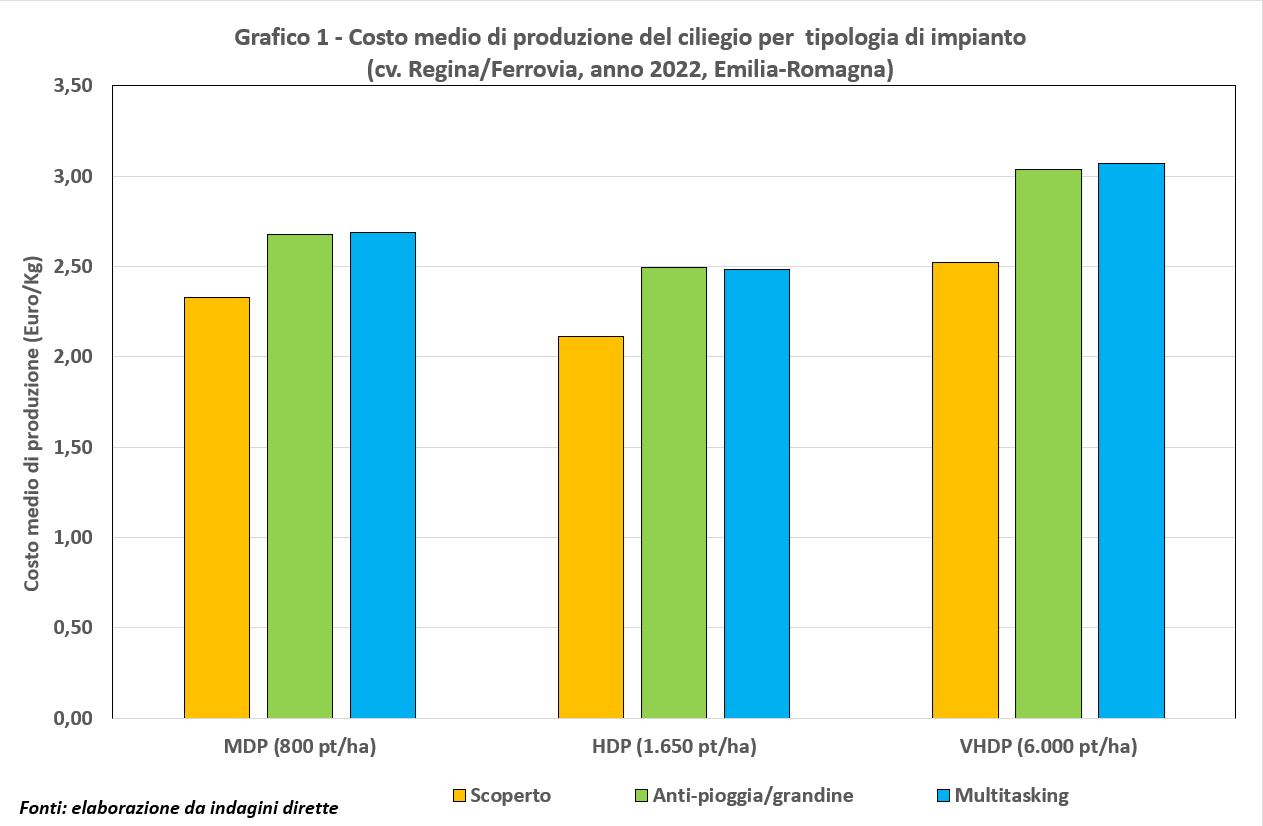

Graph 1 shows, therefore, a brief comparison between 3 types of planting, medium density (MDP), high density (HDP) and very high density (VHDP), considered both in the absence of cover and in the presence of anti-hail netting and rain or complete anti-insect. The reference area is Emilia-Romagna, while the production data refer to an average between the Ferrovia and Regina cultivars.

The highlighted costs represent the threshold values for the recovery of invested capital, calculated on the basis of the economic life cycle of the plants and therefore also consider the financial impact (on the basis of a 4% discount rate) due to the differences in production cycles.

As can be seen, in terms of density, it is the HDP plantations that record the lowest costs, thanks to a more balanced mix of entry into production, yields, harvest times and overall plant life. Medium-density cherry orchards, on the other hand, suffer from lower yields and slower entry into production, while very high-density cherry orchards, superior in yield and speed of entry into production, however, suffer from a more limited production life, as well as very high planting costs.

With regard to covers, calculations show an average cost increase of around 0.35 €/Kg on MDP and HDP plants compared to uncovered versions (+15%), but it must be considered that calculations were made with the same yields, while in practice one has to deal with climatic and biotic adversities.

In view of what has already been pointed out (production losses and increased harvesting costs), it only takes a few bad years in the life of plants to cause a sharp jump in the real costs of uncovered plants.

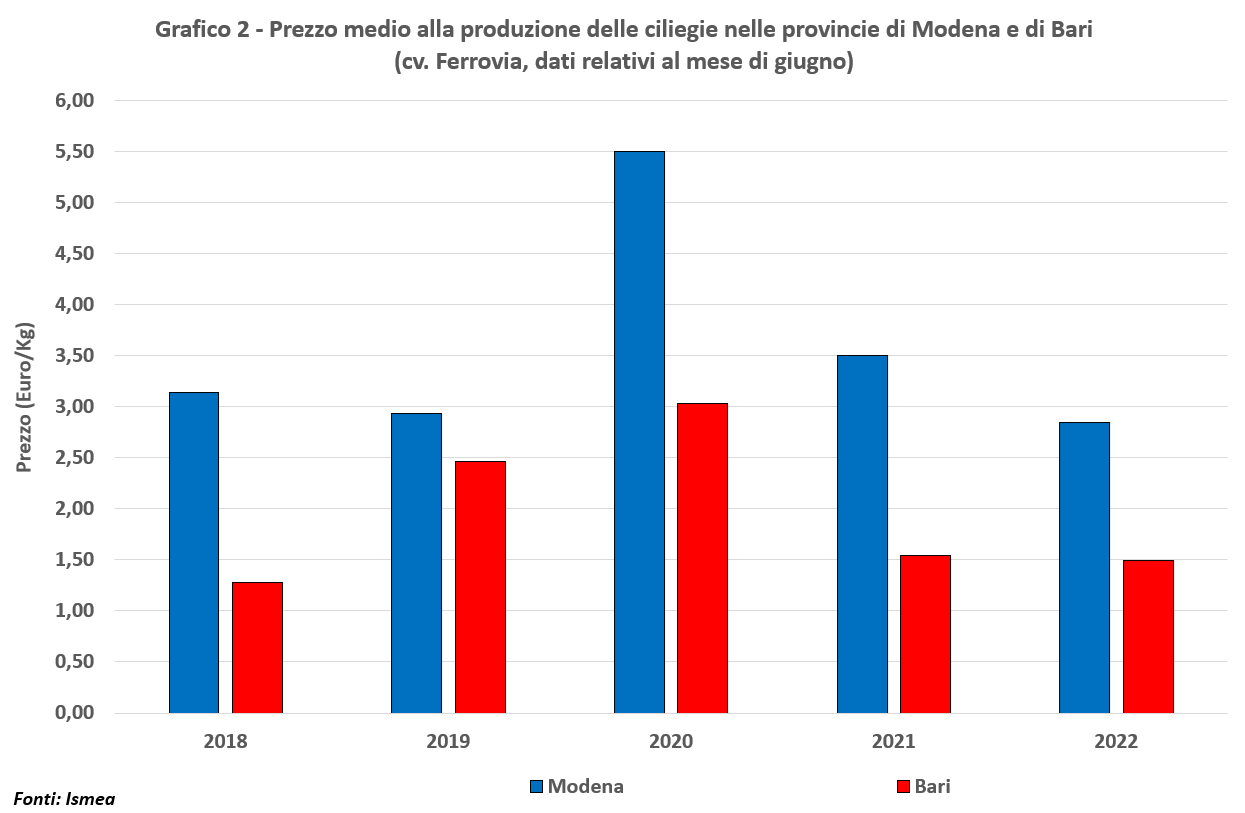

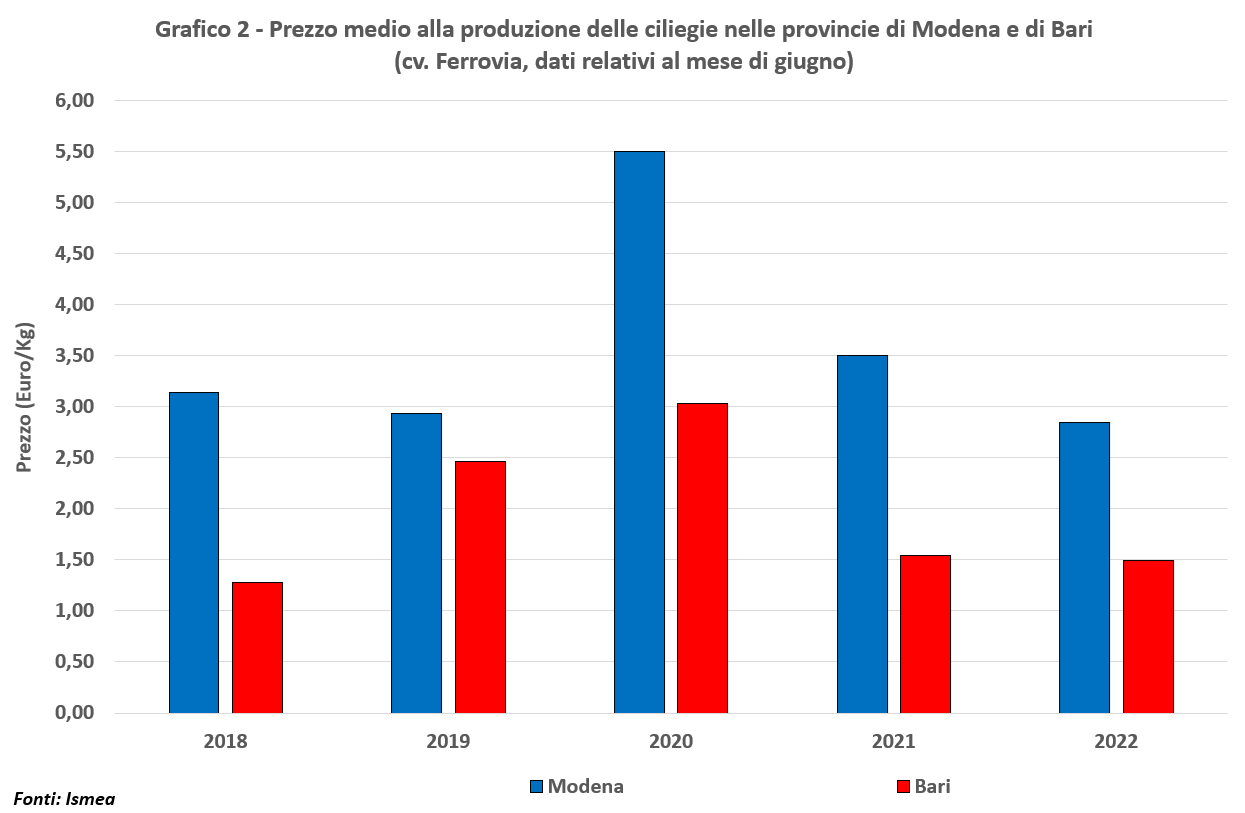

In conclusion, attention must be paid to the question of prices. Graph 2 shows the average prices for railways in June on the markets of Modena and Bari and, as can be seen, the values are well diversified.

In the Modena area, with the exception of the loss-making 2020 campaign, prices in the five-year period 2018-2022 remained around 3 euro/kg, while in the Bari area in 3 out of 5 years they did not go beyond 1.5 euro/kg. Quotations in the Modena area, therefore, made it possible to generate a positive income margin, although clearly only for those companies that maintained a production level in line with the average values considered.

For the economic sustainability of cerasiculture, however, it is essential to maintain strong actions to enhance the value of the product, which avoid its massification and thus limit its exposure to mere market dynamics.

Cherry Times - All rights reserved