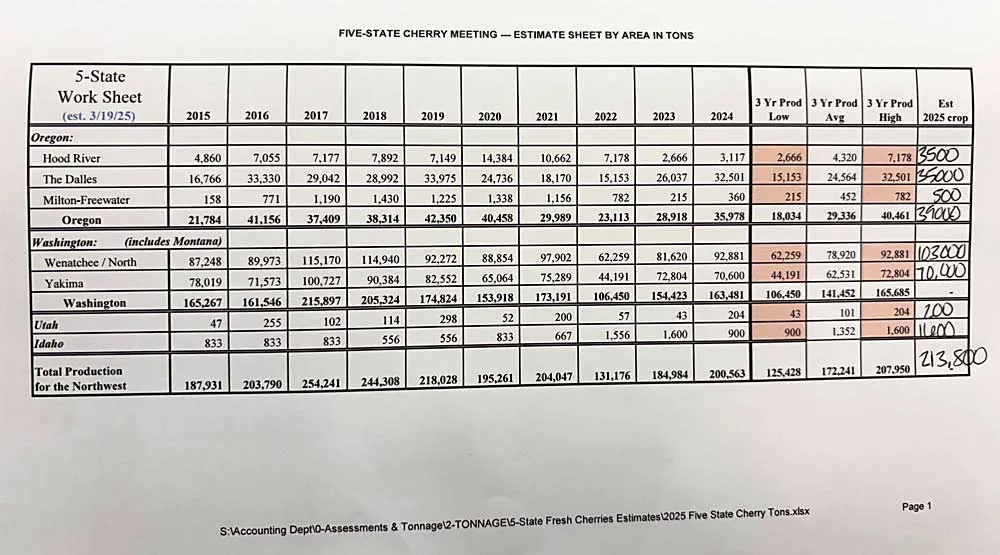

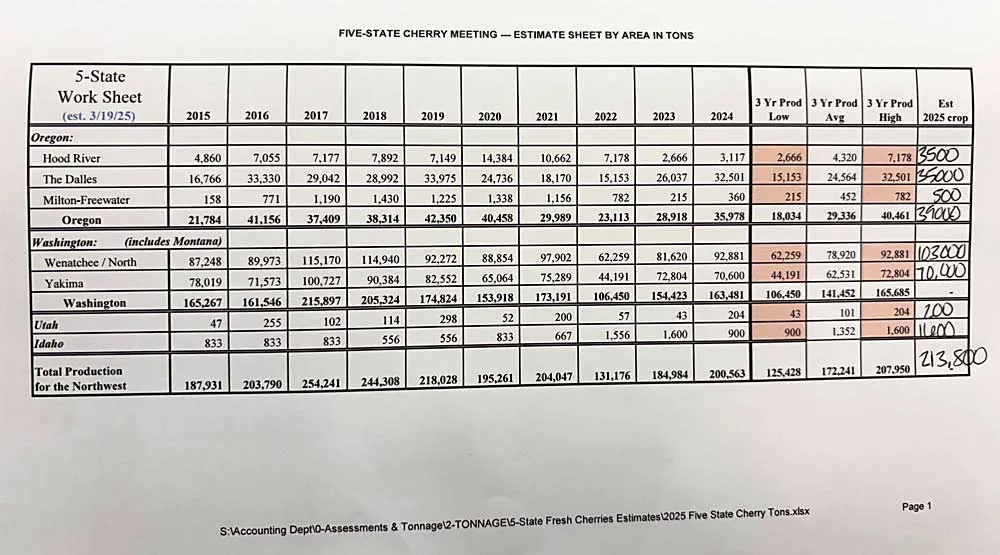

Cherry growers from five Northwest states predict a 213,800-ton crop for the upcoming harvest, which they expect to begin on June 1.

Northwest Cherries held its annual five-state meeting on May 14 in Richland, Washington, and came up with the estimate.

If it holds, that volume would beat the final 2024 crop of 200,563 tons and the three-year average of 172,241 tons, according to records kept by Northwest Cherries, which collectively promotes sweet cherries from the states of Washington, Oregon, Idaho, Utah and Montana.

The group issues frequent updates to the estimate as the crop progresses through changing weather and economic conditions.

Market potential and harvest comparison

“I think it’s definitely sellable,” said Tate Mathison, sales director for Stemilt Growers and a board member of Northwest Cherries. “I think we have the opportunity to be successful.”

The cherry industry also measures the estimate at 21.38 million 20-pound box equivalents (circa 9.7 milioni di scatole da 9 kg).

California growers started harvest in April and expect between 45,000 and 54,000 tons of sweet cherries, or between 5 million and 6 million 18-pound box equivalents (tra circa 2.3 e 2.7 milioni di scatole da 8 kg), said B.J. Thurlby, president of Northwest Cherries.

Growers from both states root for a smooth transition between California and Northwest cherries in the marketplace each year.

Weather impact and funding decisions

Thurlby said the weather seemed to favor cherries so far this spring, while bloom and growing degree-days have progressed in a way that should mean a spread-out harvest, which is good for production logistics and demand from retailers.

Also at the meeting, the Washington State Fruit Commission voted to allocate $100,000 (circa 92.000 Euro) of reserve funds to the Northwest Horticultural Council to support increased federal advocacy for cherries to be included in international trade discussions on tariffs or phytosanitary barriers at the new White House.

The council already does that kind of work and will continue with it, said Mark Powers, president of NHC, but he asked growers to help the group increase efforts as a separate, temporary project.

“Leveraging up what we do …. will give us a better chance at prevailing,” Powers said.

Figure 1. Growers with Northwest Cherries predicted a 2025 crop of 213,800 tons at the group’s annual five-state planning meeting in Richland, Washington, on May 14. (Shannon Dininny/Good Fruit Grower)

Figure 1. Growers with Northwest Cherries predicted a 2025 crop of 213,800 tons at the group’s annual five-state planning meeting in Richland, Washington, on May 14. (Shannon Dininny/Good Fruit Grower)

Additional funding and tariff developments

The separate funding has no impact on the assessments charged by the fruit commission, currently set at $18 per ton (circa 16.50 Euro/tonnellata).

The hort council will return money left unspent, Powers said, while fruit commission board members left open the option of allocating more funding at the August meeting, after they see how the 2025 cherry crop shapes up.

The fruit commission joined apple growers in the extra trade advocacy funding. In April, the board of the Washington Apple Commission allocated an additional $400,000 (circa 368.000 Euro) to the hort council to “use all the tools available to make sure apples are on the list in any negotiation,” said commission president Michael Schadler.

The apple commission also approved an additional $300,000 (circa 276.000 Euro), if needed, for the 2025–26 fiscal year, which starts in July.

Outlook on China market

Keith Hu, international program manager for Northwest Cherries, told growers he was optimistic about export markets this season after China and the U.S. agreed earlier this week to pause their respective high tariffs in what had been a rapidly escalating trade war.

“For the Chinese market, it’s essentially very pretty positive,” Hu said. “I don’t really have a whole lot of concern anymore.”

Before this week’s deal, the U.S. had a 145 percent tariff on Chinese imports, and China had a 135 percent tariff on U.S. imports.

Northwest cherry shippers had been worried that those high tariffs, or nontariff barriers that sometimes come with them, could essentially stop all cherry exports to China and force an oversupply of fruit into other Asian ports, such as Thailand, Vietnam or South Korea.

As it stands today, China has a total of 45 percent existing tariffs plus a 9 percent value-added tax. Together, those calculate to a 58 percent total duty, Hu said, citing Chinese customs officials.

Image source: WSU

Ross Courtney

Good Fruit Grower

Italian Berry - Tutti i diritti riservati