Turkey is undoubtedly a key country in the global sweet cherry industry. Thanks to the combination of agricultural tradition, favorable ecological conditions, and innovation, it has maintained its position as the world's largest cherry producer. However, despite this leadership in production, the country still faces challenges in establishing itself as the leading exporter.

In this article, we will take an in-depth look at cherry production in Turkey, its most well-known varieties, the agricultural innovations that have transformed the sector, and the growth opportunities that could enable Turkey to dominate international trade as well.

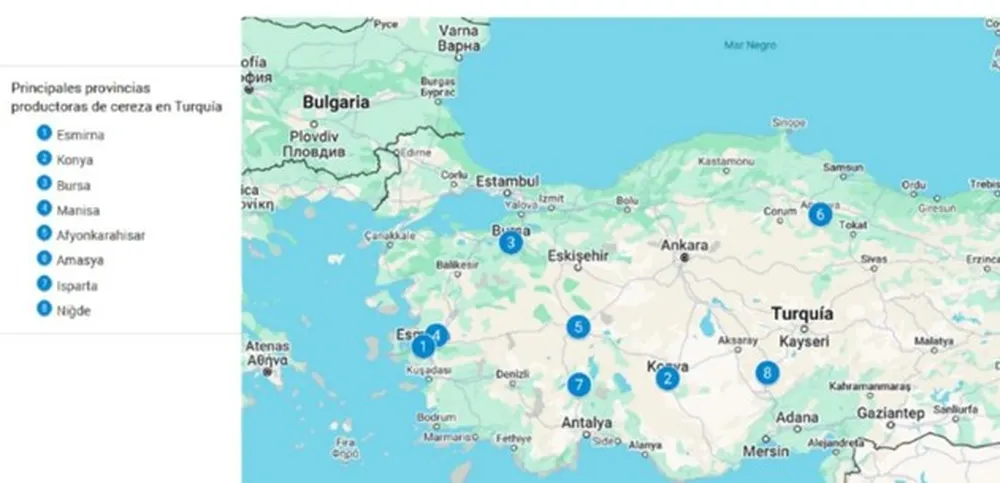

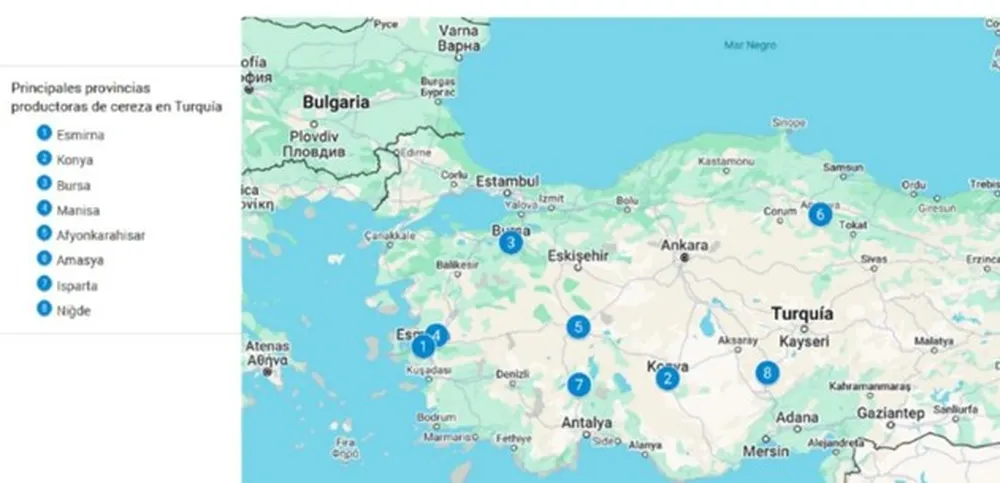

Production and Key Regions

Turkey has maintained sustained growth in sweet cherry production, reaching a volume of 736,791 tons in 2023, a remarkable increase compared to 215,000 tons in 1997 (2022 – Recent Techniques and Developments in Cherry Cultivation in Turkey).

The main cultivation areas include:

- Konya is the largest producer, with 68,204 tons in 2017, accounting for about 10.87% of the national total.

- Other provinces with significant production include Izmir (57,892 t), Bursa (52,235 t), Manisa (47,348 t), and Afyonkarahisar (41,043 t).

- Other notable regions are Amasya (36,444 t), Isparta (36,275 t), and Niğde (27,012 t), all with a significant number of trees in production.

- Overall, the rest of the country contributed 260,679 tons, solidifying Turkey as the world's largest cherry producer.

Cherry cultivation in Turkey extends from the western coast to the inland mountains, allowing for a long harvest season from May to August.

Image 1. Main cherry-producing regions in Turkey. Source: Sanchez

Cherry Varieties and Their Evolution in Turkey

The most widely cultivated cherry in Turkey is '0900 Ziraat', also known as 'Turkish cherry'. This variety dominates the export market due to:

- Large size and attractive shape

- Deep red color and firm flesh

- Good taste and transport resistance

Image 1. Fruiting of the 0900 Ziraat cherry variety

Image 1. Fruiting of the 0900 Ziraat cherry variety

However, the '0900 Ziraat' variety requires pollinators and is prone to cracking in rainy conditions (Erogul, 2018). To address these issues, other varieties have been introduced, such as:

- Regina and Kordia: more resistant to cracking and with high export quality.

- Sweet Heart and Lapins: self-fertile and highly productive.

- Royal Lynn® and Royal Tioga®: developed for warmer climates, allowing for a longer harvest season.

Image 2. The new Californian cherry variety, Royal Lynn.

Image 2. The new Californian cherry variety, Royal Lynn.

Technological Innovations: Modernizing Training Systems

In Turkey, the traditional cherry tree training system is the Vogel Central Leader, which, while effective, presents challenges in terms of labor costs and harvesting efficiency.

A study conducted between 2014 and 2018 evaluated newer and more modern methods, such as Tall Spindle Axe (TSA), Super Slender Axe (SSA), Upright Fruiting Offshoots (UFO), and Kym Green Bush (KGB), designed to accelerate production and facilitate harvesting.

Image 3. Production pruning in the KGB training system. Source OSU

Image 3. Production pruning in the KGB training system. Source OSU

The results showed that SSA and TSA produced productive trees in less time, while UFO and KGB facilitated harvesting, reducing labor costs. However, to date, their implementation in Turkey has remained limited.

Turkish Cherry Exports: A Giant Seeking Consolidation

Turkey is the world's largest producer of sweet cherries, but it is still working to establish itself as the leading exporter. In 2023, the country exported a total of 8,186,059 kg of cherries, with Germany, Russia, and Iraq as the main markets.

Main export destinations (2021-2023, in kg)

| Country | 2021 | 2022 | 2023 |

|---|

Germany | 2,455,778 | 1,534,201 | 2,667,216 |

Russian Federation | 2,267,672 | 2,459,212 | 2,262,554 |

Iraq | 712,776 | 781,348 | 1,013,111 |

Austria | 219,393 | 40,717 | 358,152 |

Italy | 115,319 | 198 | 244,291 |

China (Hong Kong SAR) | 18,798 | 43,859 | 14,402 |

Total | 7,011,524 | 5,555,586 | 8,186,059 |

Challenges and Opportunities in Export

- Growth in Asia and the Middle East: China and other Asian countries are increasing their demand for higher-quality cherries, offering new opportunities for Turkey.

- Strategic location: Its proximity to the EU and Russia provides it with a logistical and cost advantage compared to other exporting countries.

- Need for modernization: To compete in the European market, Turkey must continue improving its storage and distribution infrastructure.

Strengths and Challenges of the Cherry Sector in Turkey

Turkey boasts high ecological diversity, allowing for an extended harvest period of up to 90 days, high-quality varieties such as '0900 Ziraat,' and relatively low production costs, in addition to a strategic position near key markets like the EU and Russia.

Moreover, there is a significant growth opportunity in Asia, especially in China, where the demand for premium cherries continues to rise.

However, it faces challenges such as fragmented production, a lack of modernization in cultivation and harvesting, weak producer organization, and infrastructure issues for storage.

Additionally, competition with Spain and Italy in the European market, climate change, and fluctuations in international prices are factors that could affect export growth.

Image 4. Cherries arriving at a sorting and packaging center

Image 4. Cherries arriving at a sorting and packaging center

Conclusions

Turkey has proven to be a giant in cherry production, but it still faces significant challenges in becoming the world’s leading exporter.

Thanks to new resistant varieties, technological advancements, and more effective commercial strategies, the country has enormous potential to establish itself not only in terms of volume but also in quality and global presence.

Jesus Alonso Sanchez

The World of Cherries

Image source: SL Fruit Service

Cherry Times - All rights reserved