In Washington, a cherry grower emphasises the importance of crop insurance for his company and for the entire cherry industry. He defines the life of a grower as betting your entire investment on production, comparing the process to gambling in Las Vegas. The main challenge is the uncertainty of success or failure until the closing payments from the pool, which can take almost a year from the start of the cherry investment.

Jennifer Wiggs, the grower, points out that, although most years bring at least a break-even, there are occasionally exceptional years that make it possible to finance the following year or invest in improvements. However, there is also the risk of losing everything due to adverse weather events. Cherries, in particular, are sensitive to weather conditions before harvest, requiring constant monitoring of weather forecasts.

She advises his colleagues to consider crop insurance as a lifesaver. Shee recounts his own initial experience of scepticism towards insurance, but reveals that it became compulsory when they acquired a larger orchard with an agricultural loan. The turning point came when, hit by rainstorms, they suffered significant losses. The agent explained the value of insurance, allowing the farmer to face the challenges with peace of mind.

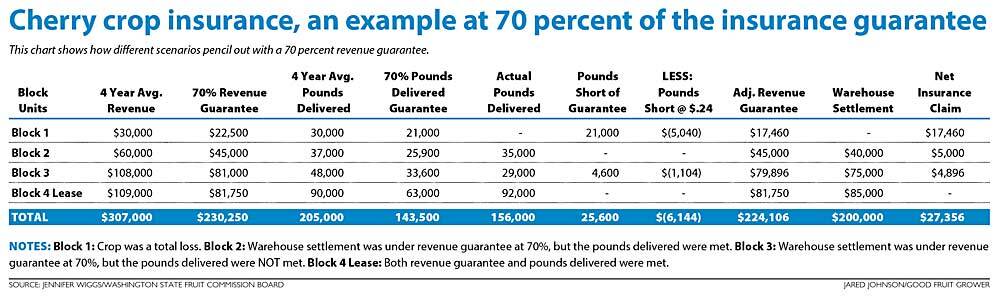

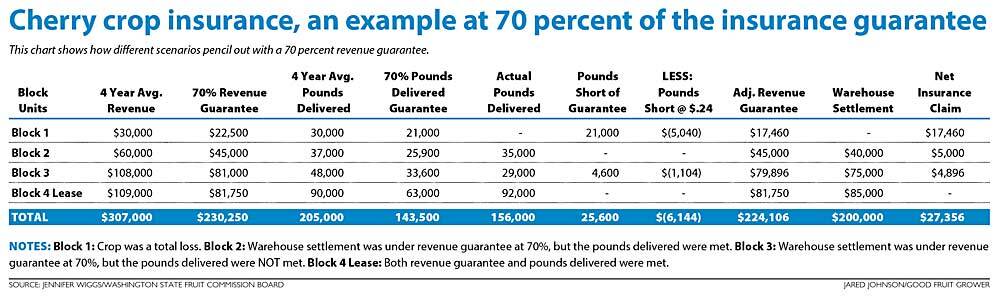

The earnings guarantee system is based on the actual earnings history of the cultivated blocks. The grower emphasises the adaptability of the policies, which are self-adjusting considering ups and downs. The coverage percentage chosen affects premiums, but offers financial security. The insurance also facilitates access to US Department of Agriculture disaster relief programmes by simplifying the application process.

In conclusion, Jennifer Wiggs encourages his colleagues to explore options with specialised cherry agents, to review coverage choices annually and to consider insurance as a way to sleep soundly.

Read the full article: Good Fruit Grower

Images: Jennifer Wiggs/Good Fruit Grower

Cherry Times - All rights reserved