In the last ten years, the area cultivated with cherries in Chile has maintained steady growth due to its profitability. The demand for Chilean cherries is high from the Chinese market, which receives over 91% of Chile’s cherry export volume. Post estimates that cherry production in marketing year (MY) 2024/25 will reach 500,000 metric tons (MT), an increase of 6.8% compared to MY2023/24.

Chilean cherry exports are expected to increase by 7.6%, reaching 445,000 tons in MY 2023/25. In MY 2024/25, Post estimates that nectarine and peach production will total 173,000 MT, a 0.6% increase compared to the previous year. Exports of peaches and nectarines are expected to rise by 0.8%, reaching a total of 116,000 tons.

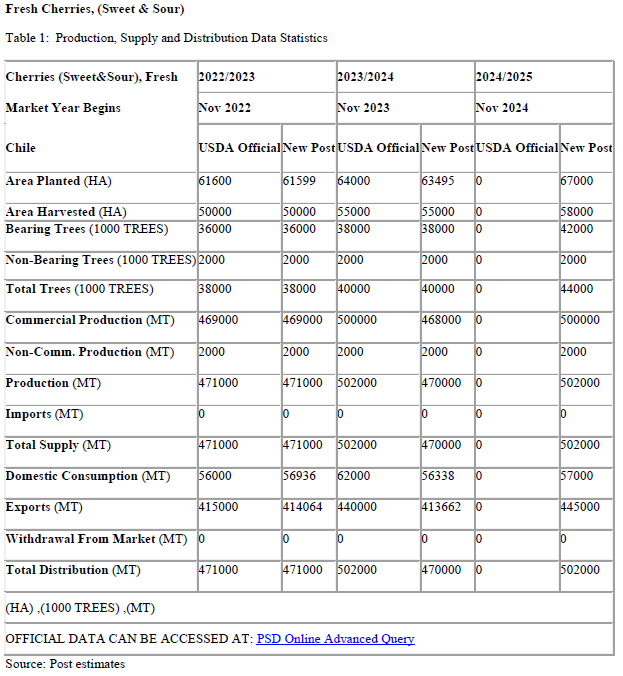

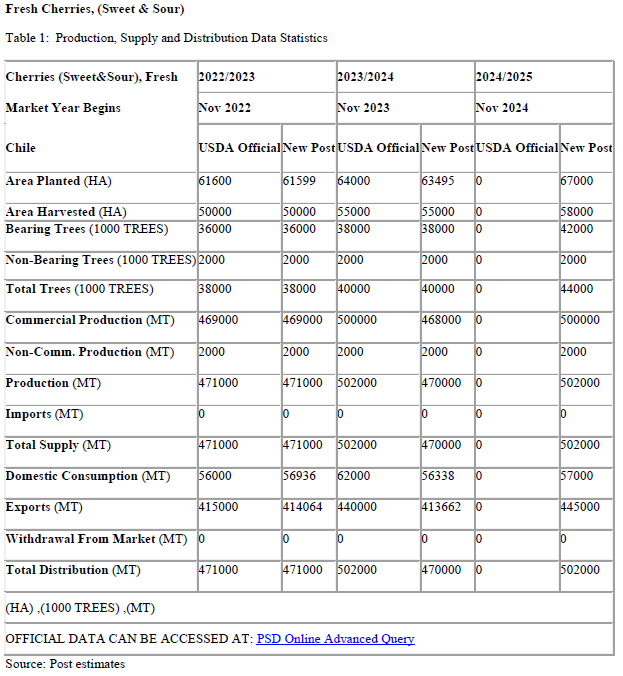

Table 1: Production, supply, and distribution data of sweet and sour cherries in Chile for the 2022-2024 seasons.

Table 1: Production, supply, and distribution data of sweet and sour cherries in Chile for the 2022-2024 seasons.

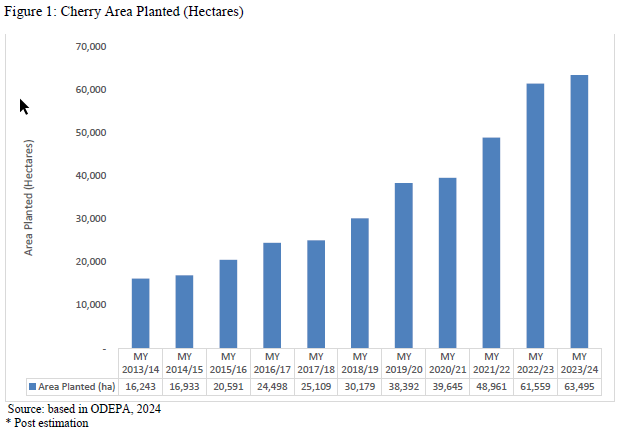

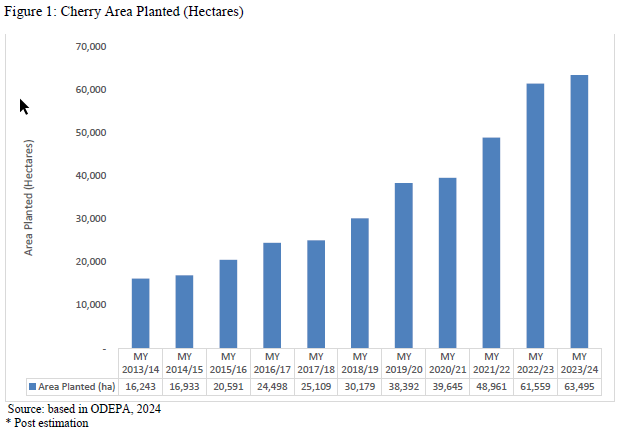

In MY2024/25, Post estimates that the cultivated cherry area will reach 67,000 hectares (HA), a 5.5% increase compared to MY2023/24 (Table 1). In the last decade, the cultivated cherry area has maintained steady growth due to its profitability and high demand, especially from the Chinese market (Figure 1).

Figure 1: Area cultivated with cherries in Chile from 2013 to 2024.

Figure 1: Area cultivated with cherries in Chile from 2013 to 2024.

In MY 2023/24, the planted cherry area grew by 3.1%, reaching 63,945 hectares. Post estimates that the harvested area will be 58,000 hectares, as many cherry orchards were recently planted and are still non-productive. Cherry production begins approximately 4-5 years after planting.

The volume of Chilean cherry production has grown steadily year after year, following the increase in planted area. However, in MY2023/24, despite the increase in planted area, production decreased by 0.2%. The climatic conditions of MY2023/24 were characterized by a warm winter and a rainy spring, which reduced cherry yields and led to lower-than-expected production.

In MY 2024/25, winter rainfall was abundant, and winter temperatures were sufficiently low. With the expected increase in planted areas and assuming regular weather conditions during spring, Post estimates that MY 2024/25 production will reach 500,000 MT, an increase of 6.8% compared to MY 2023/24.

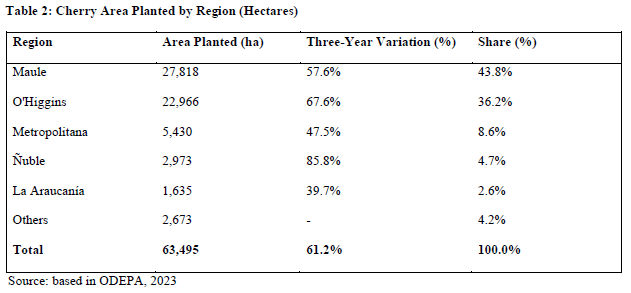

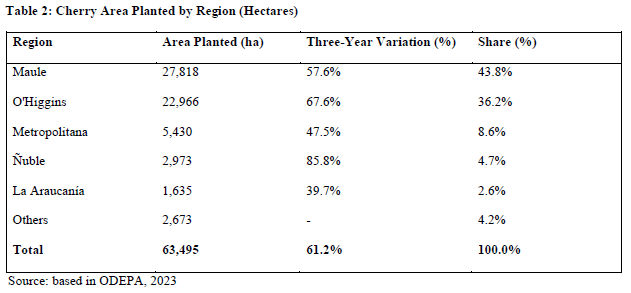

According to data from the Office of Agricultural Studies and Policies (ODEPA) of the Chilean Ministry of Agriculture, the Maule region, in central-southern Chile, holds 27,818 hectares or 43.8% of the planted area in Chile, making it the leading producing region in the country (see Table 2).

The O'Higgins region, in the central part of the country, has 22,966 hectares of cultivated area, equivalent to 36.2% of the total area. The Maule and O'Higgins regions present ideal conditions for cherry production, including sufficient cold hours during winter, ample water for irrigation, and the absence of spring frosts.

Chilean producers typically use plastic covers to prevent rainfall from damaging the fruit. Most production areas in Chile face some risk of precipitation during the flowering or harvest months, between September and February each year, so protective covers for orchards are a necessity for cherry producers.

The main cherry varieties produced in Chile are Santina, Lapins, and Regina. Many new projects use Santina as the main variety due to its adaptation to the Chilean climate and its long post-harvest resistance, which is crucial for Chilean cherries given the long distance they travel to reach the Chinese market. However, Chile also produces other varieties such as Bing, Sweetheart, Rainier, Royal Dawn, Skeena, and Kordia.

Table 2: Area cultivated with cherries by region.

Table 2: Area cultivated with cherries by region.

Trade

Post estimates that Chilean cherry exports will increase by 7.6% in MY 2024/24 compared to MY 2023/24, reaching 445,000 MT due to increased production. This estimate is based on regular climatic conditions and the absence of unexpected shocks to cherry production and industry.

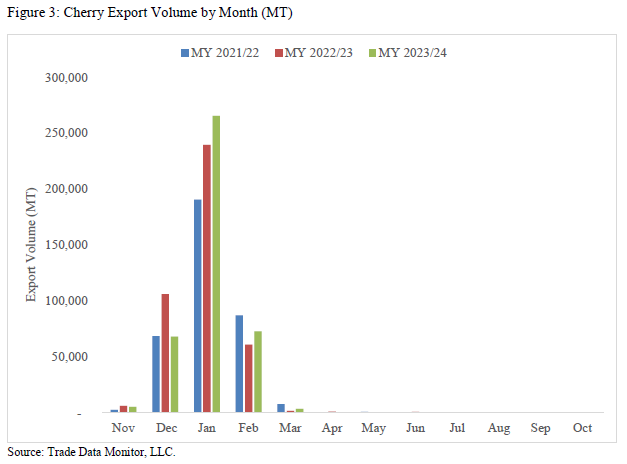

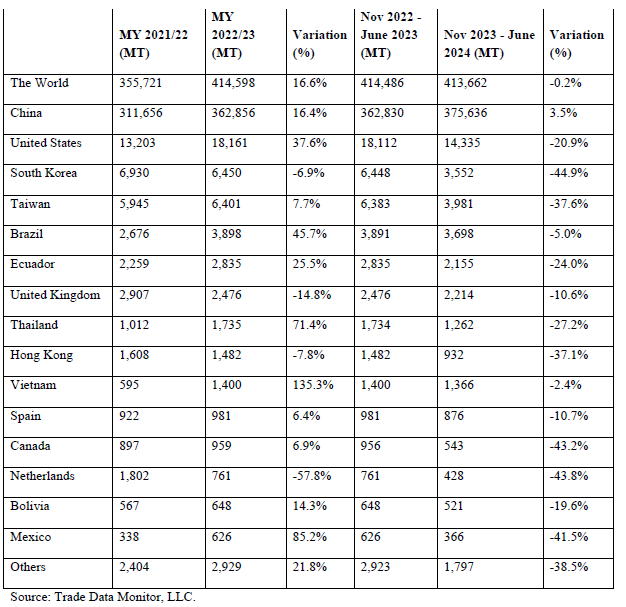

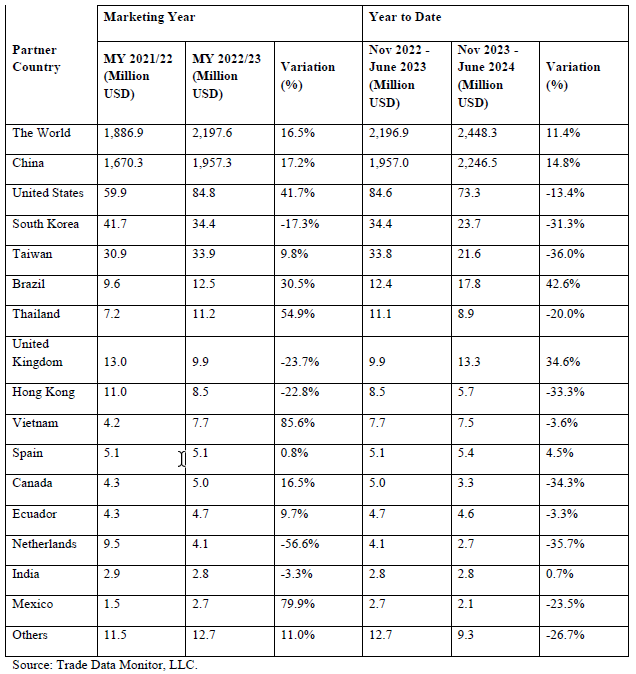

In MY2023/24 (data until June), cherry exports totaled 413,662 metric tons (MT), a 0.2% decrease compared to MY2022/23 (Table 3). However, due to high prices of Chilean cherries in the Chinese market, the value of exports in MY2023/24 increased by 11.4%, totaling $2.4 billion (Table 4).

China is the main market for Chilean cherries. Cherry exports to China amounted to 375,636 MT in MY 2022/23, representing 90% of Chilean cherry exports. The second largest market is the United States, with exports totaling 14,335 tons, accounting for 3.5% of Chile’s total fresh cherry exports.

However, Chilean exporters are looking to diversify their export markets and reduce dependence on the Chinese market. Exporters have not been able to allocate significant volumes of cherries to other markets, as demand for cherries and prices in the Chinese market are significantly higher than in any other market.

The steady growth in export volumes continues to push producers' and exporters' harvesting and packaging capacity. Both phases are critical to obtaining a high-quality cherry that can reach the most distant export markets.

Cherry harvesting and packaging are critical activities, as cherries are easily damaged by handling and high temperatures. The packaging process is automated to avoid physical damage to the fruit. Chilean cherry producers and exporters are working to ensure the harvesting and packaging process is completed quickly.

Another concern for Chilean cherry exports is the constant delivery of high-quality cherries to maintain high export prices. As production hectares increase every year, this task becomes increasingly challenging. Chile’s export industry is working with exporters and producers as a group to maintain quality standards for their exports.

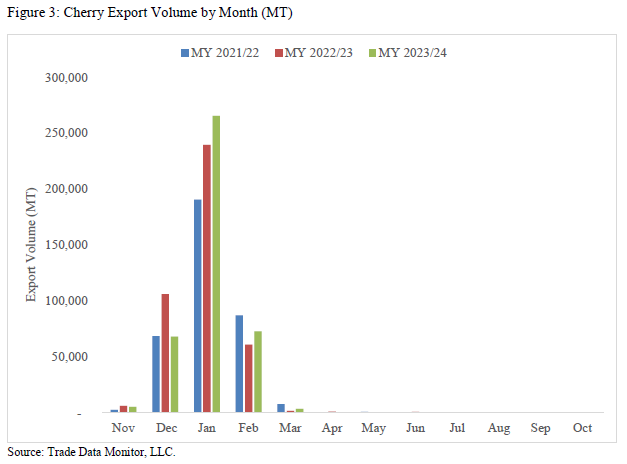

Figure 2: Monthly volumes of cherries exported from Chile in the 2022-2024 seasons.

Figure 2: Monthly volumes of cherries exported from Chile in the 2022-2024 seasons.

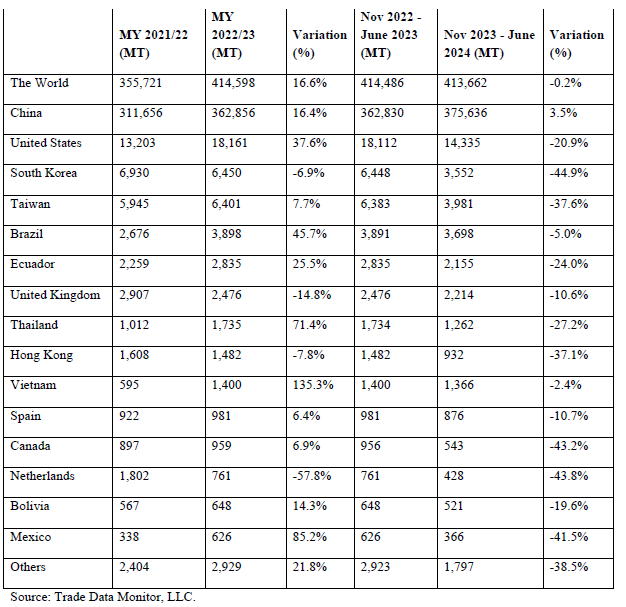

Table 3: Chile’s global exports by volume (in MT tons).

Table 3: Chile’s global exports by volume (in MT tons).

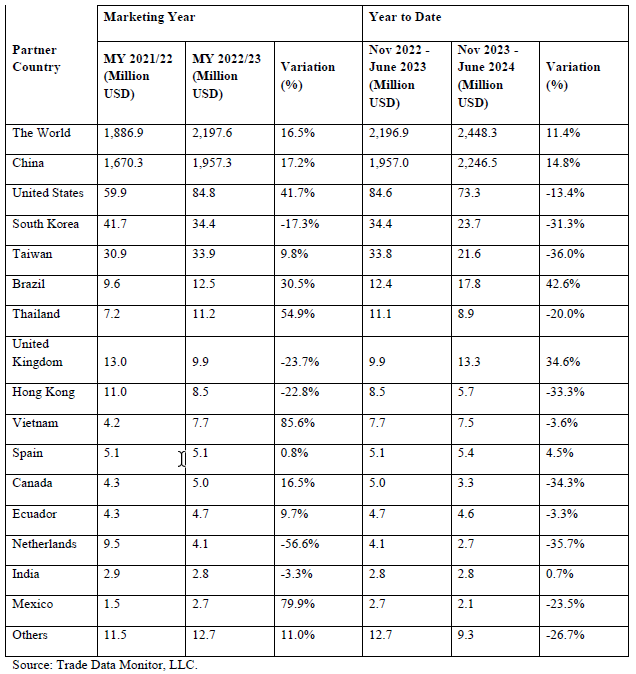

Table 4: Chile’s global exports by value (in millions of dollars).

Table 4: Chile’s global exports by value (in millions of dollars).

Consumption

In MY2022/23, Post estimates that domestic consumption will increase by 1.2% to a total of 57,000 MT, representing 11.4% of commercial production. This increase in domestic consumption follows the rise in production and, therefore, the overall supply and availability of cherries.

Domestic consumption mostly consists of cherries that do not meet the quality characteristics for export. Most domestic cherry consumption is fresh, and very few companies currently process cherries into canned or confectionery products.

Source: USDA

Images: USDA; SIAG

Cherry Times - All rights reserved