The production of fresh cherries in Japan has been significantly impacted by climate change. It is estimated that fresh cherry production in the 2024/25 season will drop to 14,700 metric tons (MT) due to damage caused by high temperatures in the country’s most important growing region.

FAS/Tokyo predicts that the decline in domestic production will lead to an increase in imports of cherries from the United States to 5,600 tons for the 2024/25 season. FAS/Tokyo also forecasts that peach production in Japan will remain relatively unchanged from the previous year. Furthermore, FAS/Tokyo expects that imports of nectarines from the United States to Japan will also remain relatively steady.

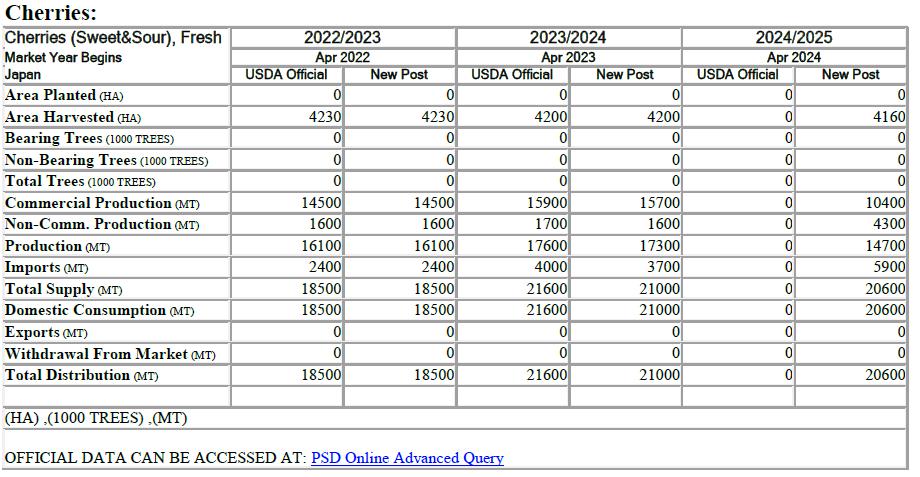

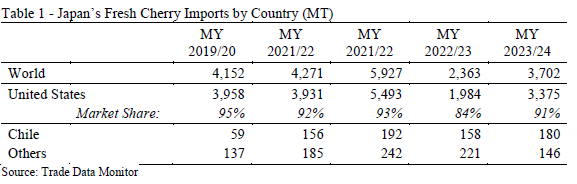

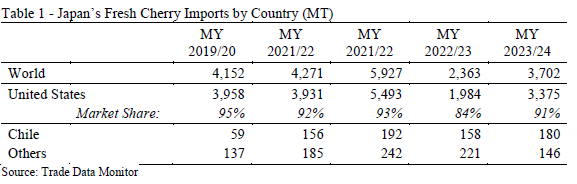

Table 1: Markets for sweet and sour cherries in Japan by starting year.

Table 1: Markets for sweet and sour cherries in Japan by starting year.

Cultivation Area

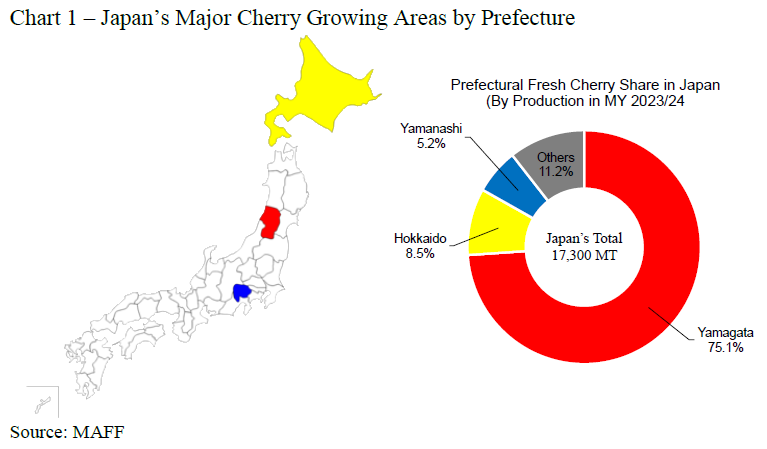

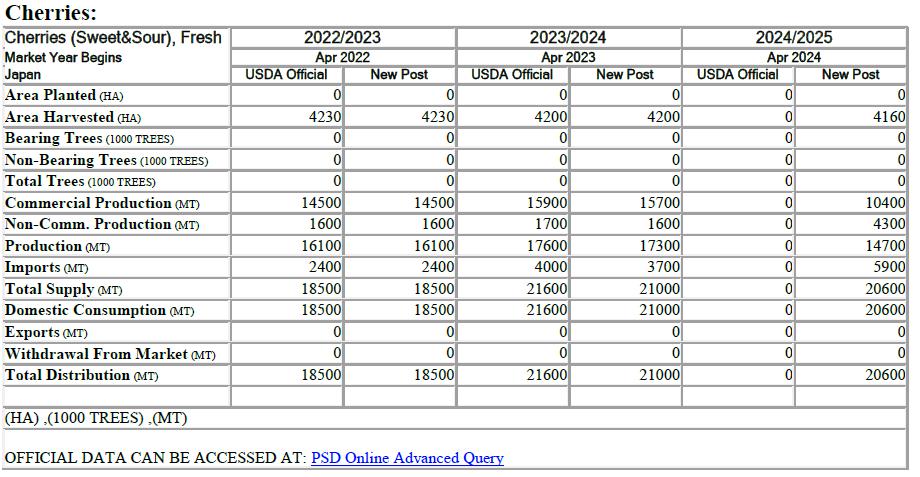

The prefecture of Yamagata (highlighted in red in chart 1), located 250 miles north of Tokyo, produces about 75% of Japan's fresh cherries, followed by the prefectures of Hokkaido (highlighted in yellow in chart 1) and Yamanashi (highlighted in blue in chart 1).

Image 1: Major cherry production areas in Japan by prefecture.

Image 1: Major cherry production areas in Japan by prefecture.

As a result, the condition of Yamagata cherries has a significant impact on Japan's total growing area and production of this fruit. Like Japanese agriculture in general, the cherry industry suffers from a shortage of successors for farming operations and laborers, resulting in a steady decline in planted areas year by year.

In the 2023/24 marketing year (MY: April - March), the area planted with fresh cherries in Japan slightly decreased to 4,200 hectares (ha) compared to 4,230 ha in MY 2022/23. FAS/Tokyo predicts that this trend will continue in MY 2024/25, with the planted area expected to reach 4,160 hectares.

Production

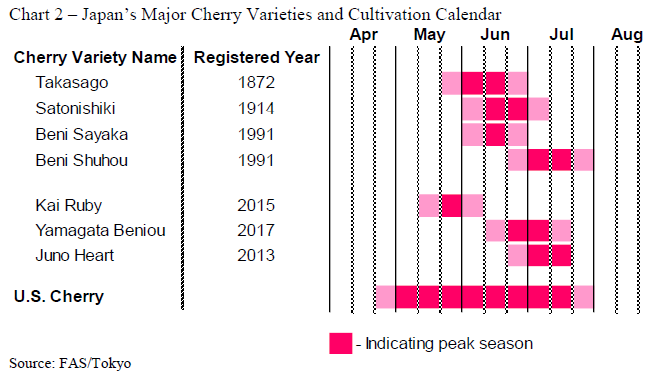

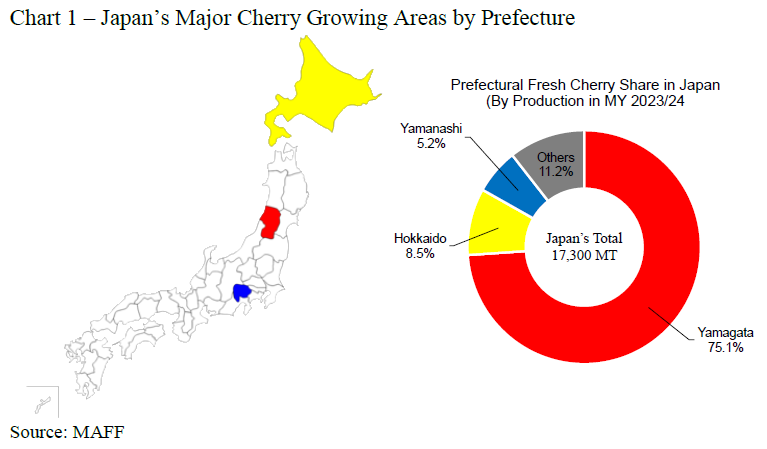

Fresh cherries in Japan consist of three main varieties of yellow cherries: Satonishiki, Beni-shuhou, and Beni-sayaka, accounting for approximately 70%, 20%, and 5% of the production, respectively. The Satonishiki has long held the top position as the most recognized variety among Japanese consumers.

However, cultivating a single variety presents the risk of overlapping harvest periods, placing a strain on the limited workforce. Therefore, growers do their best to mitigate the risk of labor shortages and the associated harvest burden, while also trying to extend the sales period as much as possible (see chart 2).

Image 2: Most produced varieties in Japan with cultivation calendar.

Image 2: Most produced varieties in Japan with cultivation calendar.

In the 2024/25 MY, high temperatures in June led to undesirable and accelerated ripening of cherries in Yamagata, concentrating the harvest time for all varieties, including the late-ripening Beni-shuhou variety.

Additionally, the high temperatures softened the skin of fresh cherries, negatively affecting their shelf life and transport suitability. As a result, although cherry production was somewhat comparable to average levels, many cherries did not meet shipping standards or were left unharvested on the trees.

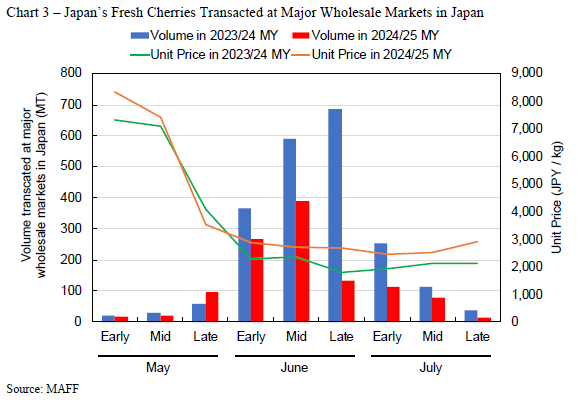

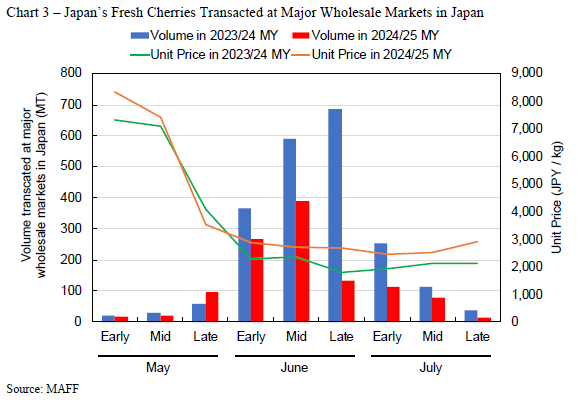

Initially, the Yamagata prefectural government announced that the estimated production would be 10% lower than the previous year. However, data from Japanese wholesale markets show that fresh cherry transactions through fruit markets have decreased by more than 40% compared to last year (see chart 3).

As a result, FAS/Tokyo predicts that Japan's total fresh cherry production will decrease by 15%, reaching 14,700 metric tons in the 2024/25 season, while commercial distribution of cherries will further be impacted, declining by 34%.

Consumption

Since fresh cherries are considered premium fruit in Japan, they are almost entirely consumed as fresh produce, with only limited quantities (mostly those outside of marketing standards) going into processed products.

In addition to distribution through wholesale markets, fresh cherries are distributed in Japan mainly through gifting, Furusato-Nozei, fruit picking, and direct sales. In MY 2024/25, large volumes of fresh cherries were left unharvested or did not meet marketing standards, significantly reducing the distribution of fresh cherries in Japan.

Media reports indicated that many pre-ordered gift sets and fruit-picking reservations had to be canceled due to supply shortages.

Image 3: Volume of cherries in wholesale markets in Japan.

Image 3: Volume of cherries in wholesale markets in Japan.

California cherries lead the imported cherry market in Japan starting in May, followed by cherries from Oregon and Washington later in the season. Supported by lower prices for California cherries compared to the previous MY, Japanese consumption of U.S.-origin cherries is estimated to have increased by 60%, reaching 5,900 MT in MY 2024/25.

Based on this information, FAS/Tokyo estimates that Japan's fresh cherry consumption in MY 2024/25 will be 20,600 MT.

Trade

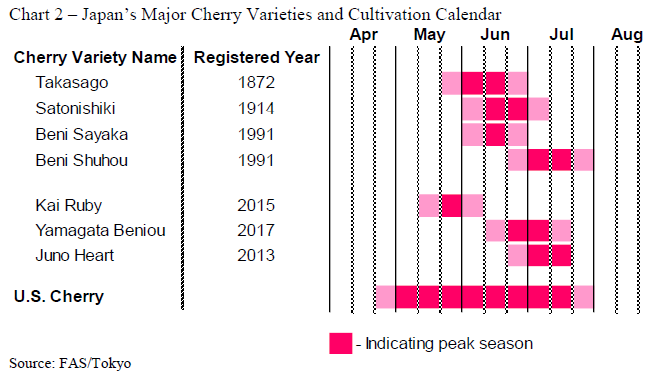

The United States is the leading exporter of fresh cherries to Japan, with an import share of about 91% in MY 2023/24 (see Table 2). Japanese consumers generally perceive U.S. red cherries and Japanese yellow cherries as distinct products, and U.S.-origin cherries do not directly compete with domestically produced varieties. As such, Japan remains an important export market for U.S.-origin cherries.

Table 2.

Table 2.

However, FAS/Tokyo estimates that Japan’s imports of U.S.-origin cherries will decrease by 5% to 5,600 MT in the 2024/25 season, primarily due to lower domestic production of Japanese cherries.

In MY 2023/24, Japan imported 255 MT of cherries from Chile and 37 MT from Canada. However, given that these volumes were largely due to marketing gaps in U.S.-origin cherries, FAS/Tokyo predicts that Japan’s cherry imports from Chile and Canada will remain below 500 MT in MY 2024/25.

Policy

The trade agreement between the United States and Japan (USJTA) eliminated tariffs on sweet cherries starting from April 1, 2023.

Source: USDA

Images: USDA; Mainichi

Cherry Times - All rights reserved