"We are very happy and satisfied this year, the cherries produced are of very good quality, good colour, good taste": from Paarl, South Africa, Karien Bezuidenhout, manager of the cherry sector for the Hortgro growers' association, did not hide his enthusiasm for the 2023/24 season that is drawing to a close.

Among stone fruits, cherries for South Africa are the new frontier, the crop that is showing vitality, in numbers. Hortgro Cherries is representative of the sector, about 90% of the producers are in fact members. "This year the weather has been kind to us, we had some rain in the south but it did not affect us," Karien Bezuidenhout told Cherry Times.

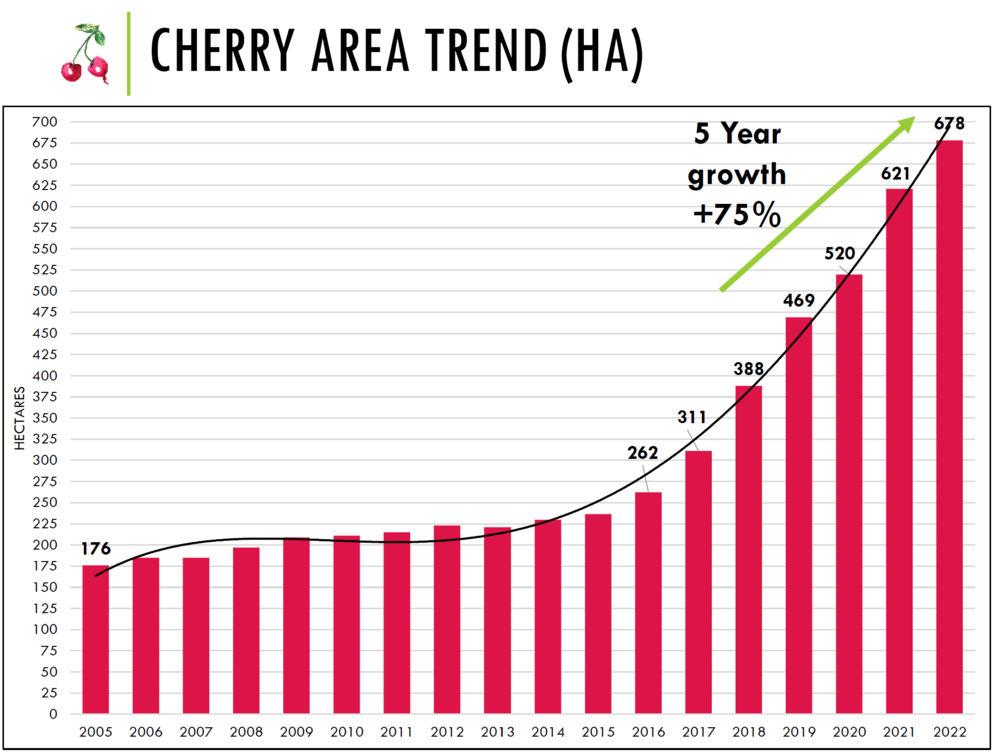

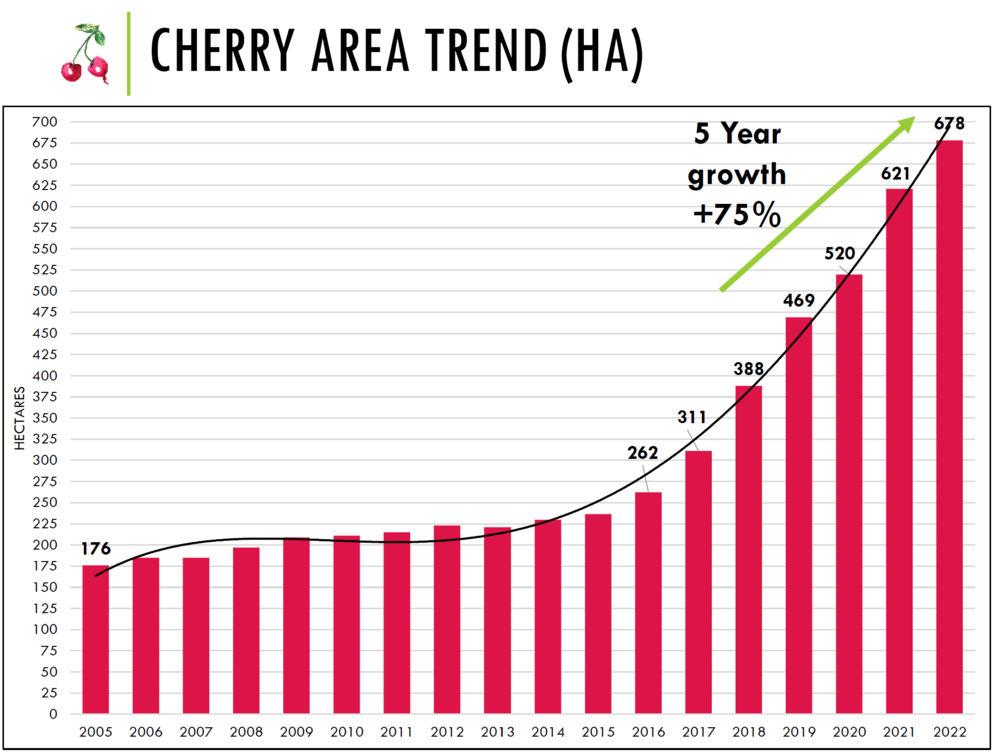

According to Hortgro's own latest figures, which, however, stop at the 2021/22 season, there are 44 producing companies in South Africa, the planted hectares are 678 (year 2022), but the interesting fact is that in the last five years the growth of the areas has been 75%, and in 2016 the planted hectares were just 262.

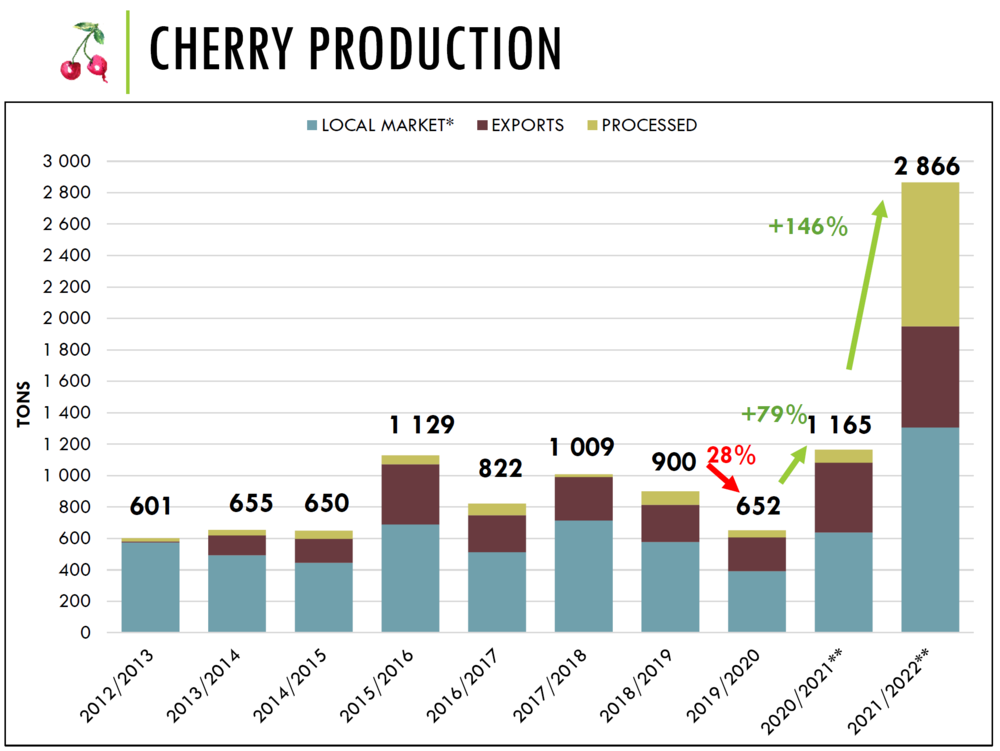

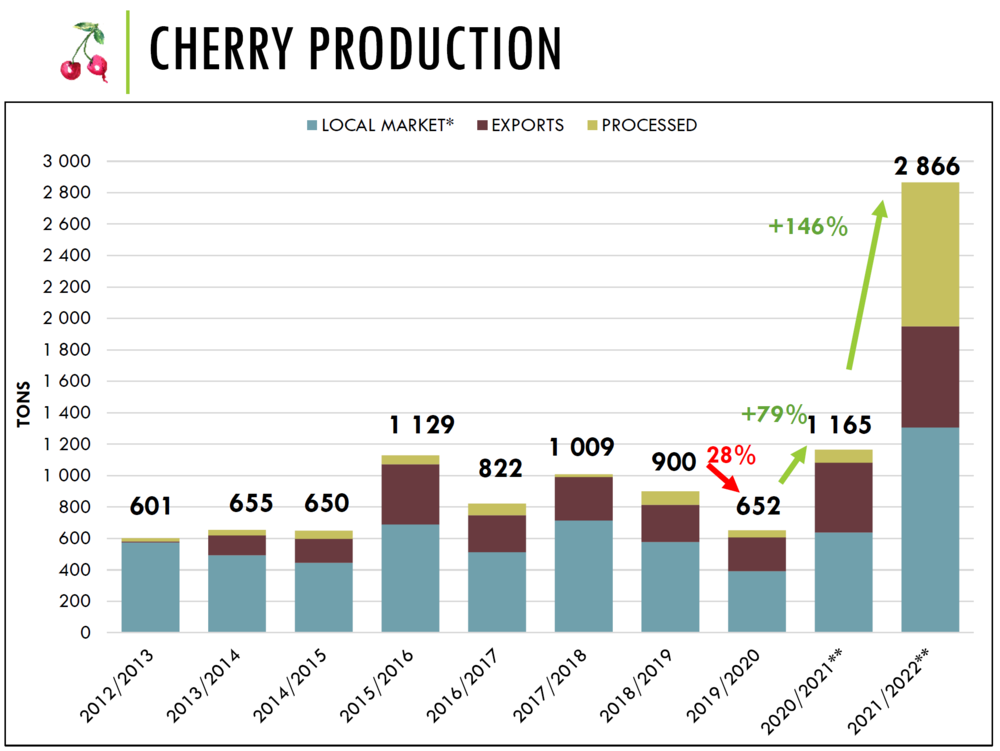

Growing production and exports

Production in 2022 stood at 2866 tonnes, with 66% marketed fresh in the country and 27% for export. The remaining quantity went to the industry. Between the 2019/2020 and 2020/2021 vintages, there was a 79% jump in production, and between 2020/2021 and 2021/2022 there was an increase from 1165 tonnes produced to 2866 with a +146%, season on season, a sign that most probably, still young plantations went into production.

In fact, most of the ceraseti are not yet in full production, 65% to be precise. The area with the highest concentration of cherry orchards in South Africa is the Southern Region of Western Cape, which alone accounts for 63% of the cherry orchard area.

Looking at the cultivars favoured by South African growers, it can be seen that Royal Hazel (15% of the acreage), Royal Tioga (11%) and Lapins (10%) are the dominant ones, but there are many varieties planted, around 20 alone. Growers are gradually abandoning Bing and Rainier, which, in fact, looking at the age of the groves, appear to have been planted much longer, most more than 18 years ago.

Looking at the cultivars favoured by South African growers, it can be seen that Royal Hazel (15% of the acreage), Royal Tioga (11%) and Lapins (10%) are the dominant ones, but there are many varieties planted, around 20 alone. Growers are gradually abandoning Bing and Rainier, which, in fact, looking at the age of the groves, appear to have been planted much longer, most more than 18 years ago.

"In the last two to three years, a good number of cultivars have been introduced into the country and I expect more to be imported. These are cultivars that have to be evaluated because we do not know how they adapt to our climate and territory. We produce both in cold areas and in warmer regions, so we also want to see how cultivars with low cold requirements behave,' he says.

"That is why the association has for some years now been funding a research programme to validate a standard protocol for evaluating cultivars. We want to be able to provide our cherry growers with independent evaluations".

The Far East could be the business of the future

While 27 per cent of production in 2022 went across the border, the producers themselves admit that there is still a lot of work to be done to boost sales abroad. 'As far as exports are concerned, our main market remains, for now, the United Kingdom,' Bezuidenhout continued, 'but we see great potential in the East, Vietnam is very interested and China could also be a good market for our cherries.

"At the moment, however, there is no agreement reached. The Chinese market,' he explained, 'remains closed for our cherries, we hope in the future. At the moment the market we can count on is the European one and then we can look at the US but there they have very strict phytosanitary rules and in addition there is a long distance to travel. Trade agreements could be open and ready, but the logistics have to be evaluated'.

According to Agri-Hub/PPCEB data reported by Hortgro, in 2022/2023 in fact Great Britain was worth 58% of fresh cherry exports, Europe 6%, the Middle East 23%, and Asia and the Far East 10%, an increase over the previous season of 7%.

In order to reach distant markets, however, it is necessary to be able to extend the life of the fruit on the shelf and make sure that the harvested cherries can withstand long crossings: "I think what we will have to pay attention to is post-harvest management.

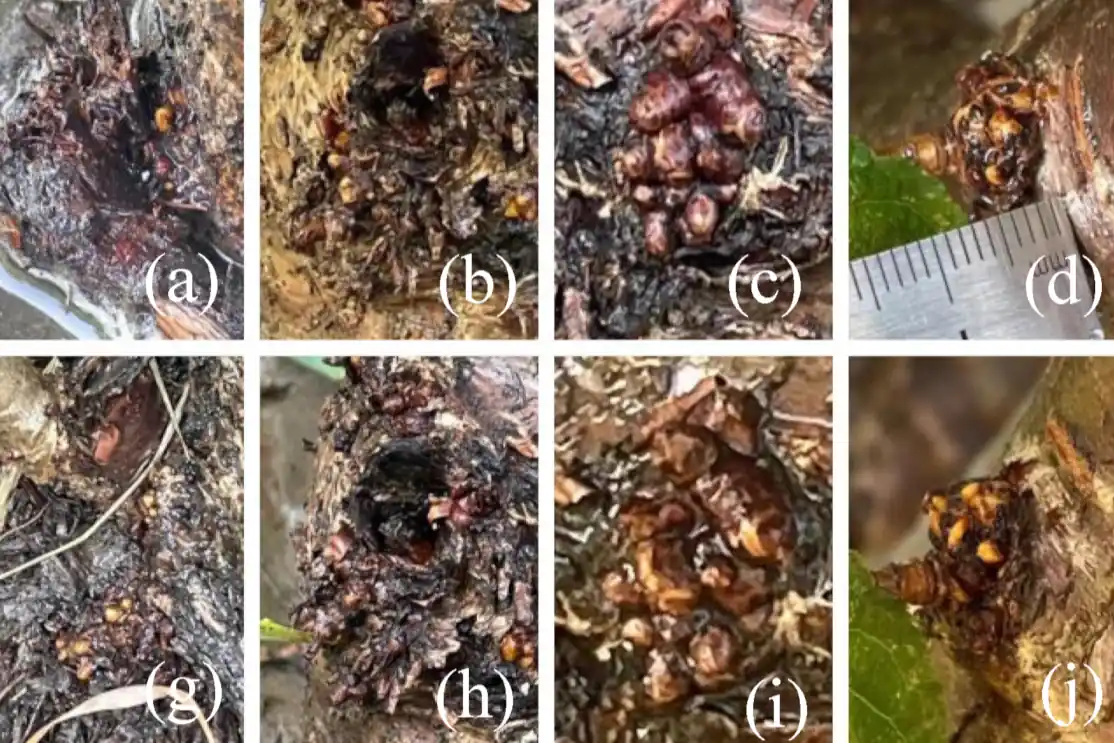

"We have to have the right packaging systems and the right logistics to ensure that the goods travel well. We are also doing research on this issue,' continued Karien Bezuidenhout. 'We are looking at treatments with biological agents or even the irradiation method. We are evaluating every possibility'.

Export needs strong logistics, problems at the Port of Cape Town

While technique and technology may help South African cherry growers to address more distant markets, the need for efficient logistics remains. Unfortunately, the current season, not only for cherries, has seen the situation at the port of Cape Town come to a head.

Just in the last few days, the tones have become more heated with industry representatives threatening to take the port authority, the Transnet Nationa Ports Autority, to court. The disruptions at the port are causing delays in the shipment of all goods, especially fruit, and the damage is extensive.

According to press reports, between November and December 2023, shipments of apricots, cherries, peaches, plums, apples and pears, as a whole, were 35% less than during the same period in 2022, but the delays have been dragging on since last season.

"I cannot quantify the damage to the cherries," said Karien Bezuidenhout, manager Hortgro Cherries, "but the problems at the Cape Town port are manifold. The facilities need to be modernised and then there is a labour problem. The situation is really serious. It is the nearest port, there would be Durban, but it is in the north and that port also suffers from similar problems as Cape Town.

Barbara Righini

Images: Graphs and statistical processing by Nina Viljoen, agricultural economist, Hortgro.

Cherry Times - All rights reserved