Alessandro Palmieri - University of Bologna (IT)

Cherry Times technical-scientific committee

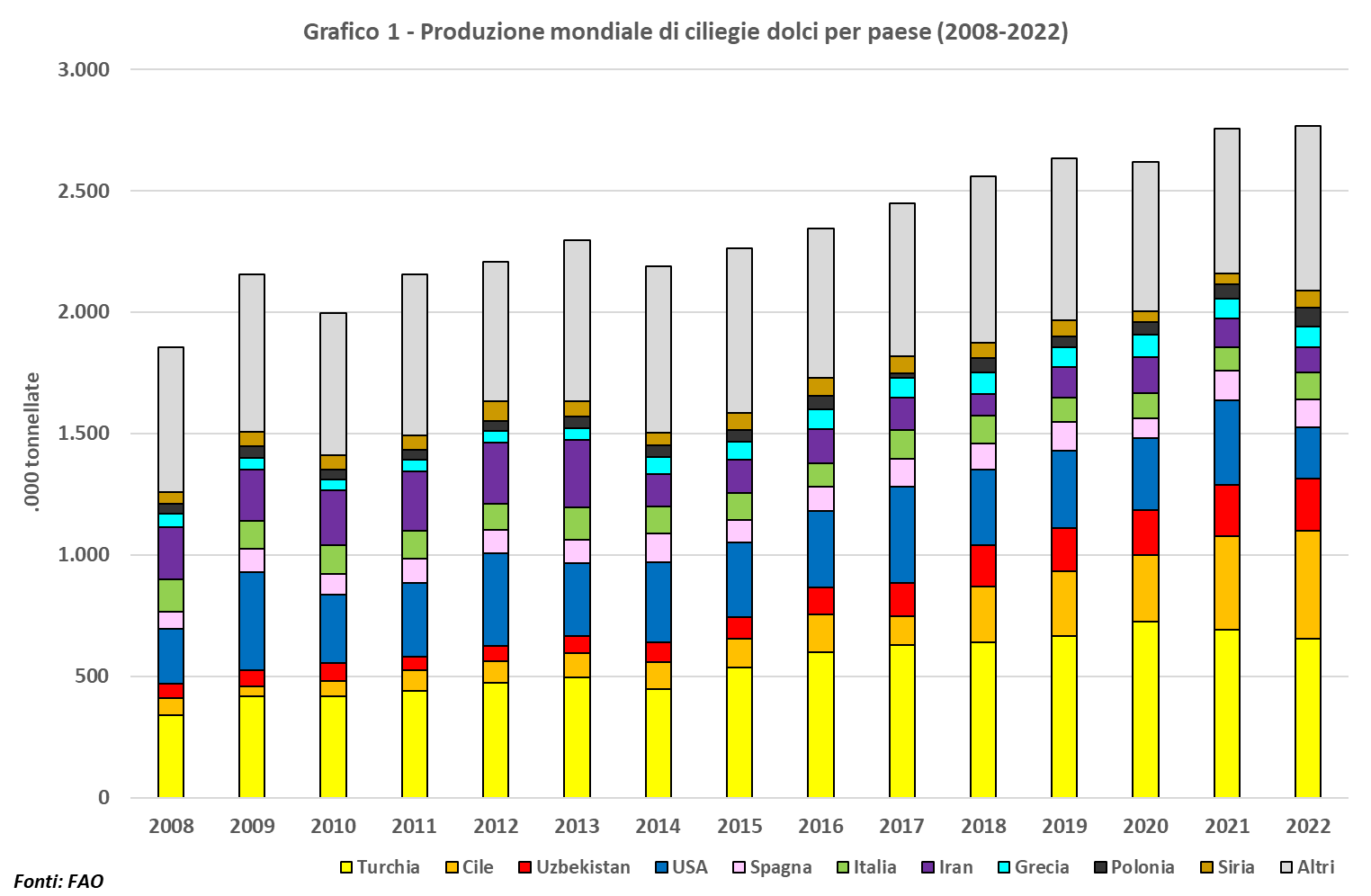

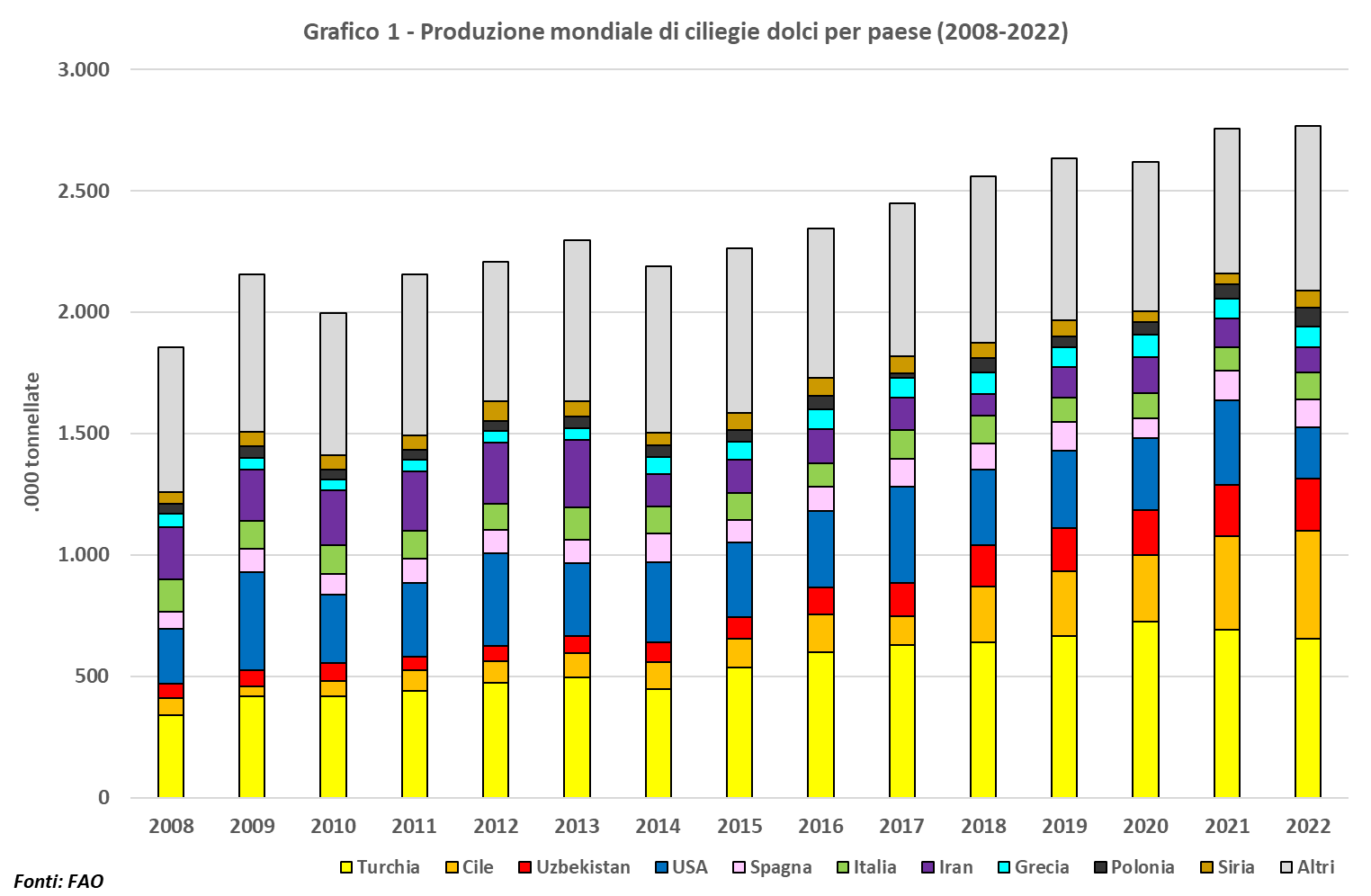

The world supply of sweet cherries rose from 1.85 to 2.75 million tonnes in the period from 2008 to 2022, an increase of about 50% (FAO data). Although still boasting small numbers compared to other fruit species, the growth rate over the last 15 years places cherries in second place among the main fresh-consumption crops (excluding citrus and tropicals), behind only actinidia, which grew by 65% over the same period.

Image 1: Wordlwide cherry production by country (2008-2022).

Image 1: Wordlwide cherry production by country (2008-2022).

The geography of world supply (Chart 1) has not changed substantially over the last 15 years, although it is possible to note a progressive concentration in a few countries: in particular, the top 10 producers accounted for around 75% of production in 2022, compared to 70% in 2008.

Compared to 2008, three large Eastern European areas, Russia, Ukraine and Romania, have dropped out of the top ten producer countries, replaced by Poland as the area's largest producer, as well as Uzbekistan, the protagonist of the greatest development among the main producers and, in 2022, moved into third place, and Greece.

Analysing the dynamics of the main producing countries (Table 1) through the aggregation of the supply volumes of the period examined in three blocks of 5 years each, one can note the progressive consolidation of Turkey as the world production leader, with a supply that went from an average of 416,000 tonnes to almost 675,000 tonnes and the consequent share from 20 to 25%.

Image 2: Cherry orchard in Turkiye.

Image 2: Cherry orchard in Turkiye.

The rest of the podium is completed by the two countries with the highest growth rate during the period under consideration, namely Chile and Uzbekistan. Both countries realised volumes of less than 70,000 tonnes in the five-year period 2008/12, while the average for the years 2018 to 2022 for Chile exceeds 320,000 tonnes and for Uzbekistan is 192,000 tonnes.

The Asian country also reached a record production of 216,000 tonnes in 2022, surpassing the US in third place. Chile and Uzbekistan currently achieve a share of 12 and 7.2 % of the world total, respectively.

Table 1 - Production data of the world's top 10 countries and evolution over the period 2008-2022. Source: FAO |

| Countries | Average productions per five-year period | Variation (%) | Share (%) |

| 2008/12 (A) | 2013/17 (B) | 2018/22 (C) | D% (B/A) | D% (C/B) | 2008/12 | 2013/17 | 2018/22 |

| Turkiye | 416,7 | 540,5 | 674,9 | 29,7 | 24,9 | 20,1 | 23,4 | 25,3 |

| Chile | 69,5 | 121,2 | 320,6 | 74,3 | 164,5 | 3,4 | 5,3 | 12,0 |

| Uzbekistan | 64,3 | 97,7 | 192,7 | 51,9 | 97,2 | 3,1 | 4,2 | 7,2 |

| USA | 319,8 | 330,1 | 296,6 | 3,2 | -10,1 | 15,4 | 14,3 | 11,1 |

| Spain | 90,3 | 104,9 | 109,8 | 16,2 | 4,7 | 4,4 | 4,5 | 4,1 |

| Italy | 116,7 | 113,2 | 103,7 | -3,0 | -8,4 | 5,6 | 4,9 | 3,9 |

| Iran | 230,1 | 165,0 | 118,1 | -28,3 | -28,5 | 11,1 | 7,2 | 4,4 |

| Greece | 49,1 | 71,4 | 86,1 | 45,4 | 20,6 | 2,4 | 3,1 | 3,2 |

| Poland | 42,1 | 43,4 | 58,3 | 3,2 | 34,2 | 2,0 | 1,9 | 2,2 |

Syria | 61,6 | 66,2 | 57,1 | 7,6 | -13,9 | 3,0 | 2,9 | 2,1 |

| Others | 614,9 | 654,5 | 649,0 | 6,4 | -0,8 | 29,6 | 28,4 | 24,3 |

| Total | 2.075,1 | 2.308,2 | 2.666,9 | 11,2 | 15,5 | 100,0 | 100,0 | 100,0 |

At the foot of the podium, considering the 2022 ranking, is the United States, which, however, with the exception of the 2022 campaign itself, which closed with only 210,000 tonnes of production, has in previous years remained at around 300,000 tonnes, accounting for more than 10% of the overall share.

In 5th and 6th position are the main European producers, Spain and Italy. The Iberian country progressively increased its supply from 90,000 to 110,000 tonnes, thus maintaining its world share. More evident is the growth of Spanish cherries in the period from 2008 to 2017, +16%, while in the last five years the increase has slowed down to just under 5%.

Italy, on the other hand, shows a substantial stability in supply, around 115,000 tonnes, but in the last five years, due to several problematic campaigns from a climatic point of view, Italian production has fallen to average volumes of just over 100,000 tonnes. Italy has thus dropped from 4th to 6th place in the world, with a share of less than 4% considering the average of the last five years.

Image 3: Cherry orchard in Apulia (IT).

Image 3: Cherry orchard in Apulia (IT).

The country with the largest drop in supply over the years analysed is Iran, which lost more than 55% of its production volumes overall. In contrast, there was a marked increase in volumes for Greece and Poland, by 65% and 37% respectively over the entire period analysed. Greek production now accounts for more than 3% of world production, while Polish production is just over 2%. Finally, Syria closes the ranking of the world's top ten producers, with production volumes tending to remain unchanged over time, although characterised by high fluctuations.

Also interesting is the analysis of the trend in production yields, which, globally, recorded an average annual growth rate of 1.27% over the time period examined. Among the main producing countries, Uzbekistan definitely stands out in terms of the productivity of its plants, with an average annual growth rate of 5.27%.

The only other countries showing a significant increase in yields are Poland, with 3.68%, and the two leading countries, Turkey and Chile, both rising at an average annual rate of 2.8%. Plant productivity remained substantially unchanged in Spain, Greece and the United States, while it declined in Italy (-1.1%) and Iran (-2.1%).

Finally, a brief analysis of the positions of the countries in the top ten, among those with annual supply volumes of more than 20,000 tonnes in 2022, shows significant growth in cherry production in Bulgaria, Bosnia, Albania and Portugal. Conversely, a marked decrease is reported in Russia, Ukraine, Romania and, to a lesser extent, France.

A note should also be made of China which, in the period under consideration, increased from 25,000 to 35,000 tonnes (+43%), thus highlighting the willingness to develop a growing domestic production to meet the development of demand.

Cherry Times - All rights reserved