Turkey’s cherry production for the 2024/25 marketing year (MY) is expected to decrease compared to last year's record, but it will still be the third-largest ever. Despite the decline in production, cherry exports are projected to reach an all-time high, as growers prioritize the more profitable foreign markets over the local ones.

Production and exports of peaches and nectarines are set to reach record levels, as larger growers continue expanding their operations to capitalize on export-driven profits.

In this record year, some small stone fruit growers who can only sell to the domestic market are struggling to make ends meet, as the cost of production inputs (e.g., labor, fuel, electricity, etc.) is rising faster than fruit prices.

Planting Area

The area dedicated to growing both sweet and sour cherries for MY 24/25 is expected to slightly increase from the previous year, reaching 99,300 hectares. This area consists of 80,000 hectares for sweet cherries and 19,300 hectares for sour cherries. Over the past decade, the total cherry-growing area has remained around 100,000 hectares.

Although the planted area has remained relatively stable over this ten-year period, the number of sweet cherry trees has increased (i.e., densification) as growers have modernized their operations. According to Turkish statistics, the number of sweet cherry trees has risen from 21.0 million to around 27.0 million from 2019 to 2024, while the number of sour cherry trees has remained relatively stable.

Turkey is home to more than 100 varieties of sweet cherries. The most popular variety is the Napoleon sweet cherry, locally known as 0900 Ziraat. This large, juicy, heart-shaped cherry has a longer shelf life than other varieties, making it ideal for long-distance shipping both domestically and abroad.

Over the past decade, Turkish scientists have developed higher-yielding, better-quality Napoleon cherries. Growers have gradually replaced the old Napoleon variety with newer and improved versions. Besides the Napoleon cherry, growers have started experimenting with other high-yielding sweet cherry varieties, such as Sweetheart, Celeste, Early Lory, Kordia, Regina, Sam, and Sunburst.

Production

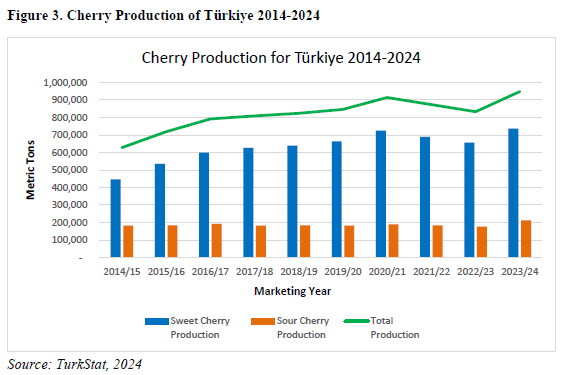

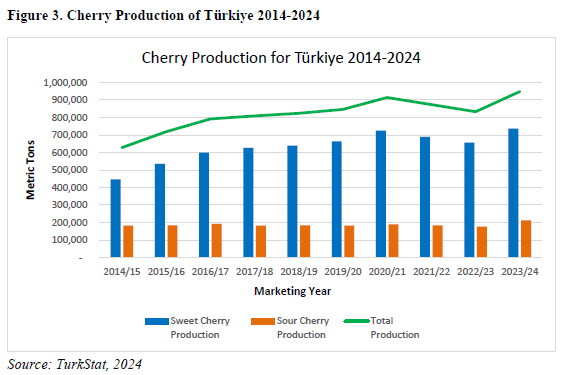

For MY 2024/25, Post forecasts a total cherry production of 900,000 MT, a decline of about 5% from last year's record, as this season's growing conditions were less than ideal. Despite the decrease, it will still be the third-largest on record.

The total forecasted amount consists of 700,000 MT of sweet cherries and 200,000 MT of sour cherries. Post's forecast is based on field visits and conversations with cherry growers, who reported that rainfall timing and amounts were adequate, and there was no frost damage in the spring.

Turkey's statistical agency (TurkStat) has forecasted a total cherry production of 988,000 MT for MY 2024/25, with 771,000 MT of sweet cherries and the remaining 217,000 MT of sour cherries. One reason for the difference between TurkStat's and Post's forecasts is that TurkStat made its projections in early May, just as the harvest season was beginning.

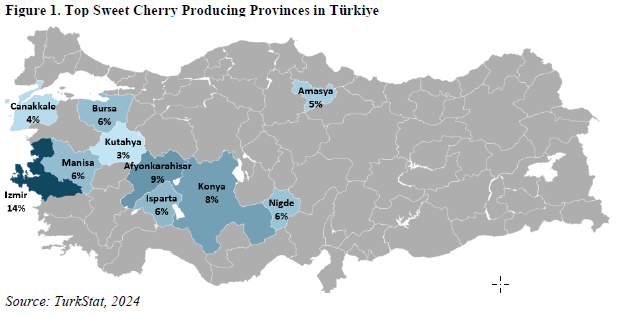

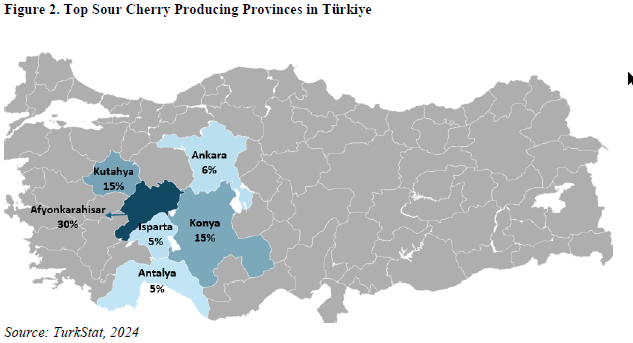

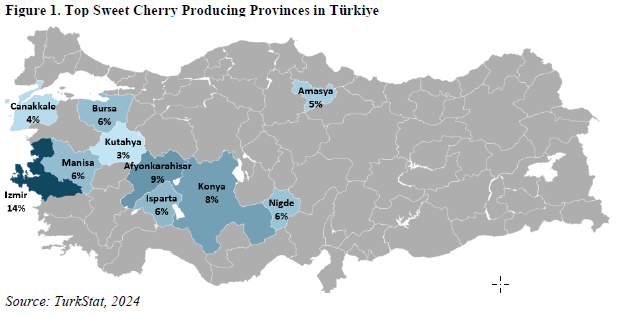

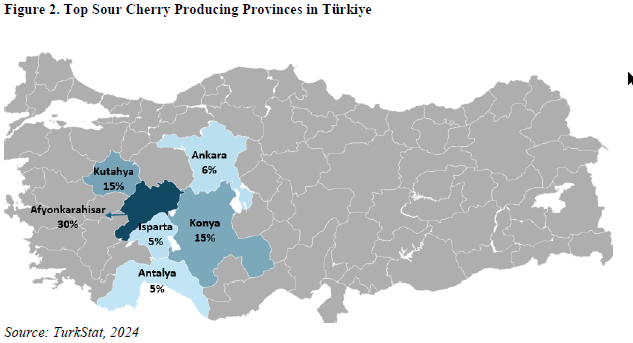

Cherry production is primarily concentrated in the western part of Turkey. The coastal province of Izmir and the inland province of Afyonkarahisar are the two main provinces for sweet and sour cherry production, respectively (Figures 1 and 2).

Figure 1: Provinces with the highest sweet cherry production in Turkey.

Figure 1: Provinces with the highest sweet cherry production in Turkey.

Figure 2: Provinces with the highest sour cherry production in Turkey.

Figure 2: Provinces with the highest sour cherry production in Turkey.

The exact timing of the cherry season may vary depending on the region and weather conditions, but typically the peak cherry harvest period begins in June. Cherry picking begins in Izmir on the Aegean coast in late May and then moves inland to provinces like Afyonkarahisar and Konya during June and July.

The price of agricultural inputs, such as labor, energy, and fertilizers, continues to rise due to persistent inflation in Turkey. Labor costs represent the largest share of overall input prices, with labor costing about 1,000 TL (29.71 USD) per day. In the face of these higher costs, some growers, especially smaller farms, are struggling to remain profitable.

Some growers report that producing one kilogram of sweet cherries costs 57 TL, but they can only sell it at a loss for 50 TL/kg. Due to these losses, some small growers are considering switching to more profitable crops. In contrast, larger producers who can export are in a better position, as they can sell cherries above the cost of production and make a profit.

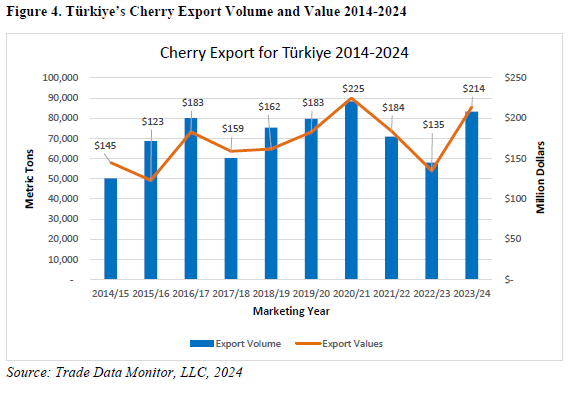

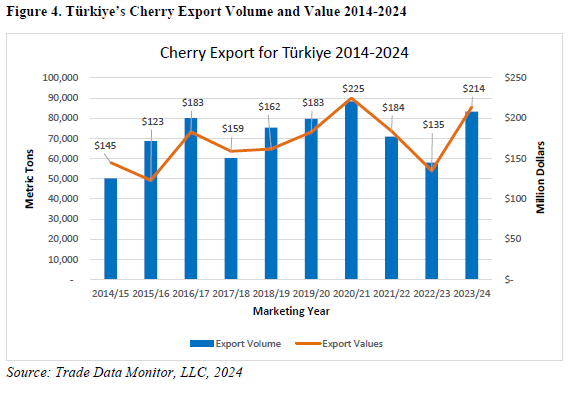

Strong export demand in recent years has been the driving force behind the increase in cherry production, which has grown by 65% over the past decade (Figure 4). The increase is mainly due to the rise in sweet cherry production, a significant portion of which is exported. Sour cherry production, however, has remained constant as the fruit is mainly used in the juice and jam industries in Turkey.

Turkey is gradually transitioning from traditional cherry production to modern methods, with the development of modern orchards using high-density planting of the latest high-yield varieties and advanced technologies. However, despite these ongoing advancements, most cherry production is still carried out using traditional methods on family-run farms.

Figure 4: Value and volume of Turkish cherry exports from 2014 to 2024.

Figure 4: Value and volume of Turkish cherry exports from 2014 to 2024.

Consumption

In MY 2024/25, domestic cherry consumption is expected to reach 810,000 MT, down by about 55,000 MT from last year's record. This decline is partly attributed to the anticipated decrease in production and record exports this season. The consumption estimate for MY 2023/24 has been revised upwards to approximately 865,000 MT to account for the adjustment in production volumes for that year.

In Turkey, over one hundred different varieties of cherries are grown and consumed. Most sweet cherries are consumed fresh, while 90% of sour cherries are used for making preserves, jams, frozen fruits, and juices.

In MY 2024/25, the producer price for sweet cherries was about 50 Turkish lira (TL) per kilogram (kg) ($1.49/kg), while retail prices ranged from 80 to 150 TL per kg ($2.38-4.46/kg). Retail prices for sour cherries ranged from 90 to 150 TL per kg ($2.59-4.46).

Trade

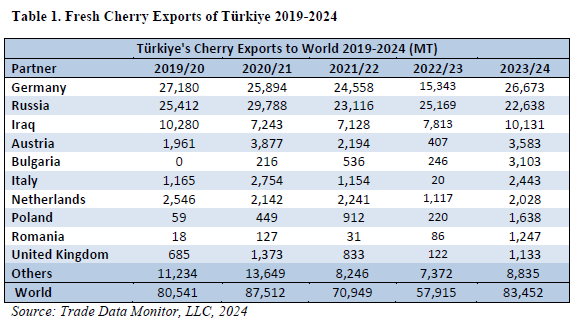

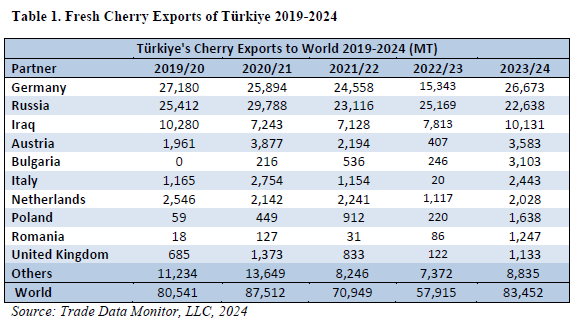

Despite the expected drop in production, Post forecasts that fresh cherry exports for MY 2024/25 will reach a record 90,000 MT, as export demand, particularly in EU markets, remains strong and more profitable than local sales. The top three export destinations for Turkish cherries in MY 2023/24 were Germany, Russia, and Iraq (Table 1).

Table 1: Turkish Fresh Cherry Exports from 2019 to 2024.

Table 1: Turkish Fresh Cherry Exports from 2019 to 2024.

Marketing

According to the Aegean Exporters' Association, Turkey's goal is to export sweet cherries worth $300 million in the near future.2 In 2023, exports amounted to approximately $214 million.

In recent years, the marketing of Turkish sweet cherries has increased significantly both domestically and internationally. Complementing these marketing efforts, Turkish companies have made new investments in cold storage facilities and packaging operations to deliver fresher cherries and cherry-containing products to consumers.

At the same time, farmers are producing cherry varieties demanded by export markets, and a growing number of Turkish companies are more familiar with cherry exports than in the past.

Source: USDA

Images: USDA; SL Fruit Service

Cherry Times - All rights reserved