Record prices for the first cherries of the season in Argentina, driven by limited availability and a demand led by high-spending consumers. The domestic market is becoming increasingly attractive, even compared to exports.

The 2025 Argentine cherry season opened with a sharp price surge, marking a historic record for the domestic market. The first batches arriving from Mendoza reached 45,000 pesos per kilo at retail outlets, fueled by extremely limited supply and a demand sustained by an elite audience willing to pay for quality.

Record figures from the Mercado Central

According to the Mercado Central de Buenos Aires (MCBA), on October 29, wholesale prices hit 30,400 pesos per kilo, an increase of more than 350% compared to the same period in 2024. The variety currently available is Nimba, “elegido” grade and medium-sized, while last year around this time the Royal Lee variety was sold, also of premium quality but in bulk packaging.

Although varietal differences and packaging types may partially affect comparisons, the price increase remains striking, highlighting a much more dynamic and competitive market.

Retail prices triple

In the main commercial areas of northern Greater Buenos Aires and the capital, retail prices reached 45,000 pesos per kilo — about 31 USD (around 29 EUR) at the official exchange rate — roughly three times higher than during the same period last year. This trend confirms the rise of Argentine cherries as a premium good in the domestic market.

According to MCBA sources, however, compared to 2024, the margins between wholesale and retail prices have not widened significantly: most of the increase is concentrated in the intermediate supply chain, between wholesalers and retailers.

The average wholesale price, still referring to October 29, stood at 29,600 pesos per kilo, showing a year-on-year spike of over 400%, a clear sign of a still very limited supply of high-quality fruit in the market.

"Those who want quality are willing to pay"

MCBA confirms that consumers willing to buy cherries at this time of year belong to the highest socioeconomic segment (ABC1), motivated by the pursuit of an excellent product. “When the cherry is good, price becomes secondary,” said a market operator.

One kilo of premium cherries displayed in a high-end supermarket in the Pilar area, for instance, exceeds 45,000 pesos — a figure that, according to some analysts, ensures higher returns than exports for producers.

Domestic vs China: the profitability challenge

The comparison with exports, particularly to China, offers interesting insights. Although the price per kilo exceeds 40 USD (around 37 EUR) in the Chinese market, transportation, packaging, and logistics costs significantly reduce the margins for Argentine producers.

The domestic market, on the other hand, is logistically simpler and less risky, with maximum distances of 1,300 km between packing centers and major consumption areas. This makes the national market a strategically more advantageous option, at least during the early part of the season.

Coming weeks: waiting for new supply

Larger volumes from Mendoza and northern Patagonia are expected to arrive in the coming days, potentially leading to a gradual price stabilization. However, analysts say it will be difficult to return to 2024 levels, due to rising production costs and national inflationary pressures.

One variable to monitor closely is the potential entry of Chilean cherries into the Argentine market. With much higher production and lower costs, Chile’s competition could put downward pressure on domestic prices, threatening local producers’ profitability.

A market in transition: between opportunities and uncertainties

The price boom reflects the growing perception of cherries as a premium product, but also underscores the need for more careful production and logistics planning to avoid imbalances that could harm consumers and create uncertainty along the value chain.

If quality and supply are managed wisely, the Argentine domestic market — historically secondary to exports — could become an increasingly relevant and profitable sales channel for national cherries.

Source: masp-lmneuquen-com

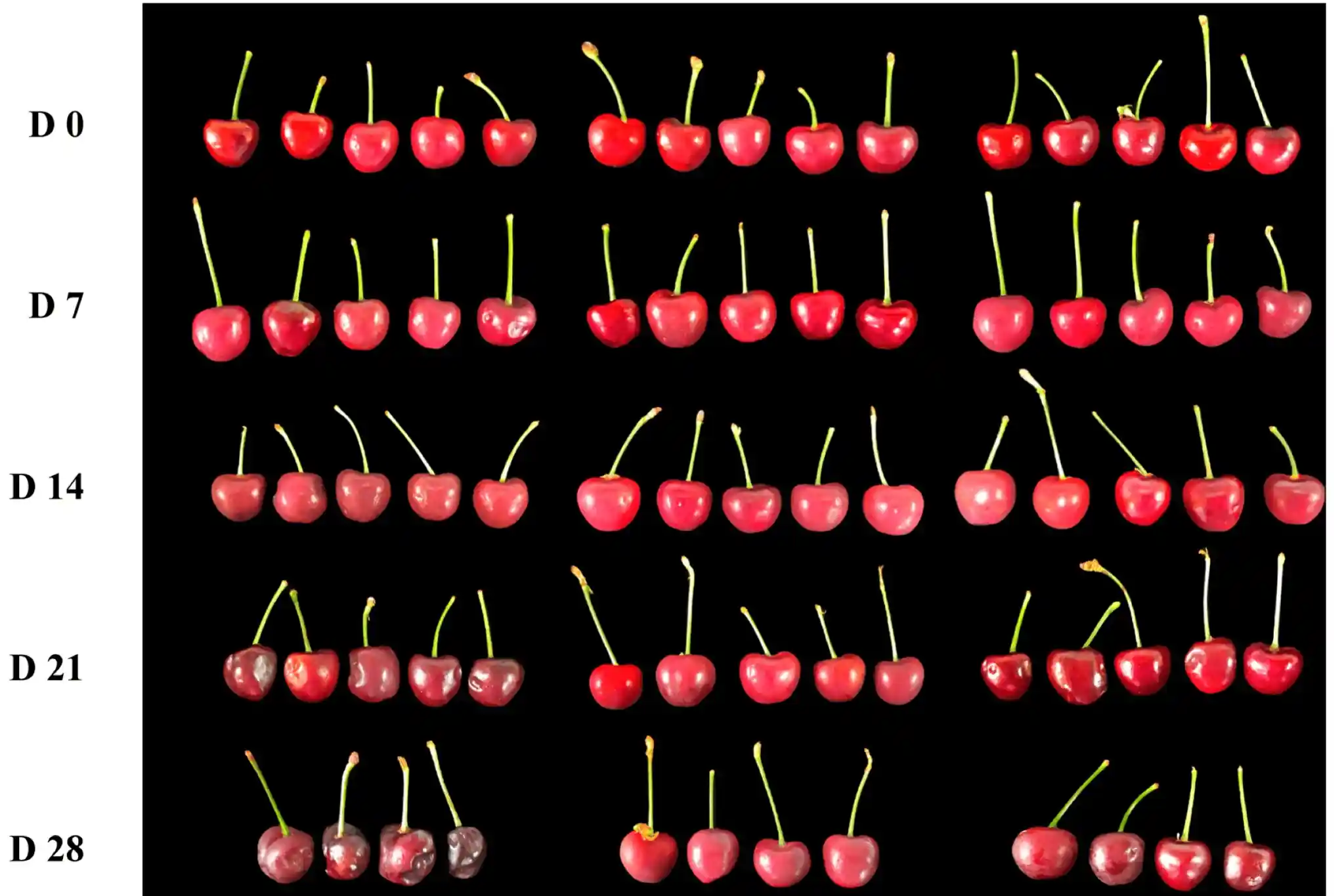

Image source: Info Mendoza

Cherry Times – All rights reserved