In 2024, Chile achieved an extraordinary milestone in its cherry exports, generating more foreign revenue than Argentina, whose total meat exports yielded lower earnings.

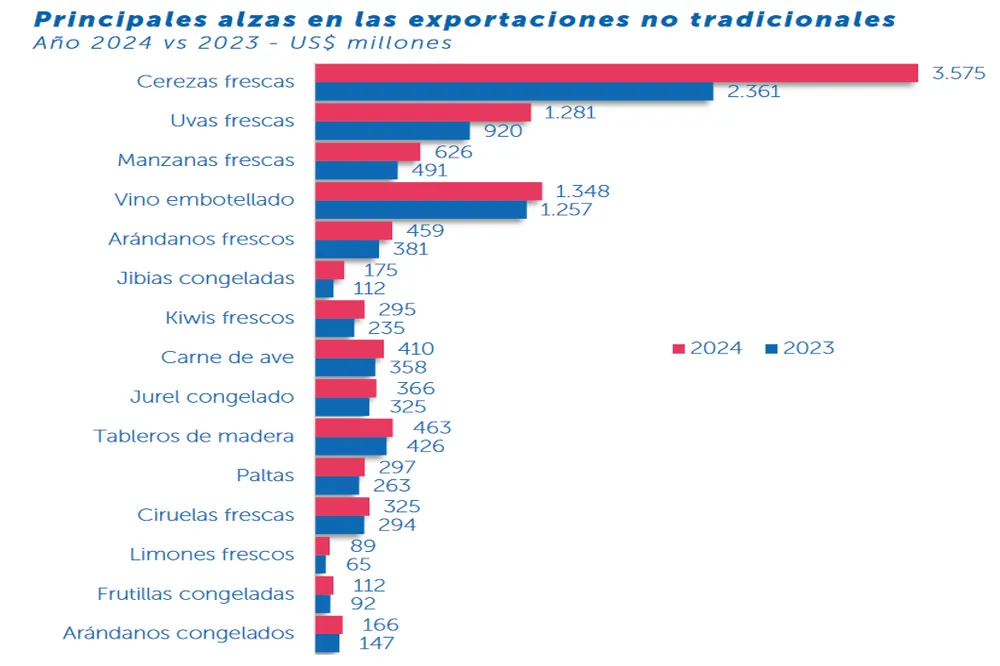

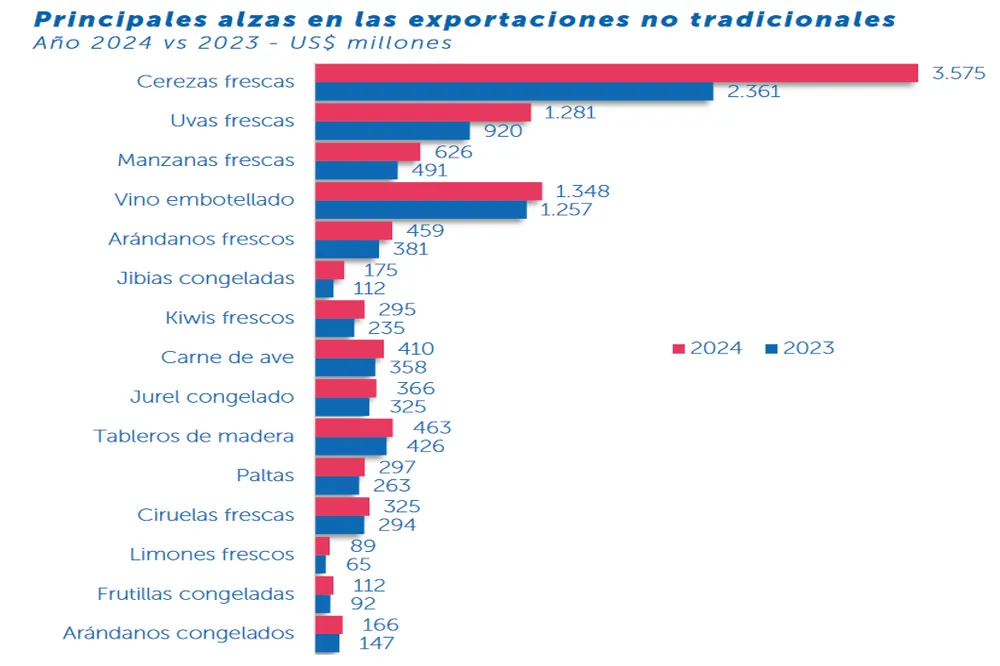

The figures are astonishing: 3.575 billion dollars (approximately 3.3 billion euros) solely from cherries, with most of this revenue coming from shipments to China, a market that has warmly embraced this Chilean delicacy.

A symbolic and profitable fruit

In China, Chilean cherries have become a symbol of good fortune and friendship, with many families and couples exchanging this fruit during celebrations.

This trend has had an extraordinary impact on Chile’s horticultural sector, turning a simple tradition into a powerful economic driver.

But this is not an isolated case. Other Chilean fruits also saw record performances in 2024: fresh grape exports reached 1.281 billion dollars (approximately 1.18 billion euros), apples 626 million (about 577 million euros), fresh blueberries 459 million (around 423 million euros), and fresh plums 325 million (around 300 million euros), among others.

The reasons behind success

What is the key to Chile’s success? A combination of advantageous trade policies and a solid macroeconomic framework.

The South American country benefits from free trade agreements with major global economies, allowing it to export under significantly more favorable conditions than nations relying on traditional commercial channels.

Market challenges

However, despite the outstanding success of cherries, 2024 was not without challenges.

Production increased significantly, but an oversupply of the product to the Chinese market caused export prices to plummet.

This prompted industry players to consider the need to diversify target markets to make the business more sustainable in the long run.

A surprising comparison

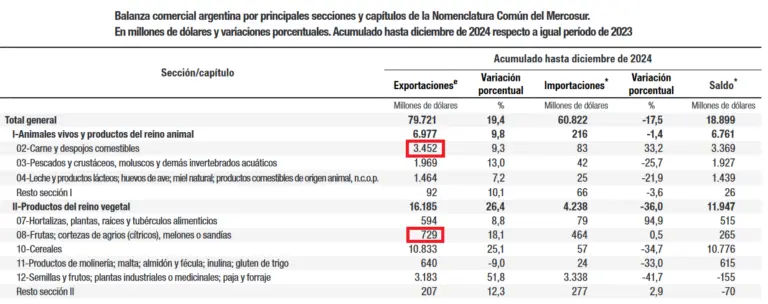

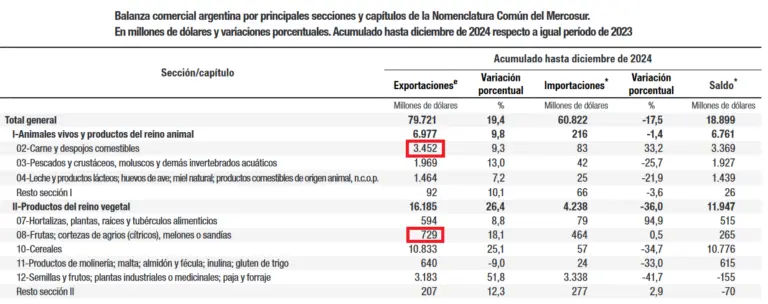

One striking fact, highlighting the efficiency of Chile’s model, is the comparison with Argentine meat exports.

In 2024, international cherry sales exceeded Argentina’s entire meat export revenue by 3%, including beef, poultry, pork, and offal.

A small fruit like the cherry thus generated more foreign currency than all of Argentina’s exported meats combined.

Opportunities and limitations

This figure is not only a success for Chile but also further evidence of how a country with limited agricultural land can generate wealth, provided it develops an adequate economic and commercial infrastructure.

Conversely, Argentina, despite having abundant natural resources and a greater agricultural potential than Chile, struggles to fully capitalize on its assets.

The numbers make this clear: Argentine agricultural exports, particularly fresh fruit, totaled only 729 million dollars (around 673 million euros) in 2024, a rather underwhelming result considering the country’s vast potential.

Chile’s dominance in the fruit market

On the other hand, Chile continued to set records, with fresh fruit exports reaching 8.245 billion dollars (approximately 7.6 billion euros) in 2024, eleven times more than Argentina, despite Chile having smaller agricultural areas.

This is a clear example of how a strategic vision, combined with free trade policies, can make a difference.

A look at the global economy

On a global scale, Chilean exports reached a record value of 100.163 billion dollars (around 92.4 billion euros) in 2024, with a positive trade balance of 22.138 billion dollars (approximately 20.4 billion euros).

For Argentina, however, exports amounted to 79.721 billion dollars (approximately 73.6 billion euros), with a positive trade balance of 18.899 billion dollars (around 17.4 billion euros), largely thanks to oilseed and grain exports.

A strategic lesson

In summary, the case of Chile demonstrates how the right mix of trade policies, market diversification, and production capacity can turn an agricultural product into a major source of wealth.

Conversely, Argentina, despite its vast resources, struggles to fully exploit them.

A lesson that should not go unnoticed.

Source text and images: Bichos de Campo

Cherry Times - All rights reserved