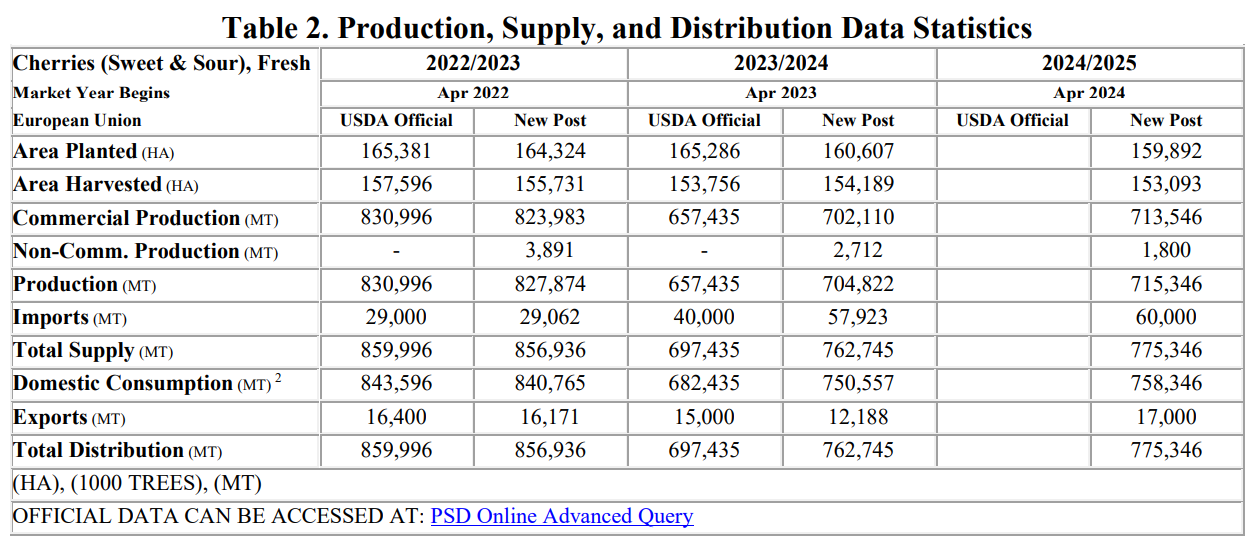

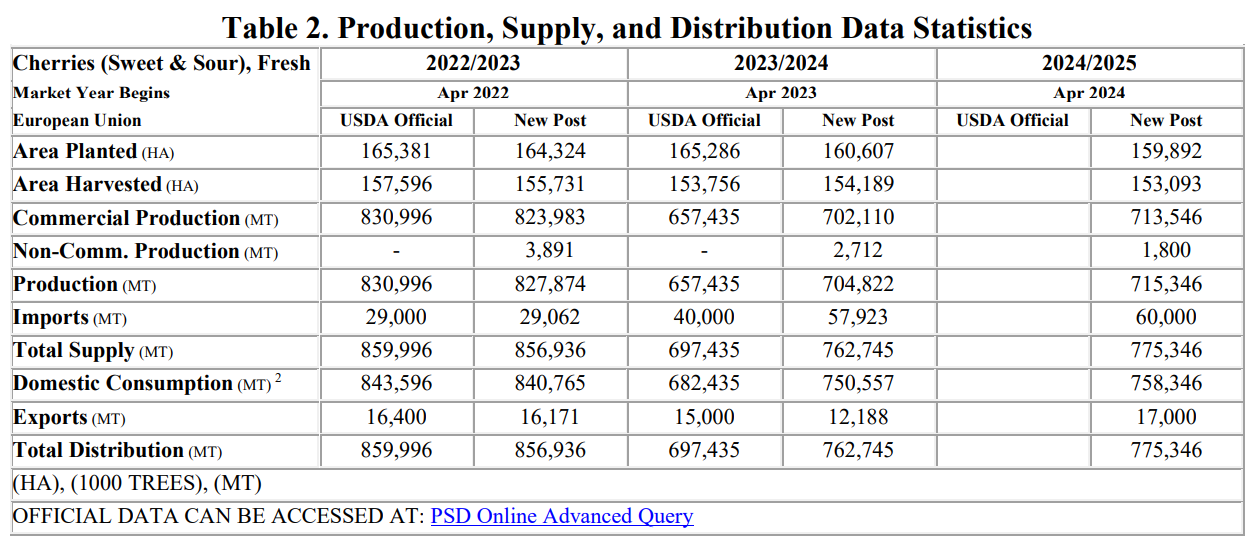

Production

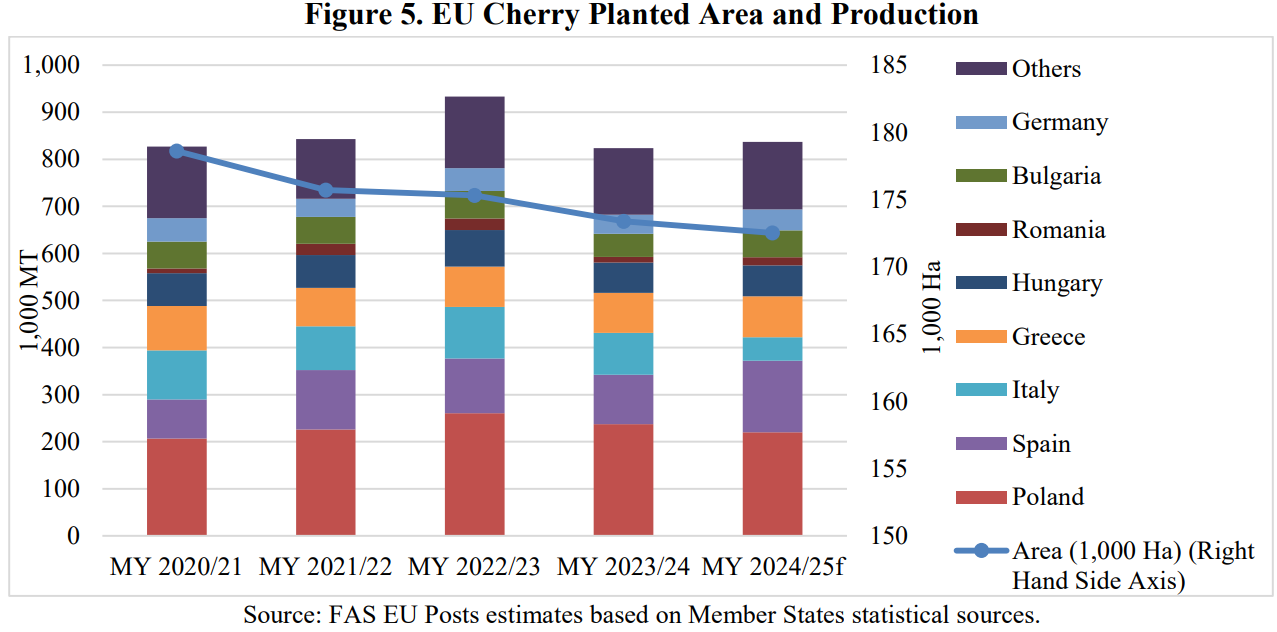

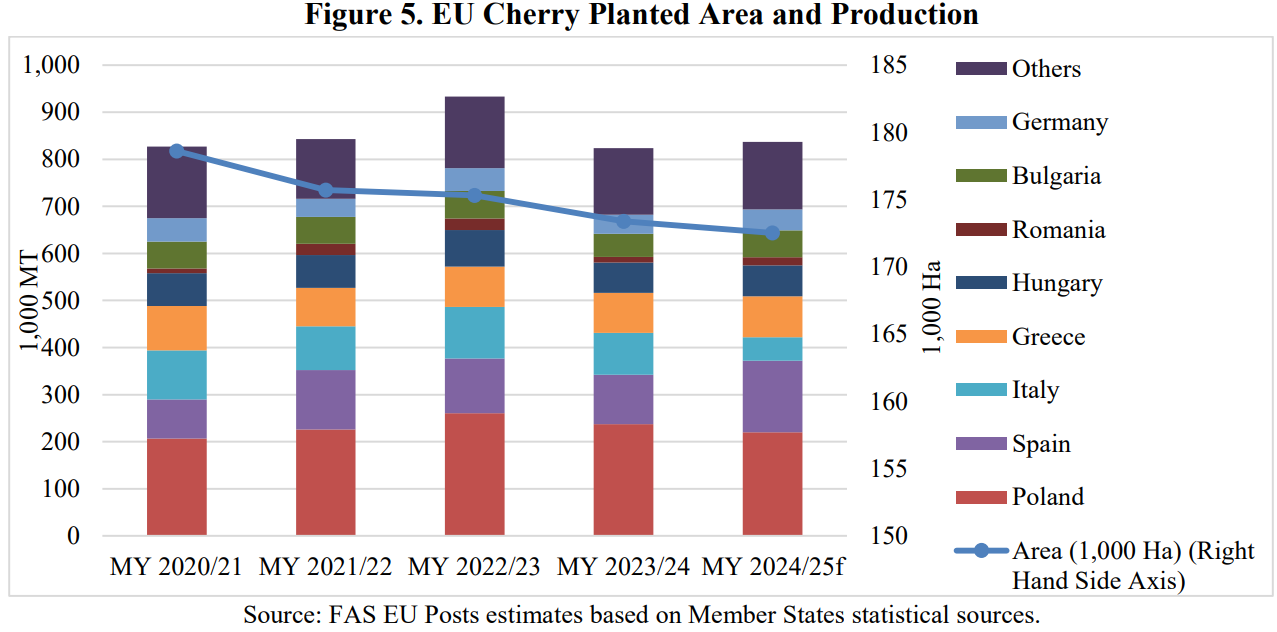

Area planted to cherry trees in the EU continues to decline slowly as old orchards are not renewed. Producers across the EU blame the lack of disease resistant varieties as well as the high production cost including but not limited to labor costs.

Total EU cherry production in MY 2024/25 is projected to recover only marginally from last year’s low levels and amount to 715 thousand MT up from the 705 thousand MT produced in 2023. In 2024, the production declines in Poland and most prominently in Italy will push the overall EU output forecast down.

Poland

In Poland, the mild winter enabled fruit trees to remain in good condition with an absence of frost damage in the roots of the trees. Favorable weather conditions in January and February also helped to stimulate the plants.

Spring plant growth started very early with vegetation developing between two to three weeks earlier compared to normal. However, the condition of fruit trees worsened due to frosts at the end of April and the first half of May.

Frosts caused significant damage to both flower buds and already set fruit. In some areas, hailstorms in the second half of May also caused damage to the trees’ structure. Consequently, MY 2024/25 cherry production in Poland is forecasted below last year’s levels.

Italy

Italy’s MY 2024/25 cherry production is forecast to decline significantly from the previous season levels as adverse weather conditions consisting of cold nights and hot days negatively impacted cherry flowering in April.

Spain

According to official estimates, overall Spanish cherry production for MY 2024/25 is projected to recover from the low volumes registered the previous season despite the mild temperatures that prevailed in the main growing regions, which in some instances did not meet the chill hour requirements for cherry trees.

Likewise, precipitations and mild temperatures delayed fruit ripening and harvest operations. In some instances, particularly for early varieties, precipitations resulted in fruit cracking.

Greece

Greece’s MY 2024/25 (April/March) cherry production is forecast to remain stable compared with last season’s levels.

Hungary

Like in Poland, vegetative development of trees in Hungary started three weeks earlier than usual because of mild winter and the early arrival of spring.

Cold spells hit some parts of the country in midMarch, causing frost damage to a few orchards, and negatively affecting fertility. During the flowering period, the weather was unusually warm with low relative humidity. Despite the pollinators’ sufficient activity, buds dried up quickly hindering fertilization and lowering crop prospects. Another cold and overcast period followed flowering for about four weeks and jeopardized fruit setting.

On a positive note, rainfalls had a positive effect on fruit size. All in all, cherry production in Hungary in MY 2024/25 is expected to slightly exceed MY 2023/24 results.

Bulgaria

Weather conditions in Bulgaria have been favorable for cherry crop development. Mild winter weather until mid-March, although drier than usual, was good for the orchards. The first half of April was unusually warm and dry, which allowed for good blossoming and pollination of stone fruit orchards.

Since mid-April, the country had cooler than normal temperatures and frequent rainfall that improved the soil moisture conditions and were favorable for the orchards’ development. In June, the average temperatures increased and the rainfall became less frequent, providing good harvest conditions for the cherries.

Likewise, improved quality compared to the previous season is projected as a larger average size of fruits and no significant cracking is expected. Consequently, most of this year harvest will be devoted to fresh consumption.

Source SLSF

Source SLSF

Germany

Based on crop assessments carried out in June 2024 by the German Federal Office of Statistics, MY 2024/25 German cherry production is expected to slightly exceed the low production obtained in MY 2023/24. The only slight recovery in production levels is largely due to of unfavorable weather conditions at pollination.

Late spring frosts reduced production particularly in the east of Germany, where some areas are said to have lost 90 percent of their production to frosts. Additionally, in the north, wet and cold weather reduced the activity of bees during the pollination time of late varieties.

Actual harvested production may be substantially lower due to thunderstorms in late June and early July, with heavy rain and hail.

France

The MY 2024/25 cherry crop in France is expected to remain stable from MY 2023/24 levels and exceed the five-year average. Rainfall and local hailstorms in May damaged the early varieties in Provence. In other regions, the wet weather boosted insect attacks, especially of Drosophila Suzukii.

Portugal

In Portugal, where adverse weather conditions, namely hail, frost, wind, and large temperature oscillations, hampered flowering and fruit setting, MY 2024/25 cherry production is expected to register a decline for the second consecutive year. Additionally, the unusually low temperatures in May, combined with excessive precipitation levels resulted in fruit cracking during the latest stages of ripening. Early varieties are comparatively more affected that late varieties.

Consumption

EU consumption of cherries in MY 2024/25, including cherries for processing, is expected to increase given the large domestic availability and the good pace of imports at the beginning of the season in the North Hemisphere. Southern EU Member States (Spain, Italy, Greece, Portugal and France), along with Germany, are the EU’s largest consumers of fresh sweet cherries.

Sour cherries, largely produced in northern producing EU Member States such as Poland, are mainly devoted to frozen fruits, juice concentrates, and jams or marmalade production by the processing industry.

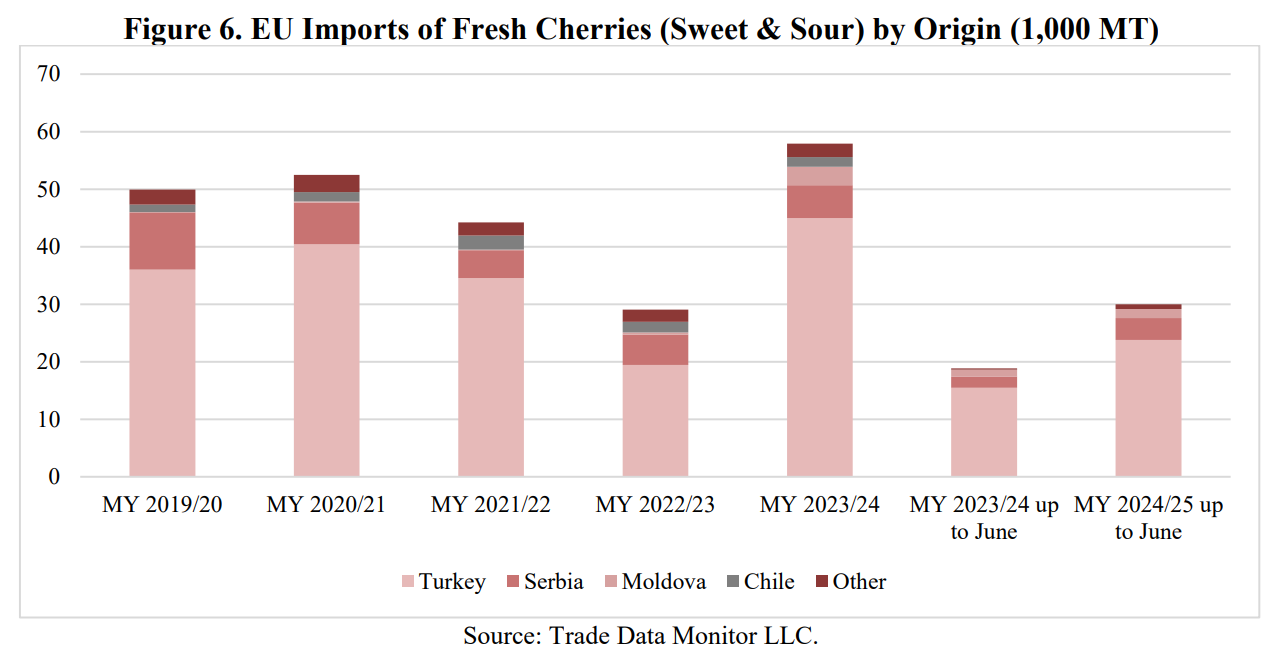

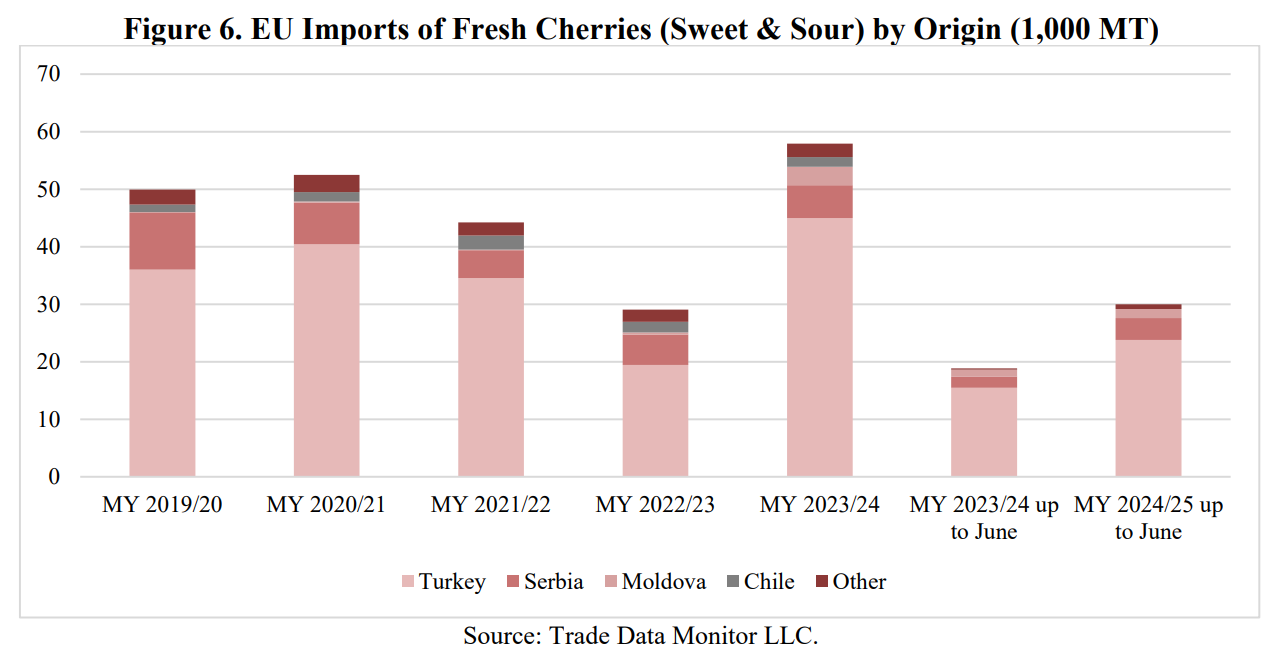

Import

After hitting record levels in MY 2023/24, data available for EU imports of cherries during the first two months of the calendar year show a new expansion, despite the ample domestic supply. The EU is a net importer of cherries, with Türkiye accounting for nearly 70 percent of EU imports. Other relevant suppliers include Serbia, and Chile and Argentina during the off-season.

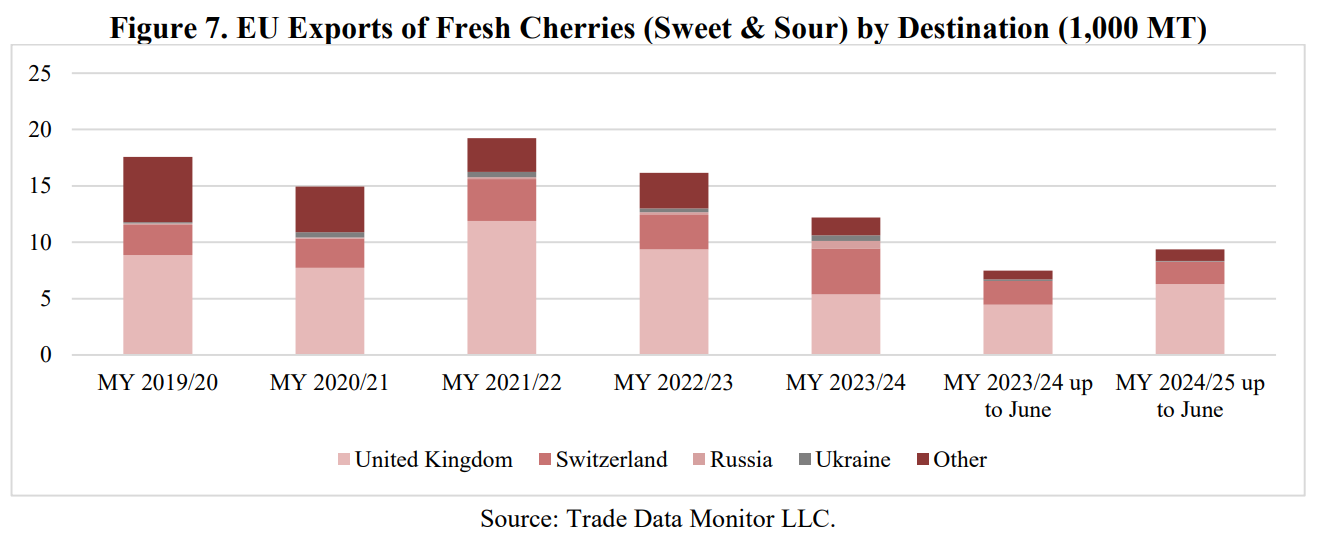

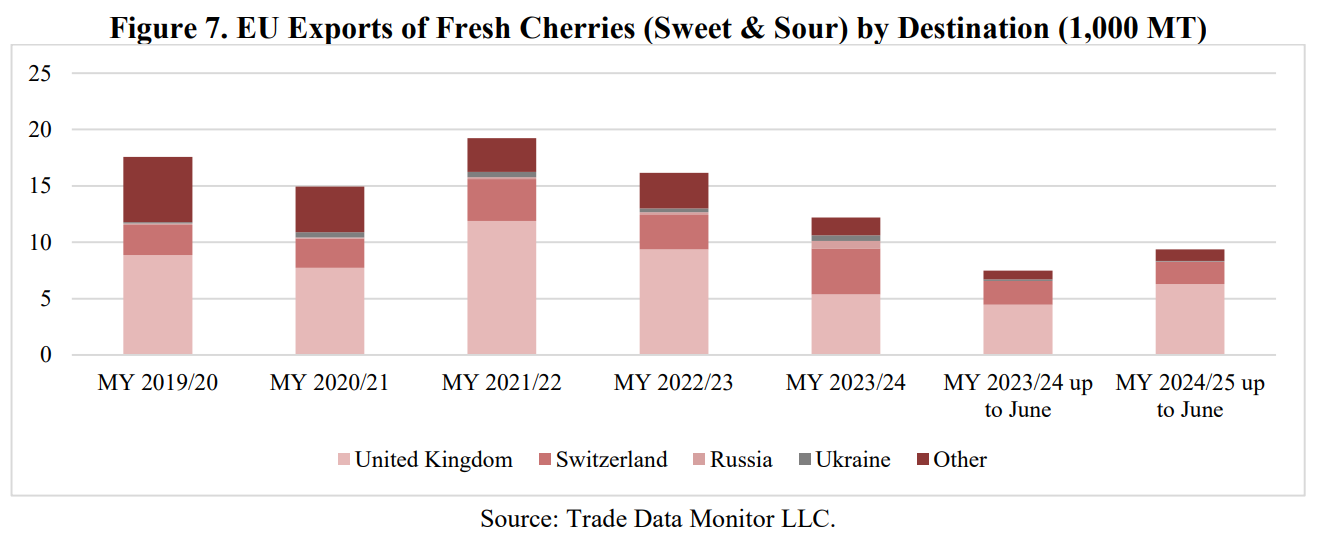

Export

In MY 2024/25, EU cherry exports are projected to return to average levels after hitting bottom in MY 2023/24, when the drought-driven short crop prevented large export volumes from materializing. Main extra-EU destinations of cherries include United Kingdom, Switzerland, Russia, and Ukraine.

Source: USDA - FAS

Cherry Times - All rights reserved