Australia's 2023/2024 cherry season has seen a recovery in export quantities compared to the previous one. These are positive numbers presented during the 'Australian National Cherry Industry End of Season' webinar event organised by Cherry Grower Australia on 19 March.

The association representing about 500 Australian producers took stock of exports by inviting an analyst: Wayne Prowse, director of Fresh Intelligence Consulting. With regard to the continent's exports, Prowse drew the lines of the season that has just ended (with harvesting and marketing in the states of Victoria and Tasmania, the game is up in Australia).

The Australian cherry industry, an overview

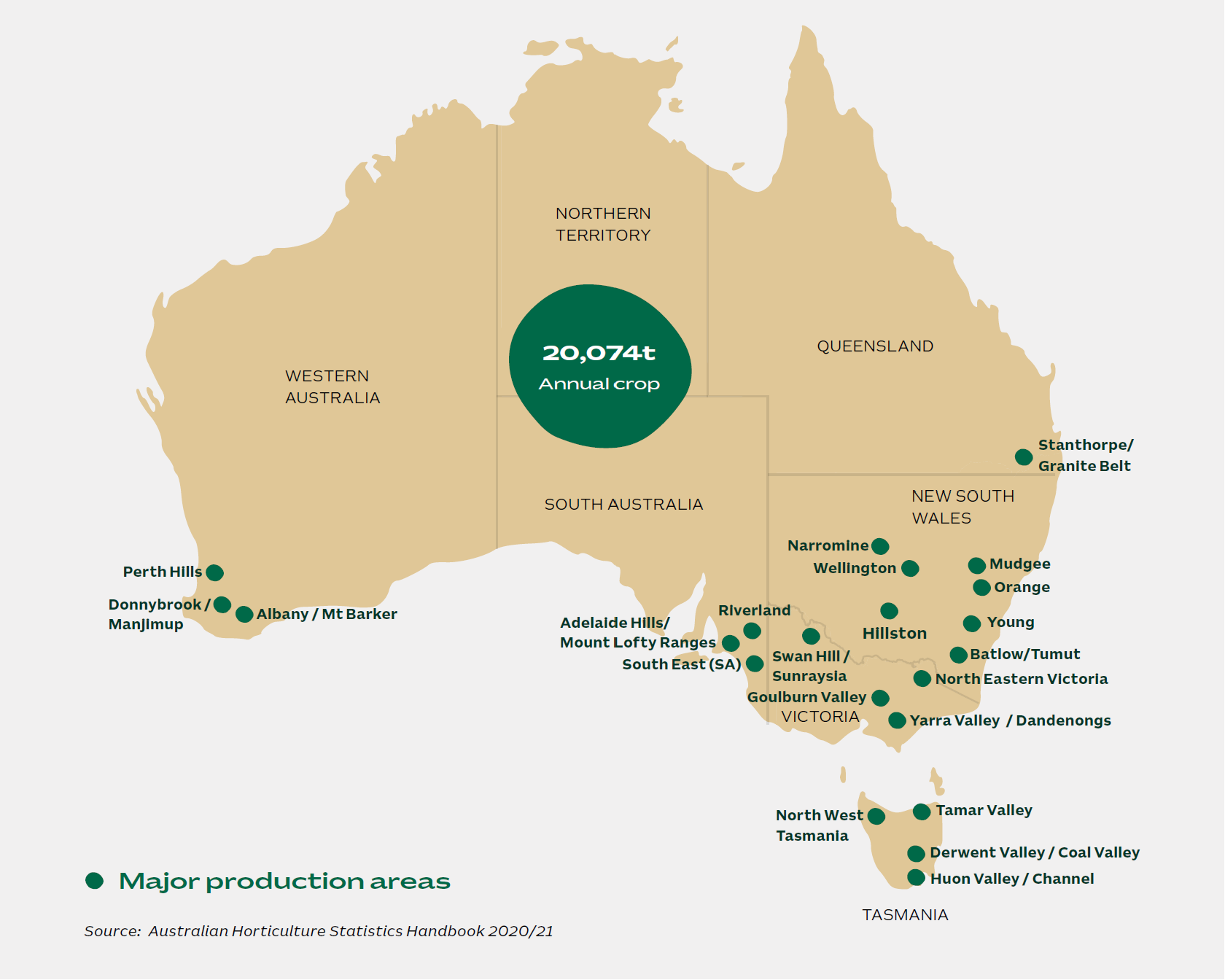

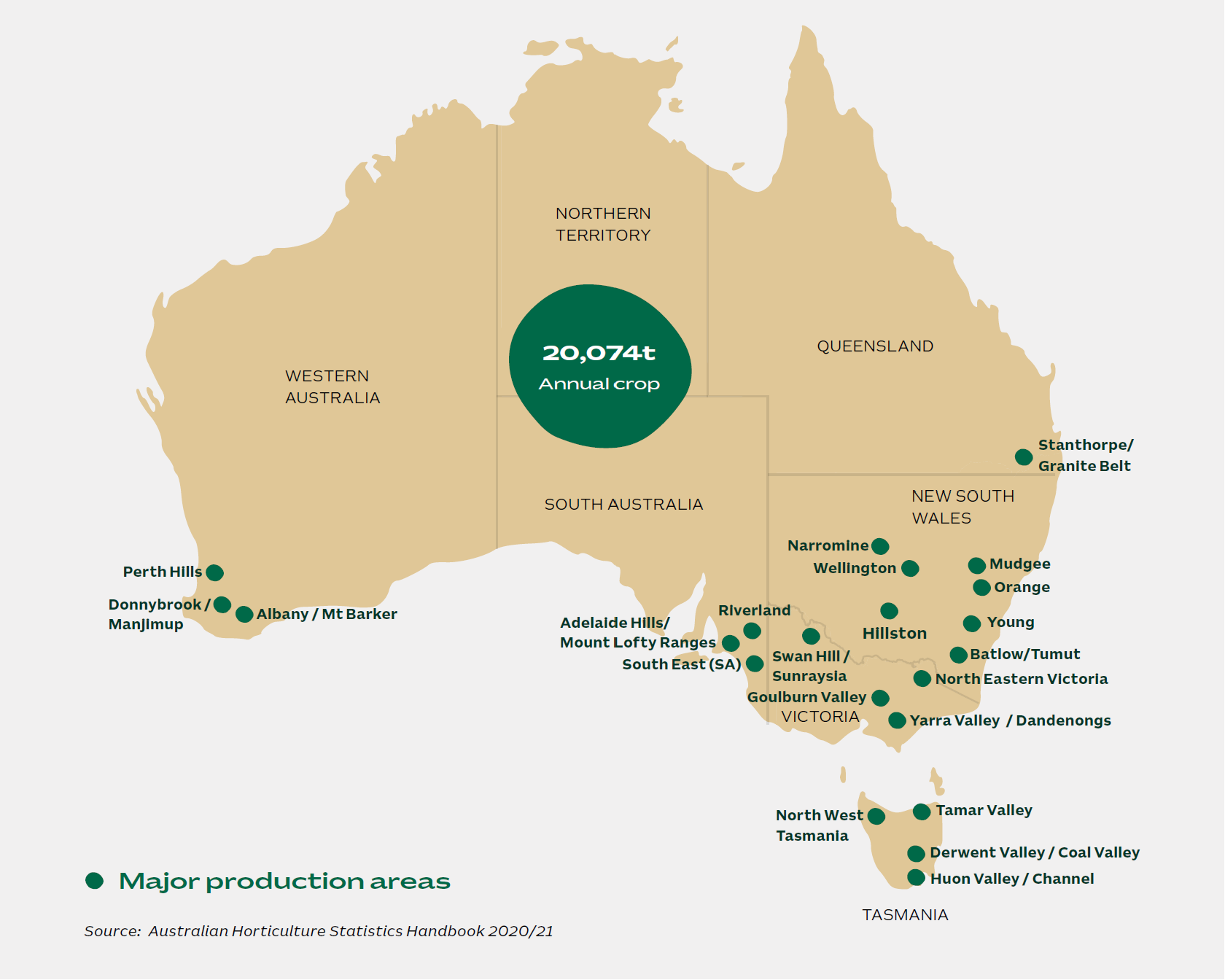

According to data from the Australian Trade and Investment Commission, dating back to 2022, around 20,000 tonnes of cherries are produced in Australia per year with a value of around AUD 213 million (EUR 129 million). Some 40 varieties are cultivated and about 4,700 tonnes of cherries are destined for export.

The target markets are concerted in the Asian region. Usually the first releases take place at the end of October, starting with the states of New South Wales, South Australia and Queensland. Production is concentrated in the south of the Australian continent, mainly in the eastern area.

Around 4,000 tonnes exported in the season just ended

Those presented by Wayne Prowse are still preliminary figures, but according to them, the '23-'24 season saw 4,097 tonnes exported. The growth was 43% over the previous season, which had been very abnormal with very low export levels.

Prowse commented: 'Four thousand tonnes is a good figure but it is still not long-term growth. We are just returning to the levels already achieved in 2017-2020. In value terms, the growth in '23-'24 over the previous year was 29.3% at AUD 86.62 million, while the average price per kg stood at AUD 21.14, down 10% from the previous season.

"It should be noted, however," Wayne Prowse further explained, "that the average price per kg has been steadily increasing since 2017-'18. During the '23-'24 season, export quantities grew week on week until 26 November, then stabilised around 200t. What turned the tide and gave a sustained boost was Tasmania's entry into the market in the last week of December.

There was a new rush at that point with a peak of 600t exported in one week, around 21 January 2024.

Export Australia, Tasmania in the spotlight

Looking at the Australian states and their contribution to exports, Tasmania leads the way with 54% of total Australian cherry exports (2,207t). Victoria's contribution has more than doubled, compared to the '22-'23 season, and is worth 35% of exports, followed by New South Wales (7%) and South Australia.

The latter state was unfortunately plagued by bad weather at harvest time. And what about destinations? The picture drawn by the analyst sees Hong Kong in first place as a trading partner, absorbing almost 1,200 tonnes (+22% on the previous season).

China made a leap forward, marking an increase of +141% over the previous season and approaching 600 tonnes. Taiwan and Malaysia were also important. The season just ended saw Australia enter the South Korean market with 47 tonnes exported.

Australia, a player in the international market that still has to make inroads

Although China is strengthening as Australia's partner, looking at the world market situation it is clear that Australia is still a small player: China imports almost 400 thousand tonnes of cherries per year and more than 90 per cent comes from Chile.

With regard to the southern hemisphere specifically, Chile is the leader. According to the data shown by the analyst (covering the '22-'23 season, however), the South American country exported 414,171 t. "We don't even come close to 1% of those quantities," commented Wayne Prowse.

The analyst then focused on the Southern Hemisphere and the cherry suppliers to the Asian market. Of the approximately 4,000 tonnes destined for the season just ended, in fact, 3,868 went to Asian markets. "With regard to the southern hemisphere specifically," he explained, "we are the leader in Hong Kong (1,161 t exported).

Australia dominates and is worth 54 per cent of the 2,256 t imported'. The other markets where it is first are Indonesia, Malaysia and Singapore, but they are still small markets. One country that can be compared with Australia for having exported similar quantities to the Asian market this season is New Zealand.

It is a major player in Taiwan and also exports comparable quantities to Australia to Japan, China and Thailand. "In the '23-'24 season we had good results," concluded Wayne Prowse, "but we have to work hard. There are many opportunities around the world and we can aspire to gain market share, perhaps stealing it from our competitors.

App presented to comply with maximum residuals

In order to be able to export, however, it is necessary to know the rules of the game well, Cherry Grower Australia presented during the same event, a novelty precisely with the aim of facilitating producers in their dealings with export target countries.

"Failure to comply with paperwork and compliance requirements can lead to delays, confiscation or the return of cherries at the producer's expense," Patrick Ulloa, the association's export coordinator, pointed out on another occasion. It was Ulloa himself who launched a practical handbook with all the necessary information for producers wishing to export.

One of the tools available to cherry growers is the result of a project in which CGA itself was involved, together with the Australian Table-Grape Association and Summerfruit Australia.

One of the most important challenges for those wishing to enter other markets is to comply with maximum residue limits (MRLs) which vary from country to country. The aforementioned project has therefore developed an app suite (AusCherrySure) that on the one hand provides information on MRLs and on the other hand offers advice on integrated pest and disease management.

Barbara Righini

Image: Australian Horticulture Statistics Handbook 2020/21

Cherry Times - All rights reserved