After overcoming a climatically complex season, producers achieved volumes similar to those of the previous season, with the difference that they increased their concentration in the Asian giant by 3%, going from a share of 88% to 91% during the last season. The highest price of the season for Chilean cherries was recorded in Shanghai, at $56.7 per kg, on October 30th (week 44).

A year of changes, prosperity, and success is what heralds the arrival of the year of the dragon in the Chinese calendar, a cycle that repeats every 12 years and that has not failed to portend a difficult but successful campaign - given the context - for the producers of this fruit in Chile.

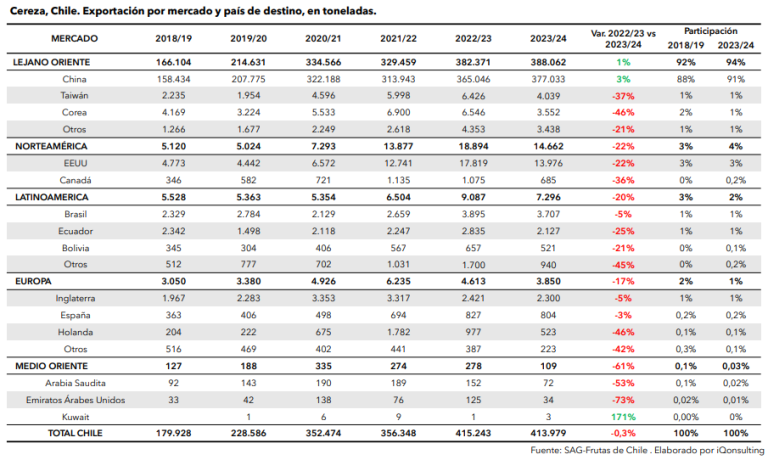

According to the cherry yearbook recently published by the market intelligence consulting company iQonsulting, during the 2023/24 season, 413,979 tons of Chilean cherries were exported, equivalent to 82.8 million 5 kg boxes. Of this volume, 91% of the exports of this stone fruit were destined for China, amounting to 377,033 tons (equivalent to 75.4 million 5 kg boxes), an increase from the 88% destined for this market in the 2022/23 season.

This represents a 3% increase in fruit destined for that market compared to the previous period, despite total exports decreasing by 0.3% compared to the previous season. This figure marked a new record of shipments to China, compared to the 365,201 of the previous season.

Although the result was slightly lower, it turned out better than expected, after weather conditions combined a warmer winter, a colder spring, and October rains that led to worse results. In terms of total FOB value, i.e., the value of the cherry business, according to iQonsulting, it showed a season-to-season increase, in line with the increase in exported volume.

Image 1: Exports of Chilean cherries by markets and country destinations (in tons).

Image 1: Exports of Chilean cherries by markets and country destinations (in tons).

"For this last season, the estimated value could exceed $3 billion FOB, despite maintaining a volume close to that of the previous year, the good prices recorded this season have allowed capturing a higher value of this global business," the annual report of the consulting company reads.

The yearbook highlights that the expectations of a lower volume of fruit due to the climatic problems that affected the previous season, mainly marked by the El Niño phenomenon, which mainly affected the earliest varieties and the central-southern areas of the country, ultimately had a positive effect on the prices achieved.

"The actual start with fewer fruits than expected allowed a steady flow of sales that kept markets clean and did not accumulate stocks like in past seasons, allowing a larger volume of fruit sold at market prices and not at clearance prices due to deteriorating conditions," the report explains.

Better prices and good demand allowed for this new record of fruit placement in China, which ended with a 3% higher volume.

Prices

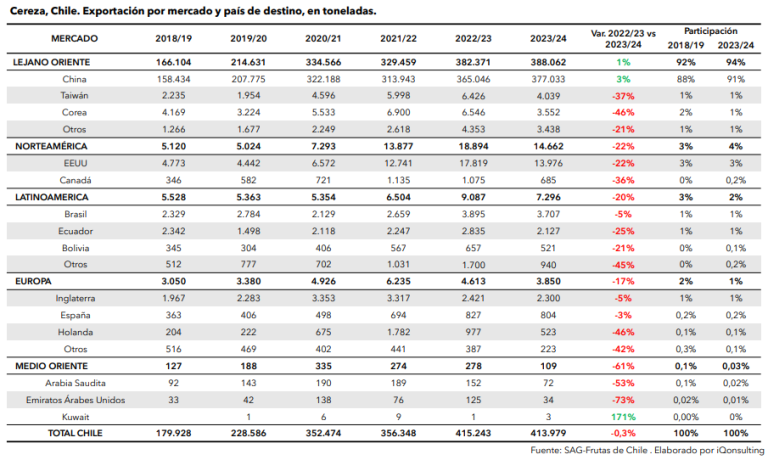

According to the report, during the 2023/24 season, prices remained slightly above the previous season's average in the period leading up to Chinese New Year (CNY), and were significantly well above the prices of the four previous seasons in the period following CNY.

In particular, seven days before Chinese New Year, a significant price increase was recorded, reaching $12.9 per kg, due to the lack of supply due to the delay of a couple of ships.

This was followed by a further increase eleven days after the CNY, reaching $14 per kg, as buyers continued to visit markets after the CNY and supply drastically decreased, with the fruits still showing excellent quality.

The first prices of the 2023/24 season were recorded in the Shanghai market in week 42, with an average value of $26.8 per kilo, and reached a peak of $45.1 per kilo in weeks 43 and 44, due to the low supply at the beginning of the season, reaching the highest prices of the season in this market.

Meanwhile, the highest weekly average price was recorded in the Jiangnan market (Guangzhou), at $45.8 per kg in week 43. The Shanghai market, on the other hand, recorded the highest price of the season, at $56.7 per kg on October 30th, in week 44.

Image 2: Average weekly prices by country of origin in Guangzhou market (USD/kg) in 2022/23 and 2023/24 seasons.

Image 2: Average weekly prices by country of origin in Guangzhou market (USD/kg) in 2022/23 and 2023/24 seasons.

Increase in air shipments

Another aspect revealed by the iQonsulting yearbook is the increase in Chilean cherry exports by air, which increased by 4% compared to the 2022/23 season, with a total of 15,000 tons, representing 4% of the total sent to China.

Air arrivals began in week 41, with the arrival of one ton at Shanghai airport, a story detailed on Redagrícola.

Shanghai airport remained the main arrival port for air shipments with 7,390 tons. This represents 49% of air shipments to a single airport. On the other hand, exports of Chilean cherries by sea began to arrive from week 48 and increased by 3% compared to the previous season, reaching a total of 362,000 tons.

Shenzhen port received 37% of the total volume of Chilean cherries for the 2023/24 season, with 135,401 tons, 30% more than the volume received in the previous season. Adding the volume from Shenzhen to that received by the ports of Nansha, Guangzhou, and Yantian, the southern region of Guangdong received a total of 236,720 tons, equivalent to 66% of the cherries shipped to China.

International competition

Regarding the competition that Chile faces during the season leading up to Chinese New Year, in terms of volumes, it is still very low compared to a Chilean supply that dominates the market. Nevertheless, some producing countries make a difference during the peak period of Chilean supply, between weeks 51 and 3, as the highest prices in the Jiangnam market in Guangzhou were obtained by Australia and New Zealand.

According to the iQonsulting report, the offer from these countries normally sets very high prices, both for the high quality of the fruit and for the exclusivity, especially in the case of New Zealand, which in China has a greater value as a country brand. Australia, on the other hand, recorded lower prices than Chile from the beginning until week 50, then dropped again in week 4, due to irregular supply.

In the Shanghai market, however, the prices recorded for Chilean cherries maintained this logic, where Chilean fruit prices surpassed Australian supply until week 48, then fell below prices obtained for fruit from Oceania between weeks 50 and 1, but the differences were smaller than those observed in Guangzhou.

Yields outside of China

During the 2023/24 season, the United States received a total of 16,277 tons from the southern cone, equivalent to 3.2 million 5 kg boxes. Of this volume, 85% of the total was of Chilean origin, with approximately 2.8 million boxes, representing a decrease of 22%. As for prices, Chile recorded a seasonal average price of $11.4 per kg.

The European market received a total of 6,089 tons, consisting of Chilean, Argentine, and South African supplies. Chile sent a total volume of 3,883 tons to this market, which represents a 64% share of the southern hemisphere's offer.

Argentine cherries arrived in Europe for a total of 1,718 tons, with a 28% share, while South Africa, one of the main suppliers of the European market, reached 489 tons, with an 8% share.

In the European market, Chilean cherries recorded the highest prices in week 51, reaching €18.07 per kilo, a value that decreased over the weeks with the entry of higher volumes into the region, with a minimum recorded in week 2 with a price of €10.25 per kilo.

In the domestic market, a total of 4,984 tons was traded in Chile's main wholesale markets during the 2023-24 season, marking a 29% decrease compared to the previous season.

Of this volume, 38% was sold at the Lo Valledor wholesale market in Santiago, followed by Vega Central with 19%. The national average price during the season was 1,083 Chilean pesos per kilo, excluding VAT, with a 61% increase compared to the 2022/23 season, due to the lower available supply.

The Maule region maintains leadership

According to official data from Odepa, the total area of cherry trees planted in Chile is 63,494 hectares, with the Maule (44%), O'Higgins (36%), and Metropolitan (9%) regions as the main production centers.

In this context, the Maule Region remains the main exporting region, with a volume of 188,806 tons during the season, representing a 46% share of the total, with a 6% increase compared to the previous season, mainly thanks to the entry into production of new orchards.

Secondly, 149,664 tons were exported from the O'Higgins region, equivalent to 36% of the total exported volume. These regions accounted for 82% of the exported volume, mainly due to the optimal climate for cultivation. The Metropolitan Region ranked third with a volume of 27,620 tons, representing 7% of the exported volume, but with a 15% decrease in the exported volume compared to the previous season.

Source: Redagrícola

Images: Redagrícola

Cherry Times - All rights reserved