Production was limited, demand was interested, and prices were sustained, which characterized the cherry campaign of 2024.

The main factor was the climatic conditions, which affected not only the yields - down compared to the already deficient last year - but also the start and end of the campaign, both occurring about two weeks earlier than usual.

In the key areas of the South, the production shortfall was evident already during the fruit setting phase, and became fully apparent with the start of harvest.

Subsequently, the high temperatures recorded between May and June, while benefiting the quality of the fruits in terms of Brix and organoleptic characteristics, albeit with generally uneven calibers, also accelerated the harvest, which affected varieties with different ripening periods (medium-late) simultaneously.

The reduced scalability and the resulting concentration of product in commercial channels did not, however, lead to difficulties in the market, with demand exceeding supply from the very beginning of the new campaign.

Different was the situation in the northern areas. The campaign, which had started under the best conditions for quantity and quality of the fruits, suffered a sharp reversal of trend due to adverse climatic events (hailstorms and heavy rainfalls occurring between the end of May and June).

The most penalized were the medium-late varieties affected by quality issues (cracking of fruits and reduced shelf-life), with volumes suitable for the fresh market contracting compared to initial estimates.

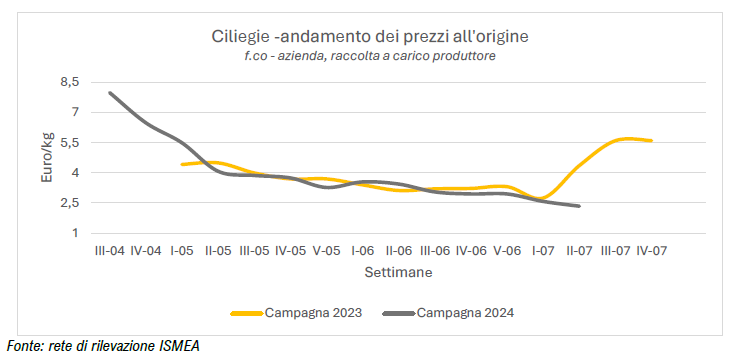

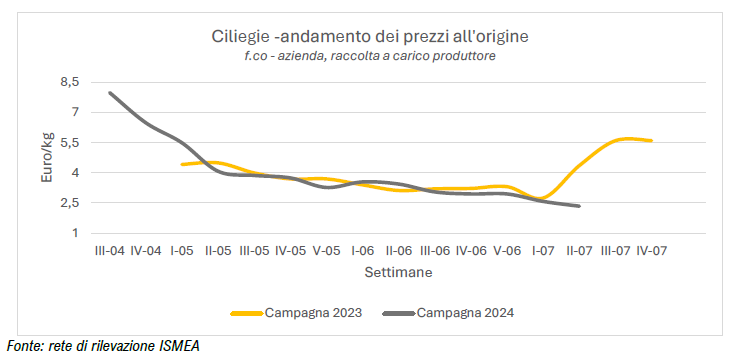

A positive aspect of the campaign was the prices, which benefited from the limited presence of Spanish goods in the domestic market, averaging an increase of about 4% compared to 2023 (3.44 €/kg versus 3.30 €/kg in 2023), which was also particularly low in product availability.

It is worth noting that only towards the end of the campaign, due to a national offer that had become scarce and no longer able to meet the demand, did the pressure from foreign products, particularly from Turkey, make itself felt. Turkish cherries, favored by an optimal quality standard, gained consumer approval.

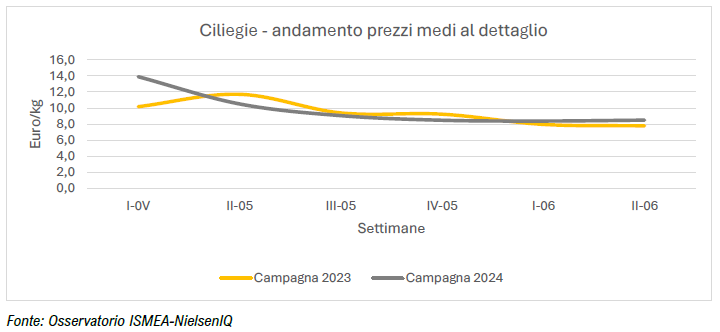

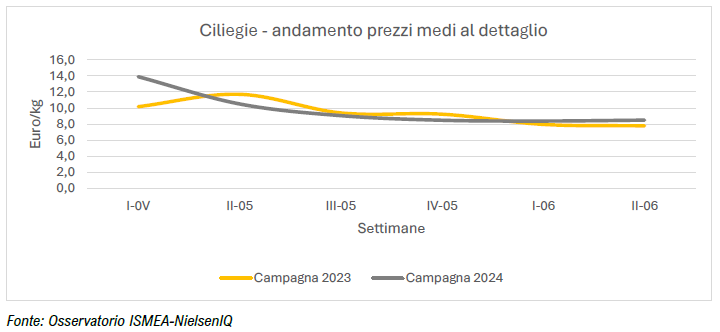

Regarding retail sales of cherries, partial data (April 29 - June 16) from NielsenIQ indicate an increase in volumes (+12.3%) and a more significant increase in spending by households (+20.3%) for 2024 compared to the previous campaign.

Considering only the packaged product with fixed weight (EAN), the average price at retail increased almost as much as the price at origin (+4.8%), rising from 8.28 Euro/kg in 2023 to 8.68 Euro/kg in 2024.

Source: ISMEA

Images: ISMEA; SL Fruit Service

Cherry Times - All rights reserved