Despite Chile’s overwhelming competition and the lack of government support, cherry growers in Patagonia continue to focus on quality, territorial identity, and market diversification to establish themselves globally.

An early season

According to Aníbal Caminiti, director of CAPCI (Argentine Chamber of Integrated Cherry Producers), the 2025 season started well ahead of the average of the past six years. Unusually high temperatures recorded in the second half of August accelerated flowering, particularly in the Chimpay area, Río Negro province.

Early varieties already show signs of fruit set, and if weather conditions remain favorable, harvesting could begin earlier: a crucial competitive advantage for exports. However, cold snaps or frosts could slow the process down.

Growing exports

If the weather continues to cooperate, Argentina expects an 8–12% increase in exports, a positive trend confirmed for over a decade, the result of increasingly efficient production management.

However, the comparison with neighboring Chile is striking: while Argentina exported 8,100 tons last season (a historic record), Chile shipped 650,000 tons, equivalent to what a single medium-sized Chilean company exports. And in 2025, Chile’s estimate stands at 690,000 tons.

Differentiate to survive

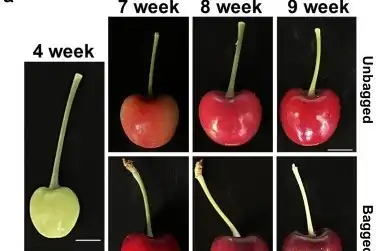

Faced with such crushing competition, Argentina is focusing on product differentiation. Since 2022, a quality protocol has been in place, setting minimum standards for exports. Moreover, 84% of Argentine cherries are exported by air, preserving freshness and quality, unlike Chile’s preference for sea transport.

The designation of origin of Valle de Los Antiguos – home to the world’s southernmost cherries – and the “Patagonia” brand are strong marketing levers in international markets. The strategy of penetrating secondary or emerging markets such as Egypt, Lithuania, Nepal, and Ireland also aims to escape Chile’s dominance in the main destinations.

A business of quality

Although cherry production requires significant investments in sorting and packing facilities, in some areas such as Los Antiguos (Santa Cruz) and Gaiman (Chubut), small growers’ cooperatives are active and able to compete by joining forces. The key to success remains the integration of production and marketing, ensuring uniformity and timeliness in packing.

Markets and international challenges

The United States remains the top market for Argentine cherries (30%), followed by China (28–29%), the European Union and the United Kingdom (22%), the Middle East (8–9%), and numerous smaller markets across Asia, Africa, and South America.

New opportunities are on the horizon: Israel could open in 2026, a valuable market where Chile is not yet present. However, Argentina lags far behind in trade agreements: while Chile boasts an extensive network of free trade agreements, Argentina suffers from years of structural backwardness in trade policy. Import tariffs in many countries (India 30%, China 10%, South Korea closed) are a huge obstacle to competitiveness.

Domestic market and prices

Domestic cherry consumption is growing, especially at the beginning of the season, when the novelty of the product justifies higher prices. However, heavy imports of Chilean cherries in January and February drove prices down and created difficulties in selling domestic produce.

On the export side, the average price last season was around USD 3.80/kg (about €3.55/kg) FOB Buenos Aires, but it is extremely variable: the first shipments are worth up to three times as much compared to the peak of Chilean supply.

Costs and institutional response

Caminiti denounces the increase in production costs, particularly energy (up 320% in one year in Neuquén), labor, and taxes. The fruit sector has repeatedly presented its demands to the central government through the “Frutas de Argentina” coordination, but has received neither answers nor stable interlocutors.

According to CAPCI, fruit growing in Argentina employs as many workers as the automotive industry and sustains entire regional economies. Yet it continues to be ignored.

A look to the future

The global cherry market continues to expand, but Chile’s supply pressure and the lack of an active trade policy make Argentina’s position increasingly precarious. Only teamwork between growers, institutions, and international promotion can ensure a sustainable future for a sector that has all the right assets – quality, climate, know-how – to be a global player.

Source: masp-lmneuquen-com

Cherry Times - All rights reserved