Chile has experienced a “cherry boom”, marked by steady growth in cultivated area, export volumes, and export value (1).

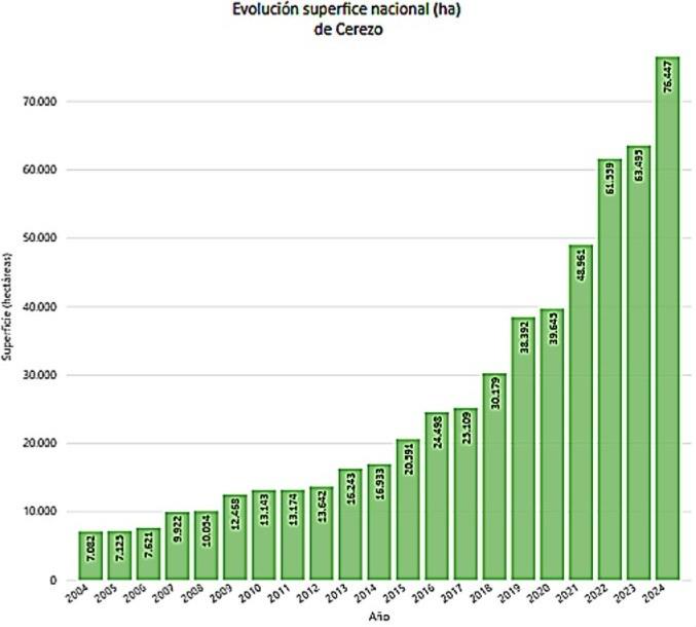

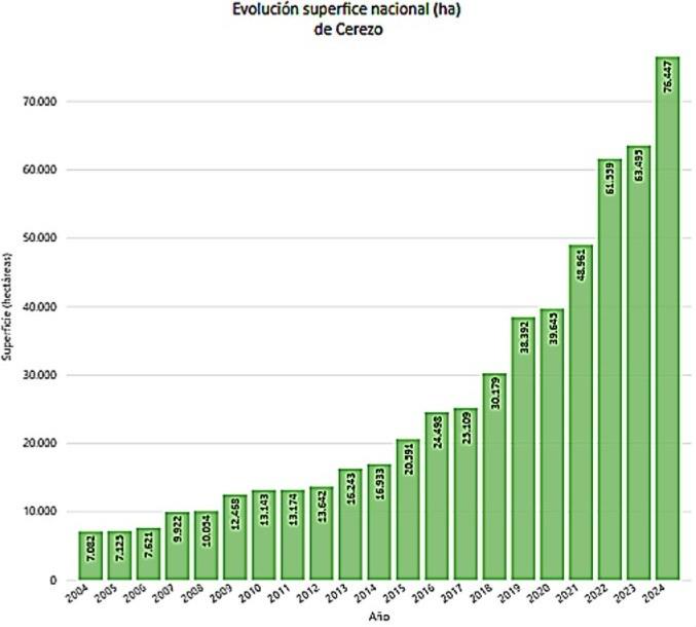

According to the ODEPA-CIREN survey, the national cherry-planted area increased from approximately 7.6 thousand hectares in 2004 to 16,933 hectares in 2014 and 76,447 hectares in 2024; this equals about 2.2x growth (2004–2014) and 4.51x (x); +351% (2014–2024), and about 10x growth overall from 2004 to 2024 (Figure 1) (2).

Chile is the world’s leading exporter of fresh cherries from the Southern Hemisphere, with a record 2024/25 season of nearly 625 thousand tons; for 2025/26, cautious scenarios forecast around ~670 thousand t in exports (production ~730 thousand t) (2, 48).

Projections estimate the planted area will approach 80,000 hectares, concentrated in the central-southern regions; the Maule and O'Higgins regions alone account for about 82% of the national surface area (2).

Varieties and Production Areas

This rapid expansion is driven by the exceptional profitability of cherry cultivation, which boasts the highest yields per hectare in Chilean fruit farming.

Today, cherries are Chile’s most exported fruit by value and the third by volume within the national fruit basket (2, 5).

The economic appeal, especially thanks to the Chinese market, has encouraged new plantations in more southern areas (Ñuble, Araucanía), expanding the production frontier (2, 5).

Although a slowdown in the pace of new plantings is expected towards 2030 due to land and water limitations, Chile could stabilize at around 87,000 hectares with 150–200 million boxes by the end of the decade, if favorable market conditions persist (6).

Varietal Range

At the same time, the varietal range has evolved: Santina, Lapins, and Regina have emerged as the main exported varieties thanks to their combination of size, firmness, and mid-to-late harvesting windows, replacing former leaders like Bing (see Table 1) (2).

These three account for 75.5% of national plantings (2), with Santina standing out in new plantations for its good postharvest performance (firm pulp and stem retention) (7).

Other late varieties like Kordia and Sweet Heart help extend the harvest into January (2), while local selections and new introductions aim to improve rain tolerance and expand the varietal offering (see Table 1) (2).

In summary, Chile enters the 2025/26 season with a solid production base and plant material aligned with the quality requirements of foreign export markets (2, 7).

Figure 1: National cherry-planted surface area in Chile, 2004–2024. Source: ODEPA–CIREN, Fruit Bulletin (panel “National cherry surface – Cherries”).

Figure 1: National cherry-planted surface area in Chile, 2004–2024. Source: ODEPA–CIREN, Fruit Bulletin (panel “National cherry surface – Cherries”).

| Variety | Harvest Season (Central Zone) | % of Total Planted (2024)* | Strengths | Considerations |

|---|

| Santina | Mid (late November – early December) | 33.9% | Very firm; good postharvest shelf life; very sweet | Medium-large size; somewhat susceptible to cracking from heavy rain |

| Lapins | Mid (mid-December) | 25.6% | Large size; self-fertile; very productive | Requires thinning for optimal size; moderate postharvest life |

| Regina | Late (late December – January) | 16.0% | Firm; uniform size; some rain tolerance | Needs cold winters; stem dries quickly unless handled postharvest |

| Bing | Early-mid (late November) | 3.8% | Classic rich flavor; good initial firmness | Old variety; medium size; limited shelf life; more local use |

| Kordia | Late (January) | 4.7% | Very firm and sweet; large size | Highly sensitive to cracking; requires intensive agronomic management |

| Tesoro | Late (January) | 2.9% | Self-fertile; consistent flavor; good productivity | Can soften if overripe; moderate shelf life |

| Others | Various | 13.1% | Rainier (bicolor) valued in niche markets; Royal Dawn opens the early window | No individual variety exceeds 5%; offer diversity with variable adaptation and management |

Table 1. Main cherry varieties in Chile and their characteristics

Agronomic Context of the 2025/26 Season

Pre-season weather conditions suggest good production potential, though with some nuances (8).

The 2024 winter, associated with El Niño, was cold and rainy, with high chill hours – enough even for high-requirement varieties like Regina – and groundwater recharge (8, 9).

As a result, flowering in September 2025 is expected to be abundant and relatively uniform (8).

However, El Niño also brings greater variability: isolated late frosts were recorded in late August and early September (from -1 to -2 °C in early sectors of Valparaíso and the Metropolitan Region), with specific damage to very early orchards (10).

Additionally, spring 2025 is turning out to be short and hot; heatwaves were observed during flowering and a phenological shift was noted compared to the previous year (8).

The Lunar New Year in 2026 will fall on February 17, later than in 2025, extending the January commercial window and allowing for staggered shipments to avoid pre-holiday congestion.

Rainfall during harvest remains a critical risk, especially during the December peak; although that month is typically dry in the central region, recent variability has increased the likelihood of damaging rainfall for sensitive varieties.

Climate Management and Labor

The industry has proactively invested in plastic covers (rain covers) to mitigate this risk: an estimated 15% of orchards now have rain covers, despite the high installation cost (about USD 22,000/ha or ~€20,700) (11).

In addition to reducing rain-induced cracking, these structures offer added protection against radiative frost, wind, and light hail (11). Their use includes rain covers and macrotunnels, depending on farm strategy (12).

Besides climate, labor availability is another critical factor: cherry harvesting is highly labor-intensive and occurs over a few weeks (14), with shortages of seasonal workers and rising labor costs.

Producers have responded by mechanizing some tasks and offering incentives to pickers to ensure fruit is harvested (14).

Production Outlook

Overall, if weather permits, Chile could export about 670,000 tons of fresh cherries (approximately 134.0 million 5-kg boxes) in 2025/26, roughly 7% more than in 2024/25 (625,208 t) (48).

This increase is largely due to orchards planted during the 2019–2021 peak entering full production (6), and a harvested area close to 74,000 ha (48), bringing the national average yield to around 9–10 t/ha, with many mature, well-managed orchards exceeding 12+ t/ha (13).

Geographically, O'Higgins and Maule represent about 82% of the area and will contribute the majority of volume; harvest starts in late November in early regions and extends to the end of January in later ones (2).

The 2024/25 experience showed that concentrated ripening and massive shipments over a short period saturated the Chinese market and depressed prices (17); for the upcoming season, the industry is promoting union agreements and strategies to stagger shipments (18).

Post-Harvest Handling and Cold Chain

Given the highly perishable nature of cherries, the Chilean industry has developed a strict post-harvest cold strategy to preserve quality from harvest to final destination.

Shelf life is largely determined by the first hours: field heat must be removed immediately, bringing pulp temperature to ≤5 °C to prevent loss of turgor and accelerated dehydration.

Full cooling must then bring pulp temperature close to ≈0 °C within 4–6 hours after harvest to limit respiration and quality loss (26, 20).

After manual harvest (ideally during cool hours and with dry fruit), cooling should begin within minutes. In large orchards, field collection centers are used (shading, ventilation, and in some cases active cooling via mobile units or pre-chambers).

In close harvests, refrigerated transport and strict timing management ensure the technical cooling window is not exceeded (19, 26, 20).

Cooling and Handling

In-line hydrocooling and forced-air cooling are combined to bring pulp temperature to ~0 °C before shipping, especially for overseas exports (19, 22, 23, 26, 20).

Exact time/temperature parameters depend on the line and equipment; typically, very cold water accelerates the initial drop, and forced air evenly removes residual heat.

Completing cooling within 4–6 hours (to ~0 °C) is critical; delays beyond this window reduce shelf life (26, 19).

The cold chain must remain unbroken: once cooled, cherries must not warm up again at any point in the logistics process (19, 26, 20).

Along with temperature control, shocks, drops, and compression must be minimized: support training for pickers (avoid drops >15–20 cm), padded ramps, water channels, individual trays in sorting machines, padded transfer points, no overfilling, headspace in boxes, and pallets with separators.

These precautions are especially important at ~0 °C, when fruit is less flexible (29, 30, 31, 32).

Packing facilities use artificial vision systems and in some cases multispectral systems to detect defects and sort by size/destination (long-haul trips require very firm and large cherries).

Continuous supply chain monitoring (temperature/humidity) is supported by data loggers for traceability and control (24).

Post-Harvest Treatments and Export Logistics

To control rot, approved fungicides and disinfectants (e.g., ozone or chlorine) are applied depending on the destination market's MRLs.

For long-distance shipments, modified or controlled atmospheres are used: liners/bags that generate low O₂ and high CO₂ levels to reduce respiration and fungal growth, extending shelf life during transit (25, 33, 34, 35, 36).

One of the main challenges for the Chilean cherry industry is transporting hundreds of thousands of tons of fresh fruit over 18,000 km as quickly as possible (37, 38).

About 95% of Chilean cherries are exported via refrigerated container lines, shipped mainly through the ports of San Antonio and Valparaíso, in the Valparaíso region.

These two terminals, just ~100 km apart, jointly handle container flows between November and January (31).

Logistics Flows and Operational Risks

In the 2024/25 season, Puerto San Antonio terminals (STI and DP World San Antonio) shipped over 17,000 containers of cherries to China, equal to 54% of the national total; specifically, STI moved 12,200 containers (+30% YoY) and DP World 5,304 (+132% YoY) (40).

Each standard container carries about 20 net tons of cherries (~4,000 5-kg boxes); handling the 2024/25 export volume required a massive land transportation operation.

To manage this flow, shipping companies, in collaboration with exporters, implemented dedicated express services called "Cherry Express", prioritizing cherries on vessels bound for Asia (37, 41).

In 2024, a direct route to Dalian (northern China) was launched, reducing transit to northern China to ~25 days with no transshipments (38).

Maintaining this cold chain with precision is essential for the fruit to arrive in optimal condition.

| Route / Destination | Transit Time (approx. days) | Container Temperature Setting | Handling Notes |

|---|

| Chile → Southern China (Hong Kong / Nansha) | 20–22 days (express service) | –0.5 °C (supply air) | Direct Cherry Express; arrival just before Lunar New Year is crucial. |

| Chile → Northern China (Shanghai / Tianjin) | 25–28 days (direct service) | –0.5 °C | The new direct route to Tianjin launched in 2024 shortens transit time (no stops). |

| Chile → Western USA (Los Angeles) | 14–18 days | –0.5 °C | Market demands very green stems, compliance with SAG/USDA, and cold quarantine where applicable. |

| Chile → Eastern USA (Philadelphia) | 21–23 days (via Panama, with stop) | –0.5 °C |

|

| Chile → Northwestern Europe (Rotterdam) | 25–30 days (via Panama or Suez) | –0.5 °C | Small volumes; often shipped in mixed loads with other fruit. |

| Air freight → China (via HK/PVG) | ~36 hours (flight + distribution) | +2 °C (airplane cargo hold) | Fruit is pre-cooled to ~0 °C but warms to ~2–5 °C during transport. Priority unloading and rapid re-cooling on arrival. Very costly; reserved for premium or emergency shipments. |

Table 2. Typical transit and cold parameters for fresh cherry exports from Chile (2025)

Transportation and Critical Incidents

Each container is pre-cooled to about 0 °C before loading; ventilated pallets are used and containers are sealed at -0.5 °C with 90% humidity for the entire journey.

However, operational risks exist: port congestion during peak weeks can delay shipments, especially when overlapping with other summer fruits (blueberries, stone fruits).

In December 2024, the container ship Maersk Saltoro suffered a propulsion failure in the middle of the Pacific while carrying over 1,300 containers of Chilean cherries (43, 46, 47).

The ship drifted for about 23 days before repairs, arriving at its destination after a total transit time of 52 days – well beyond the Chinese New Year window – resulting in catastrophic losses.

This single event is estimated to have caused nearly USD 120 million (around EUR 113 million) in wasted fruit.

Markets, Prices and Destination Quality

In 2024/25, about 652.4 thousand tons of cherry group products (all formats) were exported, of which about 625.3 thousand tons were fresh cherries (~95.8% of the total).

China remains the primary destination for Chilean cherries. In 2024/25, 90.9% of exports (568,504 tons) went to the Chinese market, including mainland China and Hong Kong.

The rest was distributed among the USA, South Korea, Taiwan, Vietnam, Canada, and other destinations (48).

These niche markets show dynamism – for example, South Korea +75.8%, Taiwan +45.1%, Vietnam +118.2% YoY – but still absorb much smaller volumes compared to China’s demand in just a few campaign days.

| Destination | Volume (t) | Share | Change vs 2023/24 |

|---|

| China (mainland + Hong Kong)* | 568,504 | 90.9% | +51.1% ** |

| USA | 20,166 | 3.2% | +40.7% |

| South Korea | 6,233 | 1.0% | +75.8% |

| Taiwan | 5,778 | 0.9% | +45.1% |

| Vietnam | 2,981 | 0.5% | +118.2% |

| Canada | 1,278 | 0.2% | +135.4% |

| Others (all remaining destinations) | 20,268 | 3.2% | n/a (multiple) |

| Total Exported 24/25 | 625,208 | 100% | +51.1% |

Table 3. Fresh cherry exports from Chile by main destination, 2024/25 season

Price Trends and Quality Issues

Despite the strong export volume growth (+51% in 2024/25), profitability did not follow: total FOB revenues fell by around 40% vs. the previous season.

Shipping more fruit led to lower returns per kilogram, a tough lesson for the industry. Large volumes had to be sold at low prices or were discarded after the festive peak.

Chinese importers also reported an increase in quality complaints: fruit arriving soft, dehydrated, or inconsistent (likely due to rushed harvesting and stressed post-harvest management).

Wholesale prices in China collapsed and total FOB revenue for the season reached only USD 1.8 billion (~EUR 1.7 billion) (45).

Dependence on the Chinese Market

China, while still the key market for 2025/26, is now seen as both the sector’s greatest strength and its “Achilles’ heel.”

There is broad agreement on the need to diversify markets in the medium term, although no other country can come close to replacing China’s volumes.

Other Asian countries are showing growing interest: South Korea, India, and Indonesia are expanding but unlikely to absorb more than 10–15% in the short term.

Domestic cherry consumption has grown to around 60,000 tons (estimated for 2025/26), acting as a minimal “safety valve” for surplus exports, albeit at much lower prices.

Quality Standards and Regulations

Quality requirements vary by market, but have generally become stricter as volumes rise.

China enforces high standards: it requires large-size fruit (JJJ or larger, ~30–34 mm), deep mahogany red color, and very firm pulp (values >70 on Durofel firmness testers) (57).

Both the US and Europe maintain strict standards for food safety and appearance, with particular focus on stem freshness and absence of decay or insects.

The sector emphasizes consistency and careful grading to protect Chile’s reputation and maintain trust in key distribution channels.

Phytosanitary Regulations and Traceability

Exports to China are regulated by the phytosanitary protocol signed between AQSIQ and MINAGRI, which defines a series of mandatory requirements (59).

All orchards and packing facilities must be registered with SAG and undergo inspections each season.

In 2023, isolated fruit fly outbreaks (Ceratitis capitata) triggered internal quarantines (61).

In November 2024, SAG declared these outbreaks eradicated, lifting quarantines just before harvest began (62).

Each box of exported cherries carries a code identifying the orchard and packing facility of origin, ensuring traceability (59).

No major regulatory changes are expected for 2025/26, but updates on MRLs, especially from the European Union, are being monitored (63).

Documentation must be complete and accurate, including phytosanitary certificates, bilingual labels, and detailed treatment records.

Risks and 2025/26 Scenarios

Even with careful planning, the season faces significant uncertainties.

Climatic risks are the primary concern: a late frost in October or heavy rains in December could decimate the crop or damage fruit quality before shipping.

El Niño increases the probability of abnormal rainfall during harvest, so producers have deployed mitigation systems (plastic covers, frost towers, emergency irrigation).

Labor availability is another issue: migration to other sectors and rising costs threaten bottlenecks in harvesting and packing.

Some companies have opted to import inputs directly or buy large lots in advance to secure inventory and prices, strategies favoring large operators.

The projected exchange rate (900–950 CLP/USD) in 2025 (~0.95–1.00 EUR/USD) favors exports, but currency appreciation could reduce margins.

An emerging risk is port capacity: overlap with other fruit peaks or labor strikes could heavily disrupt export logistics.

Expected Operational Scenarios

(i) Optimistic: mild weather, staggered harvest, excellent quality, prices +15–20% vs. 2024/25.

(ii) Base: record volume (~660,000 t), solid demand, stable prices, moderate returns, functional logistics.

(iii) Pessimistic: overproduction + adverse events = oversupply and lower quality, low prices, compromised profitability.

The sector has developed contingency plans: parametric weather insurance (~25% coverage), extra vessel capacity, promotion in alternative markets like India and Indonesia.

Comparisons with other countries highlight relevant strategies: Spain, Turkey, USA, China, and Australia invest in varietal diversification, cooling technologies, and integrated logistics.

Operational Recommendations for 2025/26

In orchards: avoid concentrated ripening, use rain covers, monitor pests with SAG, act quickly on outbreaks.

Harvest: pick during cool hours, avoid wet fruit, train staff, use padded bins, cool within 2–3 hours of picking.

Packing: check cooling setpoints (0±0.5°C), reduce drops and shocks, sort by destination, apply authorized antifungal treatments, use modified atmosphere for long transit.

Transport and refrigeration: pre-cool to 0–1°C, maintain 90–95% relative humidity, adequate ventilation, data loggers, sealed containers, Cherry Express use.

Commercial coordination: avoid shipment concentration, divert smaller sizes to alternative markets, constant communication with Chinese importers to adjust volumes.

Destination quality: strengthen presence in China for inspections, claims handling, quick redirection, and promotion in secondary cities to stimulate new demand.

Regulatory compliance: complete and accurate documentation (SAG certificates, bilingual labels, traceable codes). Mandatory pre-shipment inspections.

Post-season assessment: organize debriefings with supply chain actors, technical analysis on damage, logistics, secondary markets, claims, and protocol updates for 2026.

Conclusions

The Chilean cherry campaign 2025/26 is shaping up to be a milestone in production and exports, reflecting two decades of rapid growth.

Strict cold chain maintenance and best postharvest practices will be key to ensuring quality after more than a month of transport.

Logistics and commercial coordination will be essential to avoid oversupply and safeguard the sector’s reputation.

Chile has demonstrated a high level of technical professionalism, thanks to advances in packing, monitoring, and phytosanitary protocols.

Maintaining this leadership will require integrated planning, logistical innovation, and focus on quality over indiscriminate growth.

The operational recommendations offer a practical path to face the season, mitigate risks, and consolidate Chile’s position in international markets.

Jesus Alonso

El Mundo De La Cereza

Image source: Dialogue Earth

Cherry Times – All rights reserved