Germany is the third-largest importer of cherries in the world after China/Hong Kong and Russia. From 2010 to 2021, between 52 and 77 percent of the cherries consumed in Germany were imported, with the majority of imports originating in other EU member states. The largest non-EU cherry suppliers are Turkey for sweet cherries and Serbia for sour cherries.

German cherry production for MY 2022/23 is estimated at 54,700 MT. This is a 43-percent increase compared to the preceding year and 19 percent above the ten-year (2012-2021) average. The increase is largely a rebound from the unusually low production of 2021.

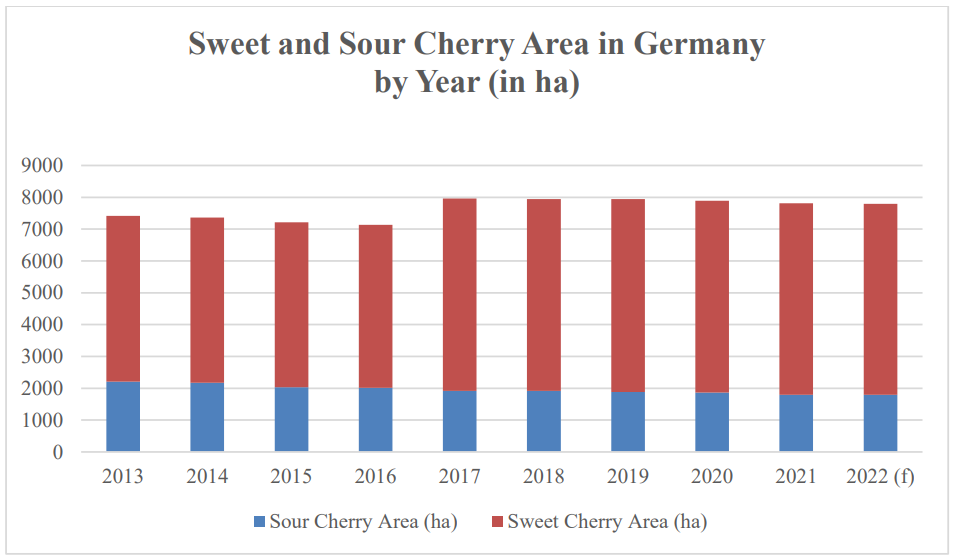

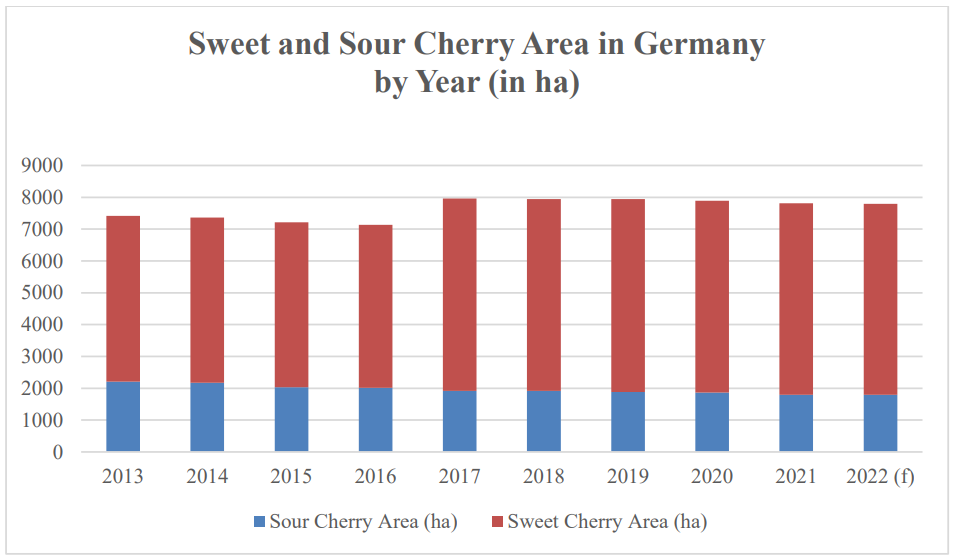

Area

The harvested area for sweet and sour cherries is expected to amount to approximately 6,000 and 1,800 ha, respectively. Germany is more competitive for sweet cherries than for sour. Most of the sweet cherry production is for fresh consumption and consumers are willing to pay a premium for locally produced cherries.

In contrast, most of the sour cherries are destined for processing. When farmers plant new sweet cherry orchards, the trend is towards shielded production. It requires a higher investment but offers protection against rain and enables the farmer to use predators as a pest management tool.

According to a newspaper article investment costs amount to approximately 100,000 Euro per ha (roughly USD240,400 per acre.) Popular varieties include Bellise, Burlat, Kordia, and Regina for sweet cherries and Schattenmorelle and Morellenfeuer for sour cherries.

Source: FAS Berlin; Data from German Federal Office of Statistics (destatis)3 , (f) = FAS Berlin forecast

Production

German cherry production for MY4 2022/23 is estimated at 54,700 MT. This is a 43-percent increase compared to the preceding year and 19 percent above the ten-year (2012-2021) average. The increase is largely a rebound from the unusually low production of 2021 when German cherry production was hit by late spring frosts, drought, and heavy rains during harvest.

Sweet cherry production is estimated at 40,600 MT and sour cherries at 14,100 MT. In 2021, production amounted to 38,370 MT – thereof 27,340 MT of sweet cherries and 11,030 MT of sour cherries.

Source: FAS Berlin; Data from German Federal Office of Statistics (destatis), (f) = FAS Berlin forecast

Trade

Germany is the third largest importer of cherries in the world after China/Hong Kong and Russia. From 2010 to 2021, between 52 and 77 percent of the cherries consumed in Germany were imported, with imports varying between 47,000 and 75,000 MT of cherries annually.

The majority originates from other EU member states—mainly Austria and Greece for sweet cherries and Hungary and Poland for sour cherries. The largest non-EU suppliers are Turkey for sweet cherries and Serbia for sour cherries.

Opportunities for U.S. sweet cherries are best at either end of the German domestic production cycle, i.e., the end of May/beginning of June and August/September. Of the two periods, the latter is more promising as there is less competition from cheaper Turkish cherries.

In recent years, U.S. cherry exports to Germany mostly occurred via other EU member states, mainly the Netherlands. Direct imports from the United States are rare. They last occurred in MY 2018/19. Germany is the third largest importer of cherries in the world after China/Hong Kong and Russia.

From 2010 to 2021, between 52 and 77 percent of the cherries consumed in Germany were imported, with imports varying between 47,000 and 75,000 MT of cherries annually.

The majority originates from other EU member states—mainly Austria and Greece for sweet cherries and Hungary and Poland for sour cherries. The largest non-EU suppliers are Turkey for sweet cherries and Serbia for sour cherries. Opportunities for U.S. sweet cherries are best at either end of the German domestic production cycle, i.e., the end of May/beginning of June and August/September.

Of the two periods, the latter is more promising as there is less competition from cheaper Turkish cherries. In recent years, U.S. cherry exports to Germany mostly occurred via other EU member states, mainly the Netherlands. Direct imports from the United States are rare. They last occurred in MY 2018/19.

German Cherry Imports (Sweet & Sour) by Origin and Marketing Year (MT)

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

|---|

| World | 69741 | 72999 | 66361 | 75365 | 69031 |

| Intra EU-27 | 58655 | 60637 | 53460 | 65474 | 63276 |

| Extra EU-27 | 11086 | 12362 | 12902 | 9890 | 5756 |

| Austria | 15418 | 14244 | 14434 | 14402 | 14306 |

| Greece | 3815 | 3915 | 5484 | 10130 | 9276 |

| Hungary | 13035 | 13294 | 10291 | 9736 | 8599 |

| Netherlands | 5740 | 4985 | 6909 | 7318 | 7529 |

| Poland | 430 | 7754 | 2685 | 13212 | 7251 |

| Spain | 6110 | 4614 | 5027 | 3585 | 6310 |

| Italy | 10057 | 5052 | 1883 | 2537 | 4671 |

| Turkey | 7858 | 8529 | 10846 | 8027 | 4162 |

| Czech Rep. | 2271 | 4421 | 2878 | 2730 | 3503 |

| Serbia | 2794 | 3376 | 1804 | 1540 | 1069 |

| France | 423 | 632 | 700 | 703 | 715 |

| U.S.A. | 0 | 30 | 0 | 0 | 0 |

| Other | 1790 | 2153 | 3420 | 1445 | 1640 |

Marketing year April/March - Source: Trade Data Monitor, LLC. (TDM), MY2021/22 = April 2021- March 2022

German Sweet Cherry Imports by Origin and Marketing Year (MT)

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

|---|

| World | 51721 | 44780 | 49167 | 49542 | 48899 |

| Intra EU-27 | 43706 | 35987 | 38120 | 41390 | 44631 |

| Extra EU-27 | 8015 | 8793 | 11047 | 8151 | 4268 |

| Austria | 14889 | 13550 | 13407 | 14341 | 14178 |

| Greece | 3702 | 3840 | 5453 | 10112 | 9251 |

| Netherlands | 5277 | 4643 | 6642 | 7036 | 7233 |

| Spain | 6088 | 4518 | 5015 | 3448 | 6158 |

| Italy | 9486 | 4608 | 1870 | 2519 | 4655 |

| Turkey | 7858 | 8529 | 10846 | 8027 | 4162 |

| Hungary | 3308 | 3065 | 3520 | 2861 | 1625 |

| Poland | 25 | 614 | 95 | 44 | 669 |

| France | 315 | 511 | 633 | 521 | 383 |

| U.S.A. | 0 | 10 | 0 | 0 | 0 |

| Other | 773 | 892 | 1,686 | 633 | 585 |

Marketing year April/March - Source: Trade Data Monitor, LLC. (TDM), MY2021/22 = April 2021- March 2022

Germany exports less than 10 percent of its total cherry supply, between 4,000 to 7,800 MT in recent years. Main destinations are other EU member states, such as the Netherlands, Austria, Denmark, and Sweden. The largest and almost exclusive extra-EU destination for German cherries is Switzerland. For MY 2022/23, exports are expected to increase because of the larger German production.

Source: FAS Berlin; Data from Trade Data Monitor, LLC. (TDM)

Source: FAS Berlin; Data from Trade Data Monitor, LLC. (TDM)

Consumption

In Germany, fresh cherries are considered a seasonal product and stocked in supermarkets mainly during the German marketing season (June/July). According to the German market information company Agrarmarkt Informations-Gesellschaft mbH (AMI) in 2020, 92 percent of private household purchases of sweet cherries occurred in June and July, and six percent in August .

In contrast, purchases of peaches, which are hardly grown in Germany, are more evenly distributed between May and October. This seasonal availability explains the lower per capita consumption of cherries (2.7 kg) compared to peaches (3.4 kg). Nonetheless, per capita consumption of cherries is more than twice as high as for plums (1.1 kg).

In recent years, sweet cherries have become a trend item that benefitted from increased health consciousness and the growing popularity of snacking. In contrast, plums are mostly used for baking and cooking. For sweet cherries, consumer preferences clearly trend toward larger sizes (>26 mm/1.024 inches).

Smaller cherries sell at a large discount. For example, in the week of June 27, 2022, the average wholesale price for domestic sweet cherries amounted to 5.18 Euro (USD 5.208 ) per kg for larger cherries but only 3.12 Euro (USD 3.13) per kg for cherries smaller than 26 mm.

The use of sour cherries for processing is relatively stable and roughly amounts to 70-90 percent of German domestic production. The majority of sour cherries are used for canning (over 70 percent), while the remainder is used in juice production.

The percentage of sweet cherries used for processing fluctuates between 30 and 50 percent depending on the weather during harvest, as rain damage increases the percentage that goes into canning or distilling into spirits.

Processing of cherries into dried fruit is not common in Germany. The small but growing demand for dried cherries is met with imports. Due to lack of a product specific HS code, data on dried cherry trade is not available.

Source: Overview on the German Cherry Sector 2022 (USDA, September 2022)

Cherry Times - All rights reserved