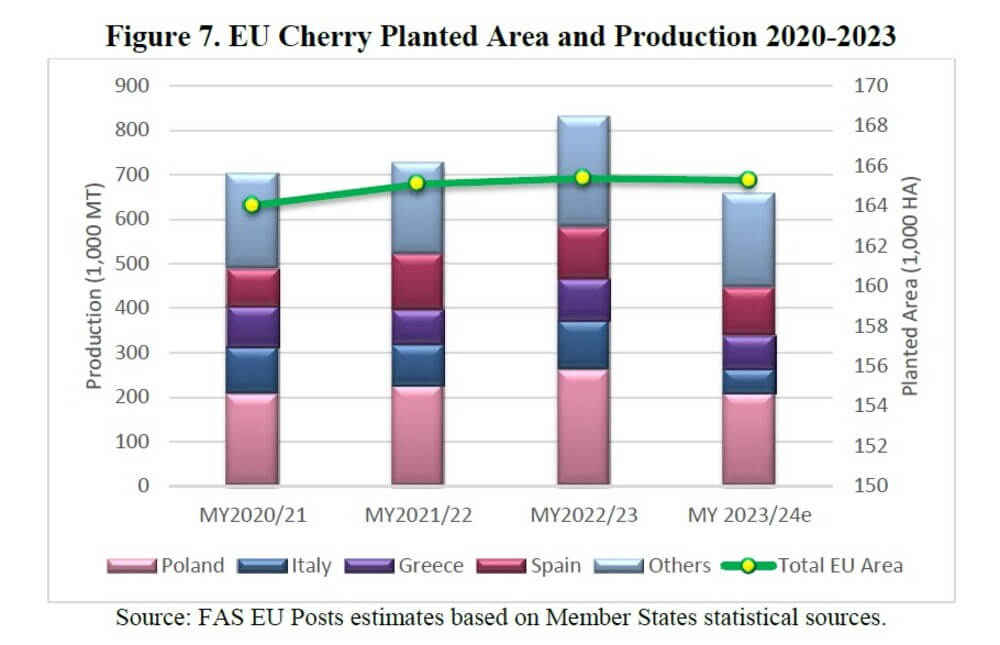

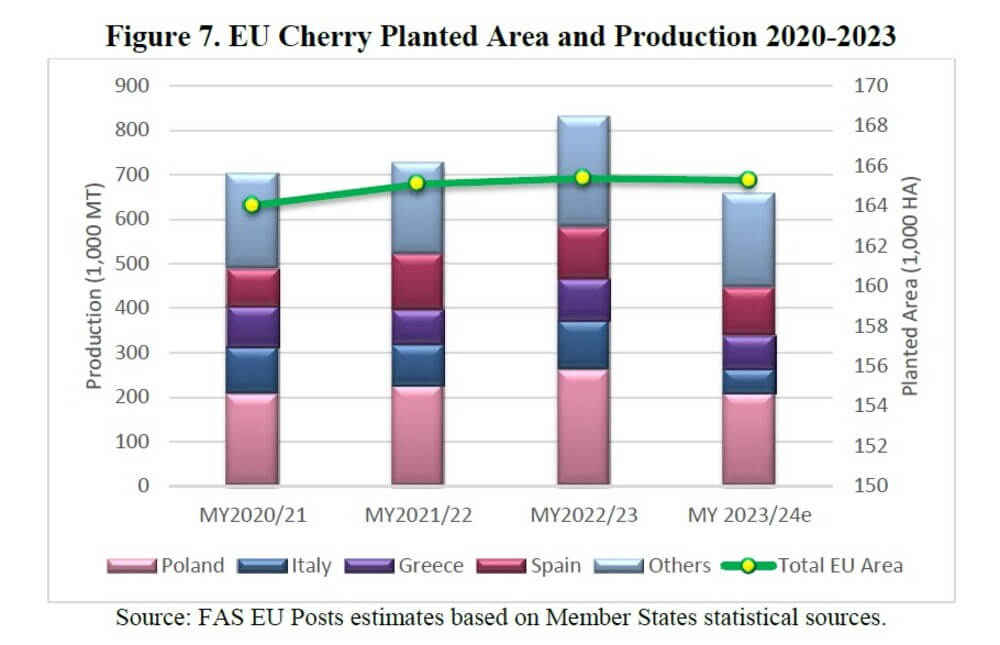

The European Union is an important producer and consumer of cherries, with the main producing countries including Poland, Spain, Italy and Greece, followed by Hungary, Bulgaria and Germany. Some EU Member States, such as France and Portugal, also make a limited contribution to production.

Poland stands out as the main processor of cherries in the EU, while Spain and Greece are the main exporters, mainly to the EU. Germany emerges as the main importer of cherries in the EU, while Italy and Spain are the largest consumers of fresh cherries.

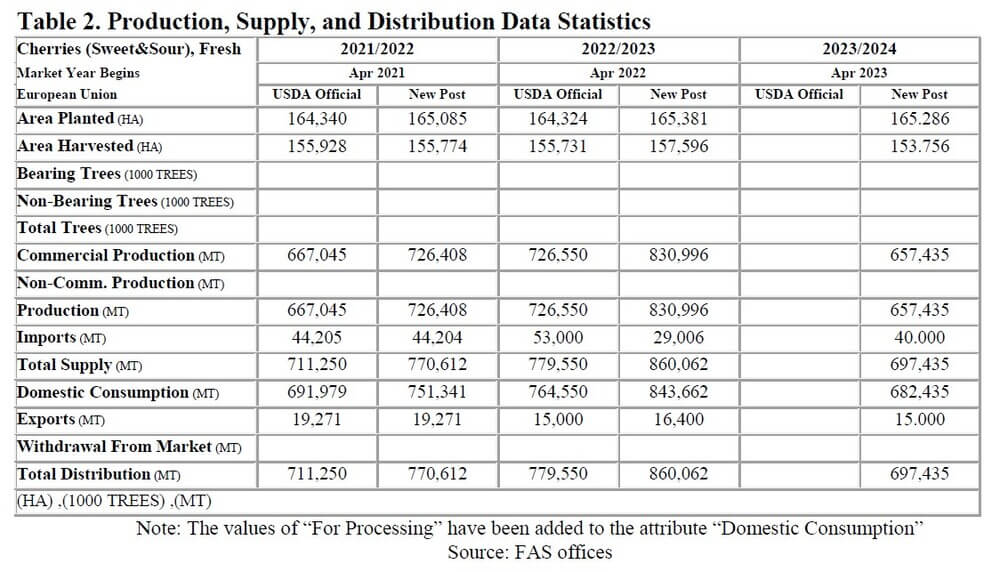

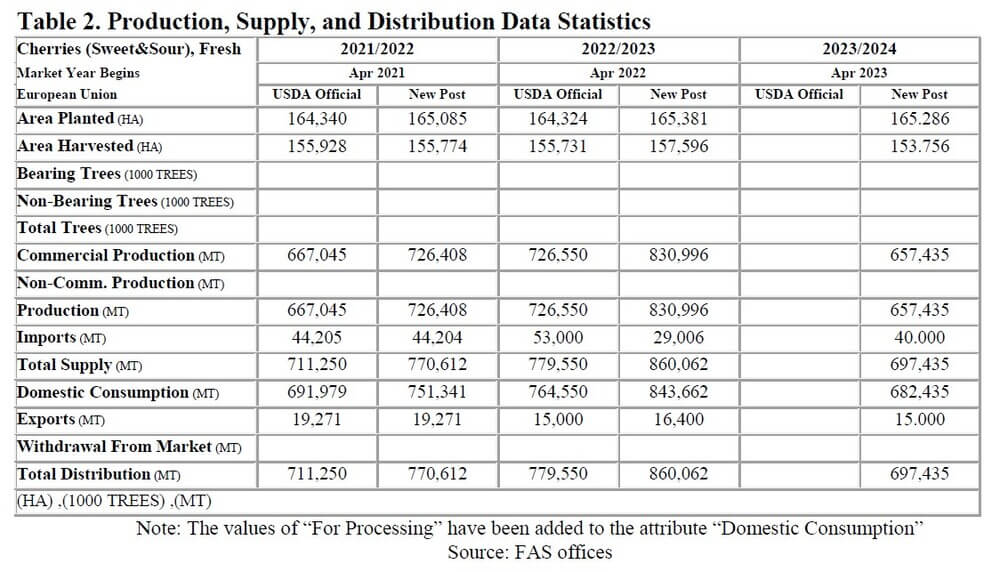

However, the outlook for the 2023/24 season is worrying, with an expected 21% decrease in total cherry production due to adverse weather conditions, such as frost and heavy rains, which have affected flowering and fruit set in several countries, particularly Poland and Italy.

Spain, despite an increase in cultivated areas, expects a 7% reduction in production due to damage caused by heavy rain. In Italy, persistent rains have led to an expected 50 per cent decrease in production, although quality is expected to be good. Greece, Hungary, and Bulgaria are also expecting decreases in production due to various climatic factors.

Germany, the main importer, estimates domestic production to be 6.7% lower than the previous year, with most of the cherries destined for processing.

The consumption of cherries in the EU in 2023/24 could decrease significantly due to the scarcity of production, also influenced by high prices and inflation rates related to the conflict in Ukraine. The southern EU countries, together with Germany, are the main consumers of fresh cherries.

In terms of trade, the EU is a net importer of cherries, with Turkey accounting for almost 70% of EU imports. Germany is the main importer of cherries into the EU. Non-EU exports, handled mainly by Spain, include the UK, Switzerland, Belarus and Ukraine.

In summary, the EU cherry season in 2023/24 is characterised by a significant reduction in production, with expected impacts on consumption and trade.

Source: Valverde C., Kuypers K., Stone Fruit Annual Report, USDA, 30/08/2023.

To read and download the full report, click here

Images: USDA

Cherry Times - All rights reserved